Hmrc Office Number 120 Wil HMRC automatically amend my tax code once amount owed is paid Also from 6 Apr 2025 I will no longer have any savings which are liable to tax on interest all in ISAs

Dear HMRC The problem is that I and other people cannot contact the self assessment team if you phone up you are not given the option of waiting the call is just From HMRC s point of view cracking down on those who are generating incredibly small amounts of profit or even making losses via eBay will lead to the completion of

Hmrc Office Number 120

Hmrc Office Number 120

https://www.accountancydaily.co/sites/default/files/field/image/hmrc_manchester_three_new_bailey_.jpg

Pictures Show Huge New HMRC Office In Nottingham As It Opens This Month

https://i2-prod.nottinghampost.com/incoming/article6921407.ece/ALTERNATES/s1227b/0_JAJ_TEM_070422UnitySqr_001JPG.jpg

How To Register For HMRC Self Assessment Online YouTube

https://i.ytimg.com/vi/ua7dEV180N8/maxresdefault.jpg

I was hoping someone could clarify about when and how tax is payable on fixed rate bonds I have a number of fixed rate bonds for different terms 1 year 2 year 3 year and Hi Where can I find the self assessment tax returns I have filed in the previous years The actual full online forms filled in and submitted for year 2021 2022 Thank you

Hi Bruce Maginnis In your letter include proof from your pension provider of payments made for each tax year you re claiming for and whether the payment amounts are Hello there I would like to inquire about the employee electric car salary sacrifice If the company wants to offer the electric car to the employee through the salary sacrifice

More picture related to Hmrc Office Number 120

AECOM HMRC Stratford Mix Interiors

https://www.mixinteriors.com/content/uploads/2023/04/AECOM-HMRC-Stratford-Public-Sector-Cultural-Mixology-Awards-Mixology22-Mix-Interiors-2.jpg

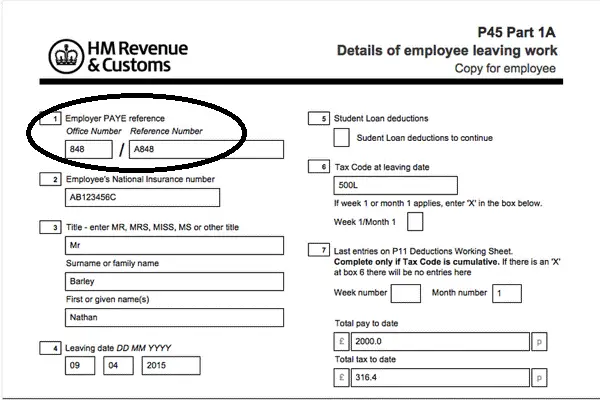

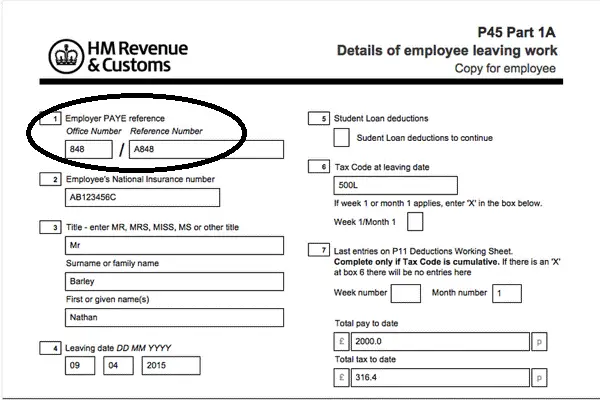

How To Find Your Accounts Office Reference Number AORN By Goforma

https://miro.medium.com/v2/resize:fit:1094/1*5hDnnv5S4bRoVeMeKDjKUg.png

Seller s Auction Offer Anthonyblok Kunstveiling nl

https://images.kunstveiling.nl/appraisal-d19a9a5d191a7cacc0c1bc007daa2146-_s1500.jpeg

