How Much Is Income Tax In Jamaica Income Tax is a tax on a person s statutory chargeable income It is important that all taxpayers submit their returns and pay their taxes on time as these funds provide the necessary income

The tax free income is outlined as follows If you are paid weekly 8 484 fortnightly 16 968 and monthly 36 764 What are the payroll taxes and statutory deductions PAYE Income Tax The salary calculator for income tax deductions based on the latest Jamaican tax rates for 2025 2026 The Jamaican Salary Calculator includes income tax deductions National Insurance Scheme National Housing Scheme

How Much Is Income Tax In Jamaica

:max_bytes(150000):strip_icc()/Term-Definitions_Income-tax-blue-9a708041207743b5a57cfdae08df2b10.jpg)

How Much Is Income Tax In Jamaica

https://www.investopedia.com/thmb/vmecxtzh3YtlhkIY783GtuYo7Ds=/1500x0/filters:no_upscale():max_bytes(150000):strip_icc()/Term-Definitions_Income-tax-blue-9a708041207743b5a57cfdae08df2b10.jpg

Salary Breakup Structure Format Calculation More Razorpay Payroll

https://d6xcmfyh68wv8.cloudfront.net/learn-content/uploads/2022/02/Facebook-post-16-1024x538.png

Which States Have The Highest And Lowest Income Tax USAFacts

https://staticweb.usafacts.org/media/images/1-highest-state-income-taxes-usafacts.width-1000.png

In Jamaica individuals are prone to pay Income Tax at the rate of 25 on their chargeable income not more than 6 million Jamaican dollars whereas chargeable income in In April 2024 the threshold for personal income tax will be increased to J 1 700 088 from J 1 500 096 and a tax credit will be given to Jamaicans earning less than 3

