Fpi Meaning In Itr 2 The pre filling and filing of ITR 2 service is available to registered users on the e Filing portal This service enables individual taxpayers and HUFs to file ITR 2 through the e Filing portal This

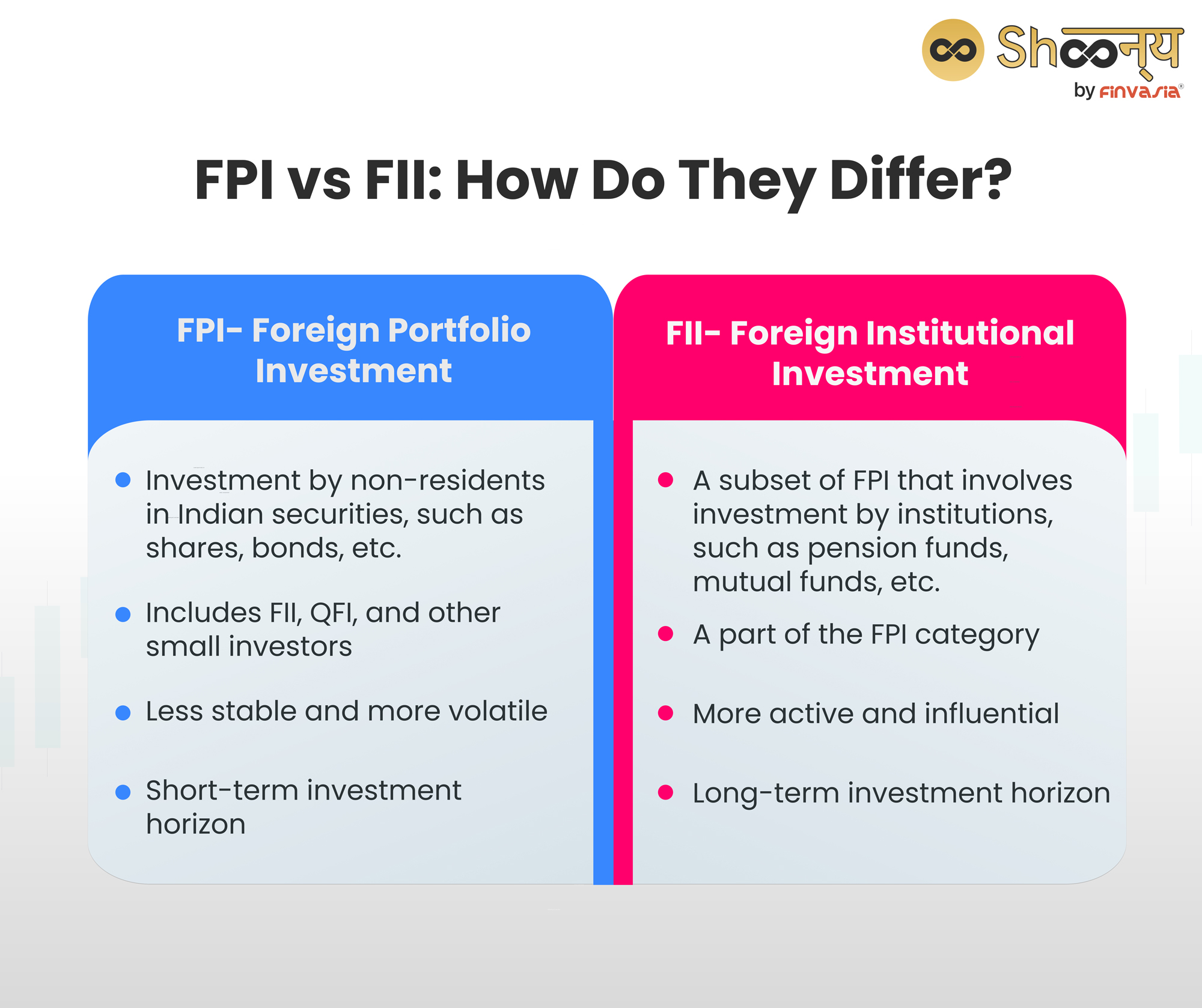

Foreign Portfolio Investment FPI refers to the investment by individuals institutions or funds in financial assets such as stocks bonds mutual funds and exchange traded ETFs of a foreign FII means foreign institutional investors and FPI means foreign portfolio investors The central government on clarified the income tax returns filed by foreign institutional

