Expenses Meaning In Nepali With Example The expenses you can deduct include any GST HST you incur on these expenses minus the amount of any input tax credit claimed However since you cannot deduct personal expenses

Eligible medical expenses including medical expenses for self spouse or common law partner allowable amount of medical expenses for other dependants Federal non refundable tax Expenses you incurred when your employer was not a GST HST registrant expenses that relate to an allowance you received from your employer that is not reported in Part C of the

Expenses Meaning In Nepali With Example

Expenses Meaning In Nepali With Example

https://i.ytimg.com/vi/t2U7IsXsruo/maxresdefault.jpg

Tense Overview Present Past Future Structures Examples Of Each

https://i.ytimg.com/vi/1oWPabXK070/maxresdefault.jpg

Nepali New Year Status Happy New Year 2024 New Year Status

https://i.ytimg.com/vi/7DhYY77oWw4/maxresdefault.jpg

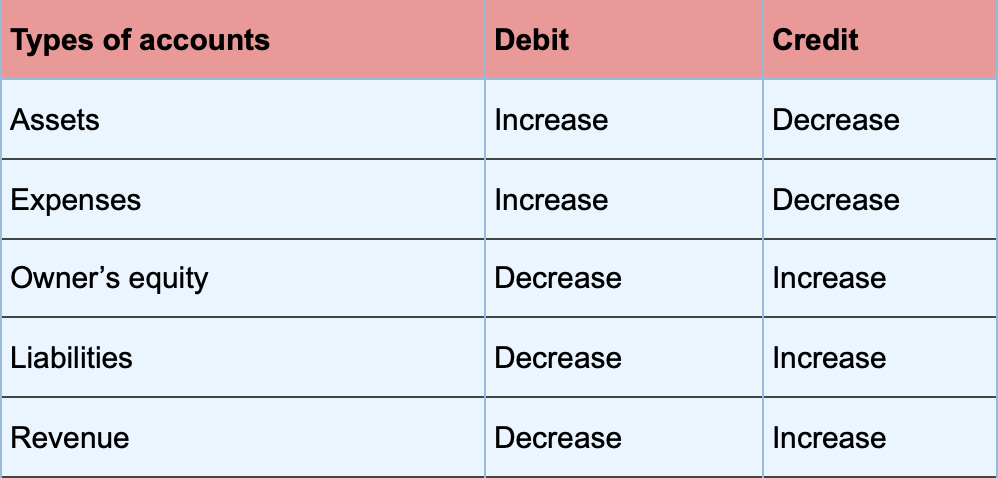

Variable B is the taxpayer s ratio of permissible expenses for the year multiplied by the taxpayer s ATI unless the taxpayer made an election under subsection 18 21 2 The ratio of December 30 2024 Ottawa Ontario Department of Finance Canada Today the Department of Finance Canada announced the automobile income tax deduction limits and expense benefit

T2SCH130 Excessive Interest and Financing Expenses Limitation 2023 and later tax years Download instructions for fillable PDFs These include small items such as pens pencils paper clips stationery and stamps For office expenses related to your workspace see Line 8811 Office stationery and supplies below