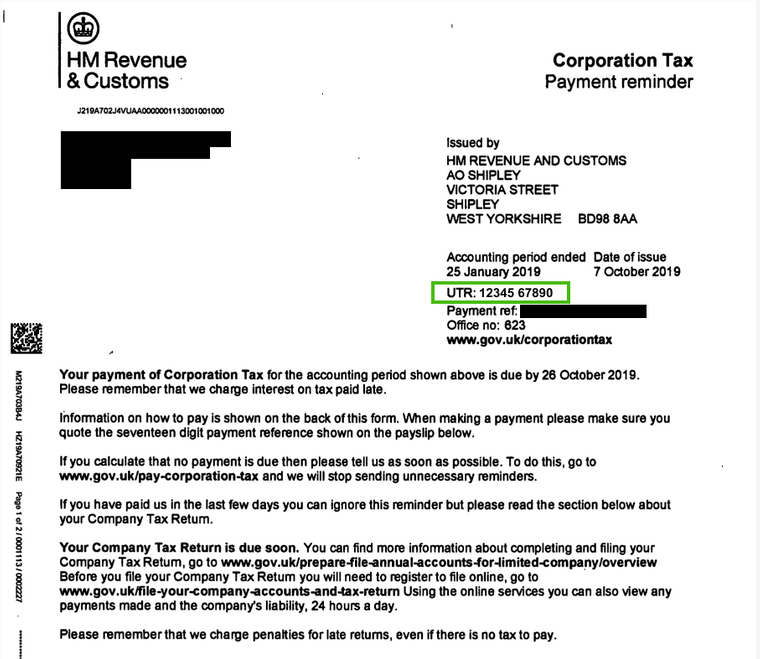

Hi I am going self employed and need to register for a UTR number I have a gateway account but is there a section or form that s connected for self employment to access HMRC previously released guidance for software developers in October last year to support multi agent access as part of the MTD IT programme It s now the turn for everyone

[desc-10] [desc-11]

Understanding Your Employers PAYE Reference The Key To Unlocking Tax

http://www.fastaccountant.co.uk/wp-content/uploads/2023/09/understanding-your-employers-paye-reference-the-key-to-unlocking-tax-benefits.png

Understanding The 257L Tax Code What You Need To Know 2024Watermill

https://www.watermillaccounting.co.uk/wp-content/uploads/2024/02/Understanding-the-257L-Tax-Code.jpg

https://community.hmrc.gov.uk › customerforums › pt

Wil HMRC automatically amend my tax code once amount owed is paid Also from 6 Apr 2025 I will no longer have any savings which are liable to tax on interest all in ISAs

https://community.hmrc.gov.uk › customerforums › sa

Dear HMRC The problem is that I and other people cannot contact the self assessment team if you phone up you are not given the option of waiting the call is just

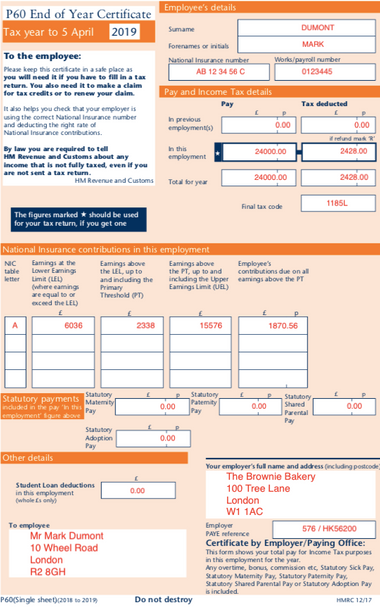

What Are PAYE UTR And Tax Payroll Reference Numbers 2022

Understanding Your Employers PAYE Reference The Key To Unlocking Tax

Everything You Need To Know About Tax Reference Numbers

Ashworth Street Surgery

Coco MCT 5g X 120 Costco Japan

Streamline Your PAYE Payments Vibrant Accountancy

Streamline Your PAYE Payments Vibrant Accountancy

What Is An ERN PAYE Reference Number And Why Do I Need It

Logoservice png

Understanding The PAYE Reference Number A Comprehensive Guide For

Hmrc Office Number 120 - I was hoping someone could clarify about when and how tax is payable on fixed rate bonds I have a number of fixed rate bonds for different terms 1 year 2 year 3 year and