Fpi Meaning In Itr 2

Fpi Meaning In Itr 2

https://www.myfinopedia.com/wp-content/uploads/2023/06/What-is-FPI-Meaning-Risk-and-Benefits-1024x576.jpg

How To Download Your ITR V From The Department Website Tax2win

https://emailer.tax2win.in/assets/guides/itr/itr-v-acknowledgement-1.jpg

ITR 2 FILING PROCESS Fintoo Blog

https://static.fintoo.in/blog/wp-content/uploads/2023/03/2.png

FPIs hold 50 of their total equity investments in a single Indian corporation or group FPIs with more than INR 25 000 crores in equity stakes in India individually or with their investor group Foreign Portfolio Investment FPI involves an investor buying foreign financial assets It involves an array of financial assets like fixed deposits stocks and mutual funds All the investments

FPI refers to overseas investors investing into Indian financial assets Entire investments are passively held by all the investors Furthermore because of the strong performance of Indian stocks shares or equities ITR 2 Form is for Individuals and HUFs not carrying out business or profession under any proprietorship WHAT ARE THE DIFFERENT MODE OF FILING ITR 2 Offline Individual who are of the age 80 years or more and

More picture related to Fpi Meaning In Itr 2

What Is ITR 3 Form And Information On How To File ITR 3 Ebizfiling

https://ebizfiling.com/wp-content/uploads/2022/05/How-to-file-ITR-3.jpg

Top 10 Benefits Of Filing Your ITR Fintoo Blog

https://static.fintoo.in/blog/wp-content/uploads/2023/06/benefits-of-ITR-1-1.png

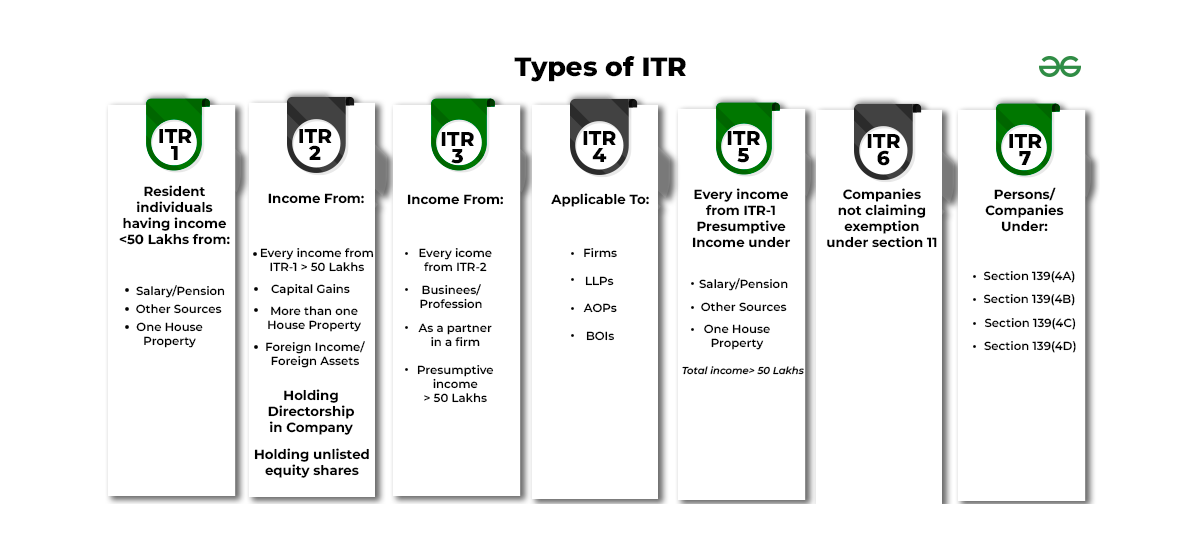

Types Of ITR Which ITR Should I File GeeksforGeeks

https://media.geeksforgeeks.org/wp-content/cdn-uploads/20230210110107/TYPES-OF-ITR.png

As per the FPI Regulations a Foreign Portfolio Investment is required to satisfy the eligibility conditions given under Regulation 4 and to register itself as an FPI with a Designated Depository Participant DDP Income earned by FPIs can be categorized either into gains from the transfer of securities or interest and dividend income Income from the transfer of securities will be