More picture related to Expenses Meaning In Nepali With Example

Basic Word Meaning Nepali To English Nepali To

https://i.ytimg.com/vi/g_uGRI_drPo/maxresdefault.jpg

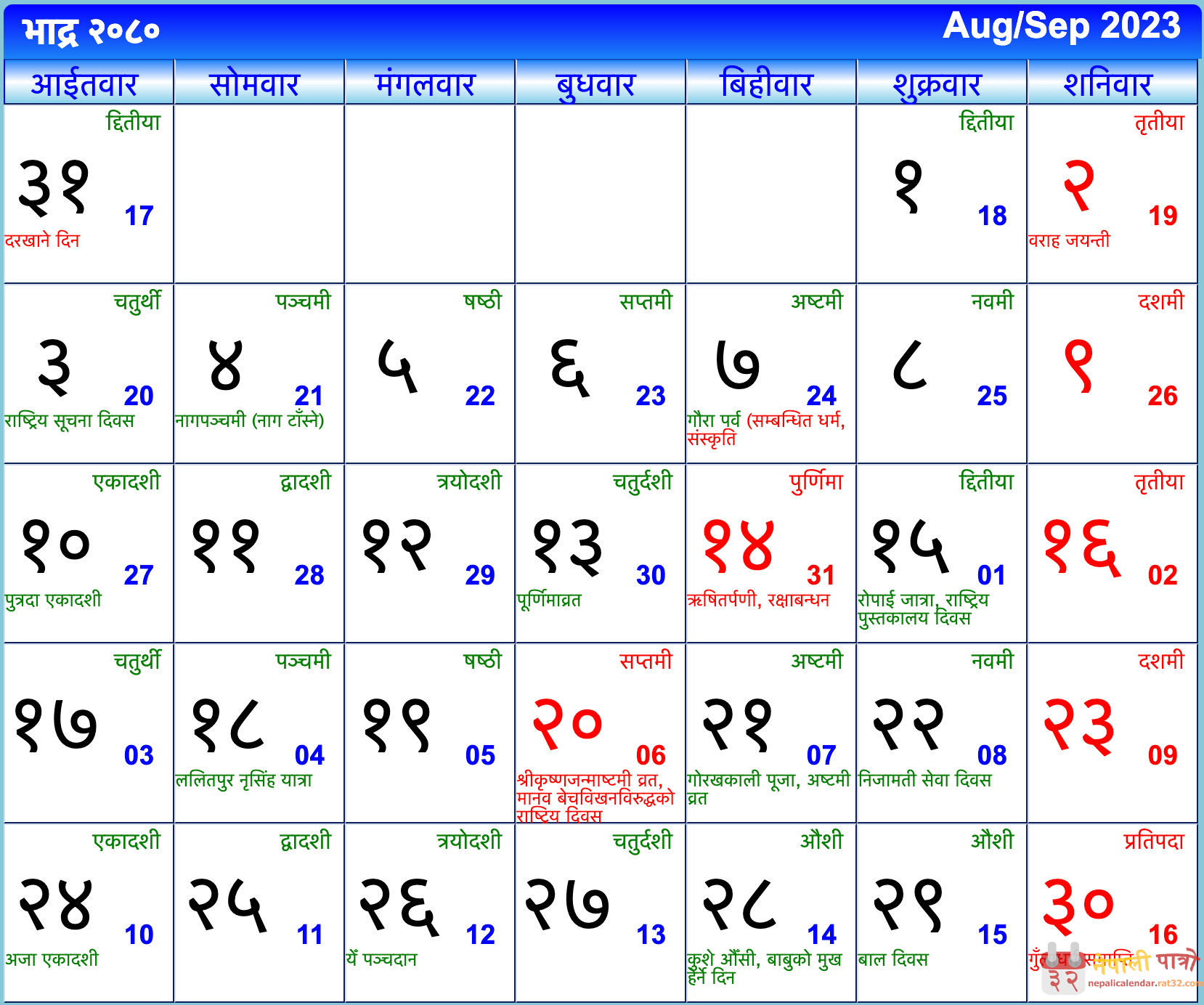

2048 Nepali Calendar Bhadra Calendar Infoupdate

https://nepalicalendar.rat32.com/download-nepali-calendar/nepali-calendar-2080-bhadra.png

What Is A Reimbursement And How Does It Work With 48 OFF

https://www.wallstreetmojo.com/wp-content/uploads/2021/06/Sundry-Expenses-1.jpg.webp

The work space in the home expenses you can claim are limited when you work only a part of the year from your home You can only claim the expenses you paid in the part The medical expense tax credit provides tax relief for individuals who have sustained significant medical expenses for themselves or certain of their dependants The medical expense tax

[desc-10] [desc-11]

100 ENGLISH Words With NEPALI Meaning Along With Sentences 57 OFF

https://i.ytimg.com/vi/7vg1BXiO3cw/maxresdefault.jpg

Nepal House Restaurant Menu

https://nepalhouse.com.np/images/menu2.jpg

https://www.canada.ca › ...

The expenses you can deduct include any GST HST you incur on these expenses minus the amount of any input tax credit claimed However since you cannot deduct personal expenses

https://www.canada.ca › ... › deductions-credits-expenses › deductions-c…

Eligible medical expenses including medical expenses for self spouse or common law partner allowable amount of medical expenses for other dependants Federal non refundable tax

FREE Nepali Alphabet Chart With Complete Nepali Vowels Nepali

100 ENGLISH Words With NEPALI Meaning Along With Sentences 57 OFF

Tasteshow Blog

Deduct Medical Expenses Electronicsgugl

Ipnu Logo

Nepal Flag

Nepal Flag

Prepaid Expenses

Expense Meaning Example Vs Expenditure Types

Administrative Expenses Definition Meaning Example Tally Prime

Expenses Meaning In Nepali With Example - December 30 2024 Ottawa Ontario Department of Finance Canada Today the Department of Finance Canada announced the automobile income tax deduction limits and expense benefit