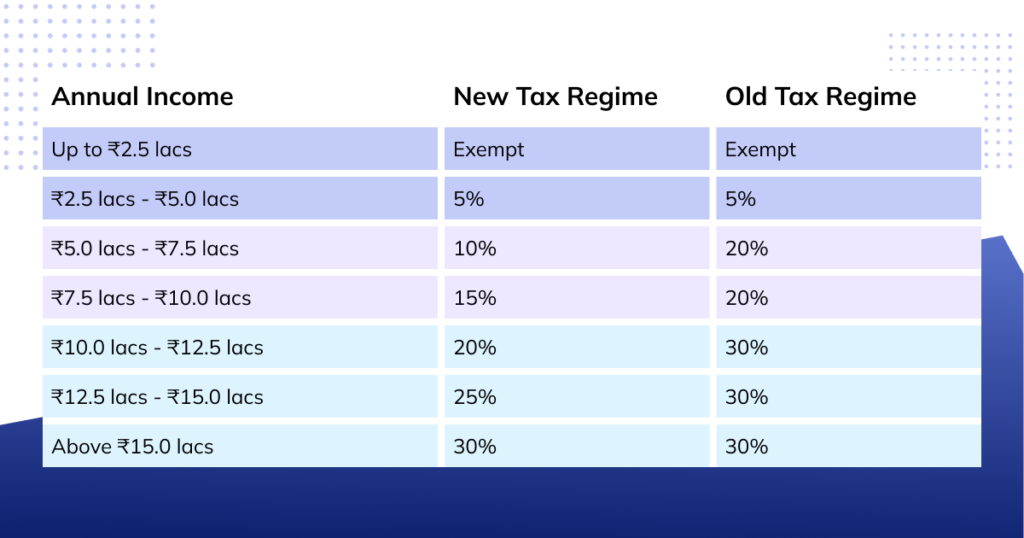

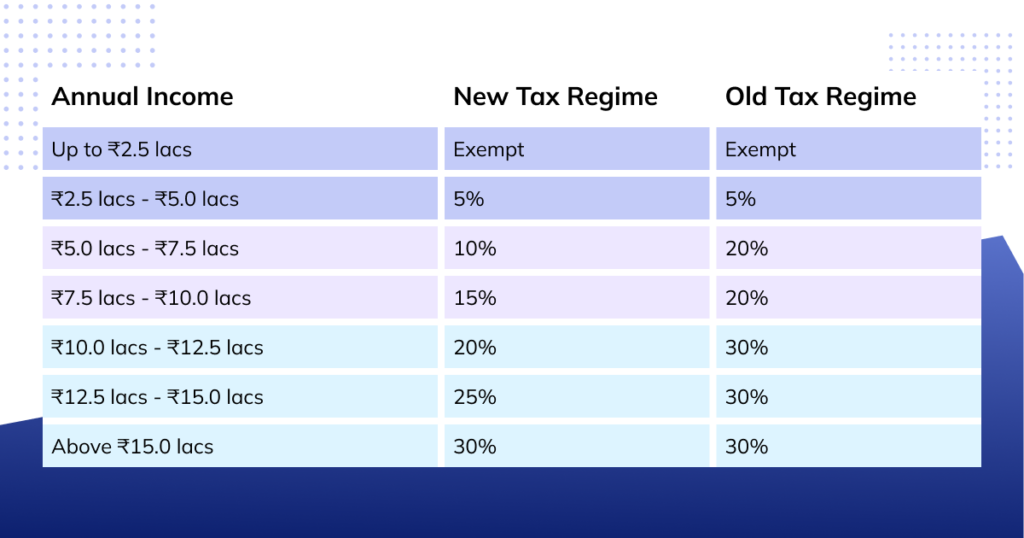

NOTE For years of assessment 2016 and onwards Statutory Income SI above the Threshold up to 6M is taxed at 25 SI in excess of 6M yearly or SI in excess of 6M yearly or Review the latest income tax rates thresholds and personal allowances in Jamaica which are used to calculate salary after tax when factoring in social security contributions pension contributions and other salary taxes in Jamaica

More picture related to How Much Is Income Tax In Jamaica

:max_bytes(150000):strip_icc()/Form1040copy-7af98beb63114d4ab3f7a999ba1f3608.jpg)

Change One Word Page 805 Big Board Of Fun LoversLab

https://www.investopedia.com/thmb/DPa_w90U8Wx_lL-et-1ESMTYzwY=/1500x0/filters:no_upscale():max_bytes(150000):strip_icc()/Form1040copy-7af98beb63114d4ab3f7a999ba1f3608.jpg

Jamaica National Insurance Scheme Life Insurance Quotes

https://i.ytimg.com/vi/5zFqubOlWXk/maxresdefault.jpg

How Much Taxes Do I Owe 2024 Xenia Karoline

https://www.nerdwallet.com/assets/blog/wp-content/uploads/2022/10/Example1_TY2022.png

The income tax is charged at a rate of 30 when the annual income exceeds JMD 6 million Income Tax is imposed on individuals only at the national level and is not separately Income tax at the rate of 25 is deducted at source from gross interest paid to Jamaican residents i e individuals and companies by a prescribed person Prescribed

A comprehensive suite of free income tax calculators for Jamaica each tailored to a specific tax year These user friendly tools are designed to help individuals and businesses in Jamaica The headline Personal Income Tax PIT rate is 25 on income above JMD 1 500 000 and 30 on income over JMD 6 000 000 The headline Corporate Income Tax CIT rate is 33 for a

Income Tax Brackets 2024 25 Fafsa Ciel Melina

https://thecollegeinvestor.com/wp-content/uploads/2022/10/TCI_-_2023_Federal_Tax_Brackets_1600x974.png

How Much Is Tax In California 2025 Siana Annabal

https://federal-withholding-tables.net/wp-content/uploads/2021/07/federal-income-tax-brackets-released-for-2021-has-yours.png

:max_bytes(150000):strip_icc()/Term-Definitions_Income-tax-blue-9a708041207743b5a57cfdae08df2b10.jpg?w=186)

https://www.jamaicatax.gov.jm

Income Tax is a tax on a person s statutory chargeable income It is important that all taxpayers submit their returns and pay their taxes on time as these funds provide the necessary income

https://www.jamaicatax.gov.jm › income-tax-faq

The tax free income is outlined as follows If you are paid weekly 8 484 fortnightly 16 968 and monthly 36 764 What are the payroll taxes and statutory deductions PAYE Income Tax

What Are The Tax Bra Clem Annmaria

Income Tax Brackets 2024 25 Fafsa Ciel Melina

Tax Forms 2024 Ontario Maryl Sheeree

2025 Tax Rebate Nike Tawsha

What Are The Tax Brackets For 2024 By Income And Income Drusie Aurilia

Income Tax Slab Fy 2023 24 India Image To U

Income Tax Slab Fy 2023 24 India Image To U

Income Tax Calculator New Regime Fy 2024 25 Image To U

Here Are The Federal Income Tax Brackets For 2023 Axios NEWS DEMO

What Is The Tax Bracket For 2024 India Vevay Donelle

How Much Is Income Tax In Jamaica - In Jamaica individuals are prone to pay Income Tax at the rate of 25 on their chargeable income not more than 6 million Jamaican dollars whereas chargeable income in