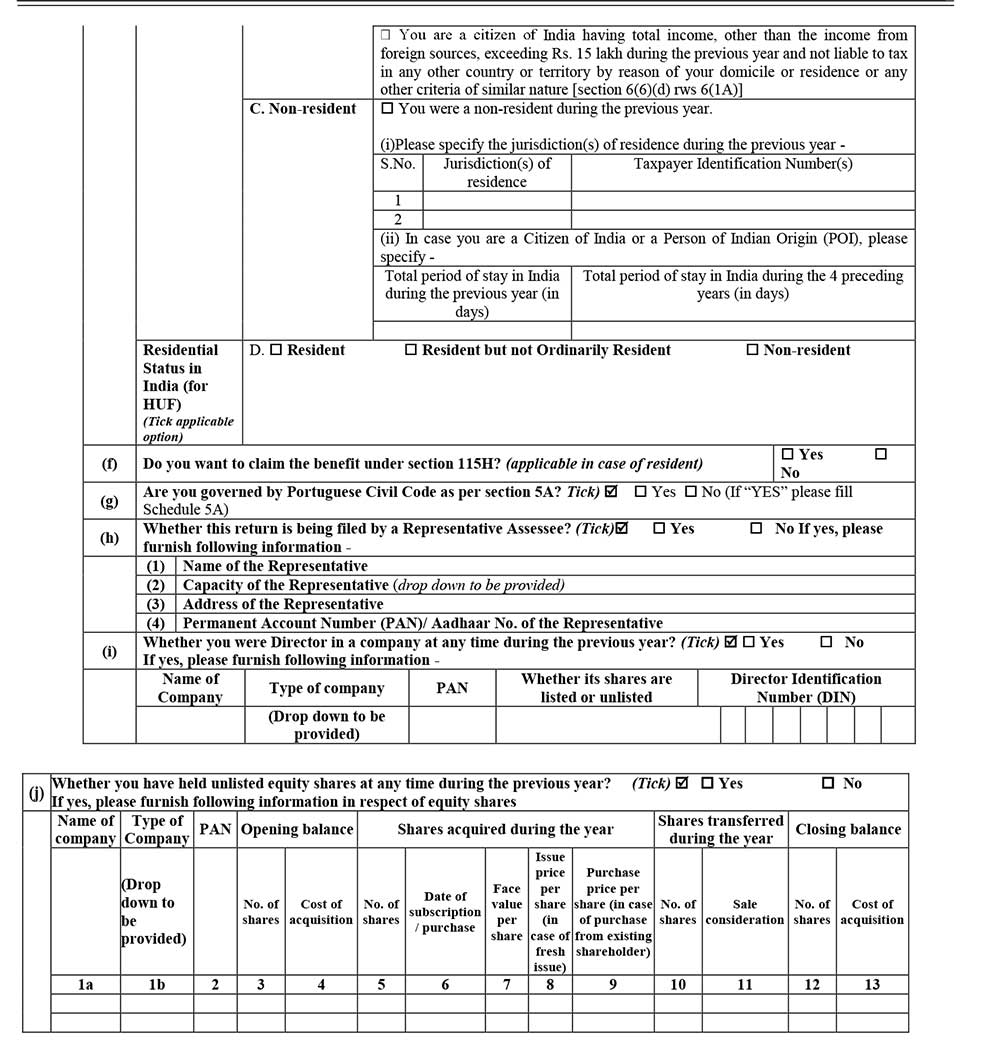

Instructions for filling out FORM ITR 2 These instructions are guidelines for filling the particulars in Income tax Return Form 2 for the Assessment Year 2019 20 relating to the Financial Year To file I T returns the choice for salaried individuals will be between the Indian Income Tax Return 1 ITR 1 and ITR 2 forms If your earnings for the year are through

Fluorescent Penetrant Testing For Finding Cracks On A Component FPI

https://i.ytimg.com/vi/oYRi_oZ07Go/maxres2.jpg?sqp=-oaymwEoCIAKENAF8quKqQMcGADwAQH4Ac4FgAKACooCDAgAEAEYHCBMKH8wDw==&rs=AOn4CLBbMToYNQjm5ny_668n5CnJt8PDPQ

ITR Filing AY 2023 24 Update Income Tax Filing AY 23 24 ITR Start

https://i.ytimg.com/vi/0D_l81bvzSo/maxresdefault.jpg

https://www.incometax.gov.in › iec › foportal › help

The pre filling and filing of ITR 2 service is available to registered users on the e Filing portal This service enables individual taxpayers and HUFs to file ITR 2 through the e Filing portal This

https://cleartax.in › glossary › fpi-foreign-portfolio-investment

Foreign Portfolio Investment FPI refers to the investment by individuals institutions or funds in financial assets such as stocks bonds mutual funds and exchange traded ETFs of a foreign

Definition Meaning Of ITR Forms Tax2win

Fluorescent Penetrant Testing For Finding Cracks On A Component FPI

FPI Vs FII Difference Between Two Types Of Foreign Investments

FDI Vs FPI Vs FII Difference FDI FPI FII QFI Meaning Explained

How To File ITR 2 2023 Income Tax Return Filing AY 2023 24 How To

ITR 2 Filling Of Agriculture Income Online AY 23 24 Free Step By

ITR 2 Filling Of Agriculture Income Online AY 23 24 Free Step By

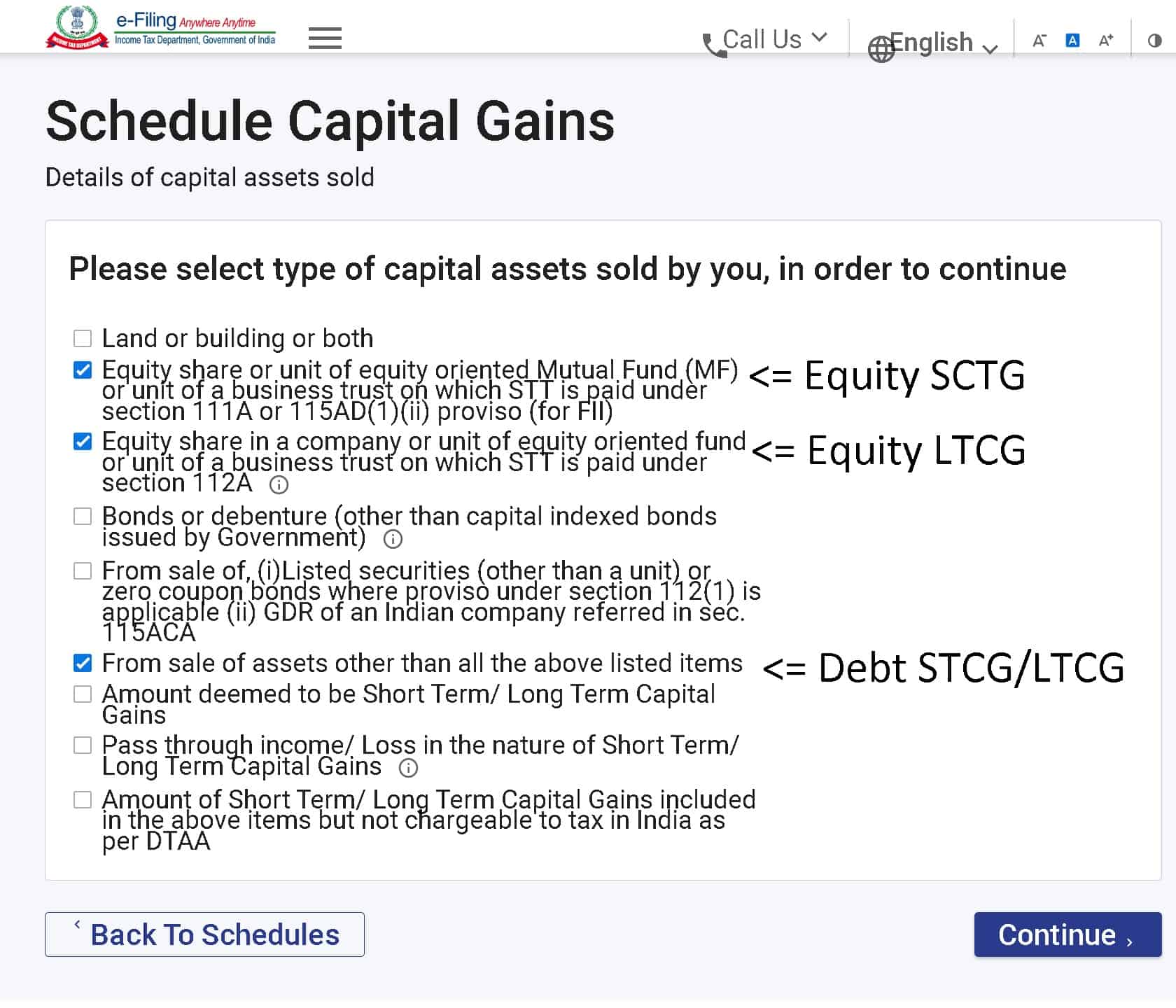

How To Enter Mutual Fund And Share Capital Gains In ITR2 or ITR3

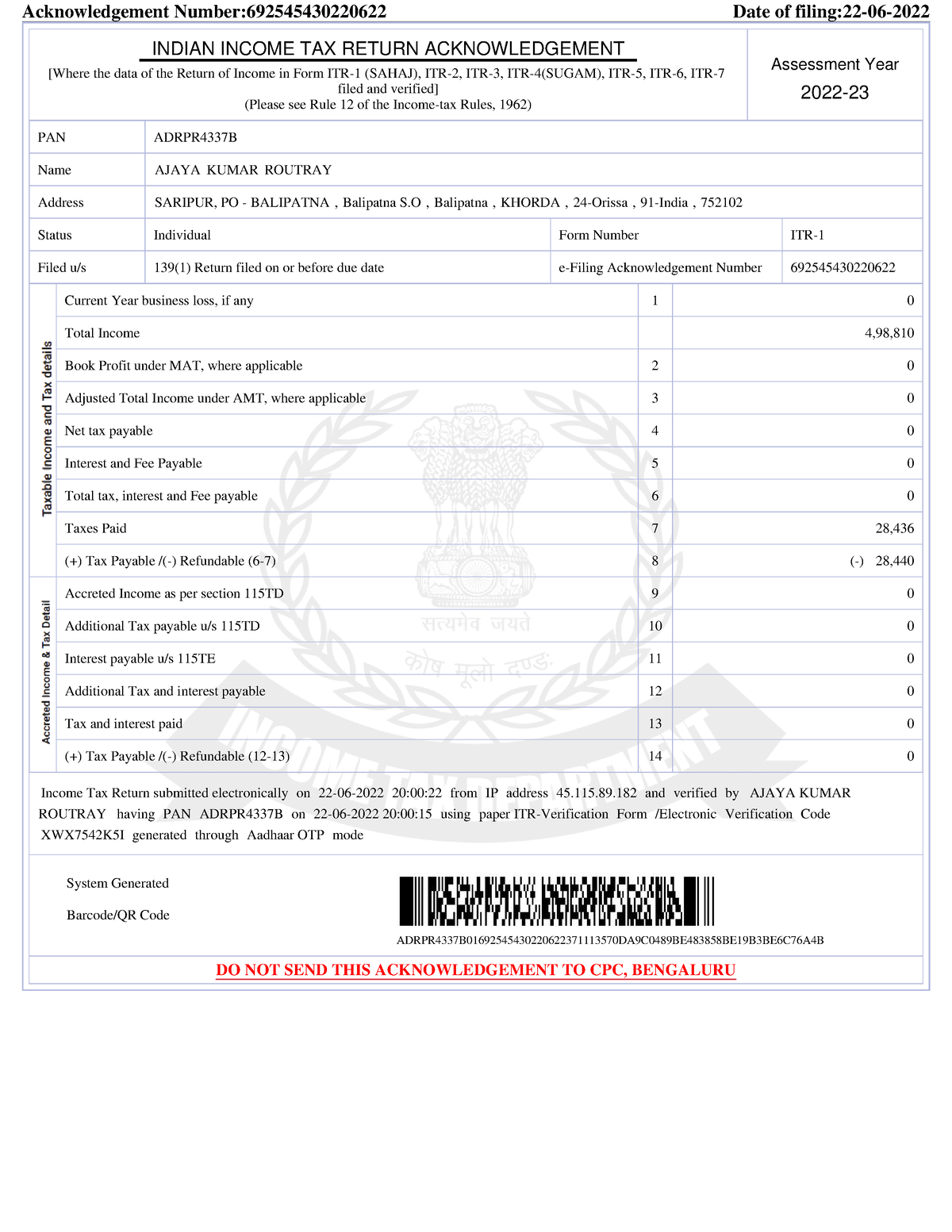

ITR AY 2022 23 AAA Acknowledgement Number 692545430220622 Date Of

Itr 2 Form For Ay 2023 24 Printable Forms Free Online

Fpi Meaning In Itr 2 - Find out about the legality of Foreign Portfolio Investment FPI how to invest in it and what are the tax benefits involved This blog post will answer all your questions regarding