Income Tax Calculation Sheet For Salaried Employees Change in individual income tax rate The Government of Canada has tabled legislation proposing to reduce the lowest income tax rate effective July 1 2025 For more information Government

Your net income is used to calculate your federal and provincial or territorial non refundable tax credits The CRA also uses your net income and your spouse s or common law partner s net The Government of Canada has tabled legislation proposing to reduce the lowest income tax rate effective July 1 2025 For more information Government tables a Motion to bring down costs

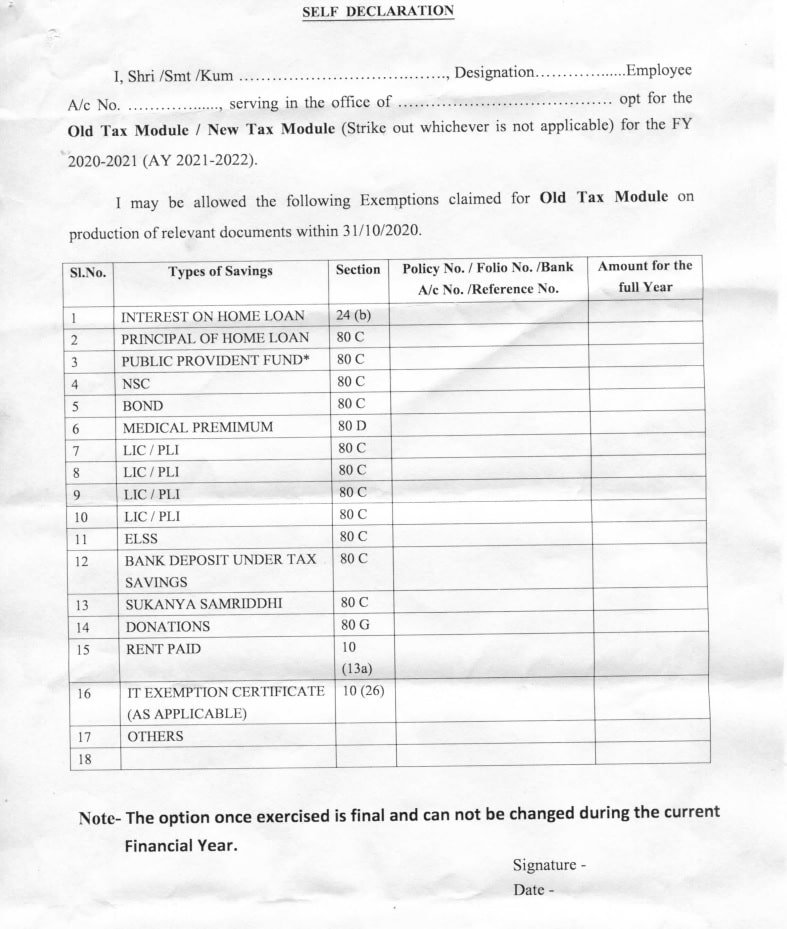

Income Tax Calculation Sheet For Salaried Employees

Income Tax Calculation Sheet For Salaried Employees

https://i.ytimg.com/vi/z2YPRyH8_xo/maxresdefault.jpg

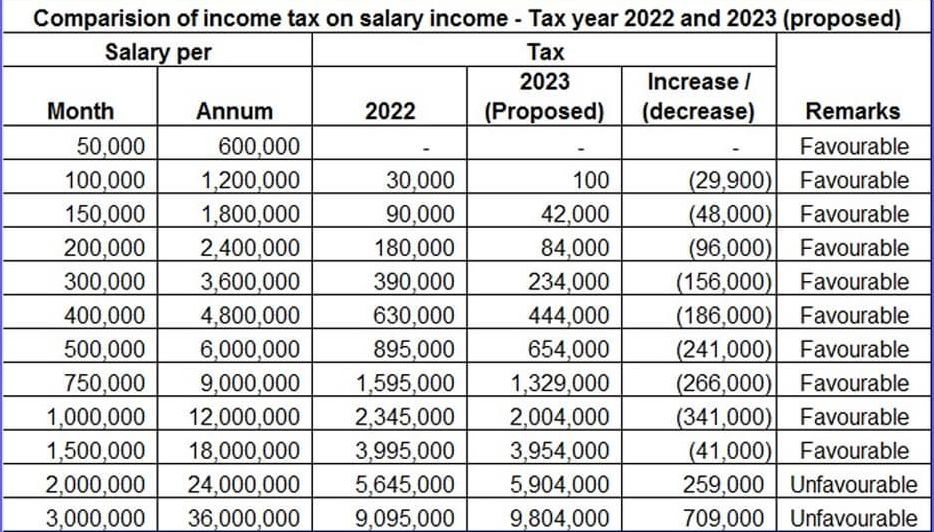

Income Tax Calculation 2022 23 How To Calculate Income Tax FY 2022 23

https://i.ytimg.com/vi/aTDYGbVWpas/maxresdefault.jpg

How To Calculate Income Tax On Salary With Payslip Example Income Tax

https://i.ytimg.com/vi/USW68EaURfg/maxresdefault.jpg

As an employee you complete this form if you have a new employer or payer and will receive salary wages or any other remuneration or if you wish to increase the amount of If your net world income exceeds the threshold amount 86 912 for 2023 you have to repay part or your entire OAS pension Part or your entire OAS pension is reduced as a monthly recovery

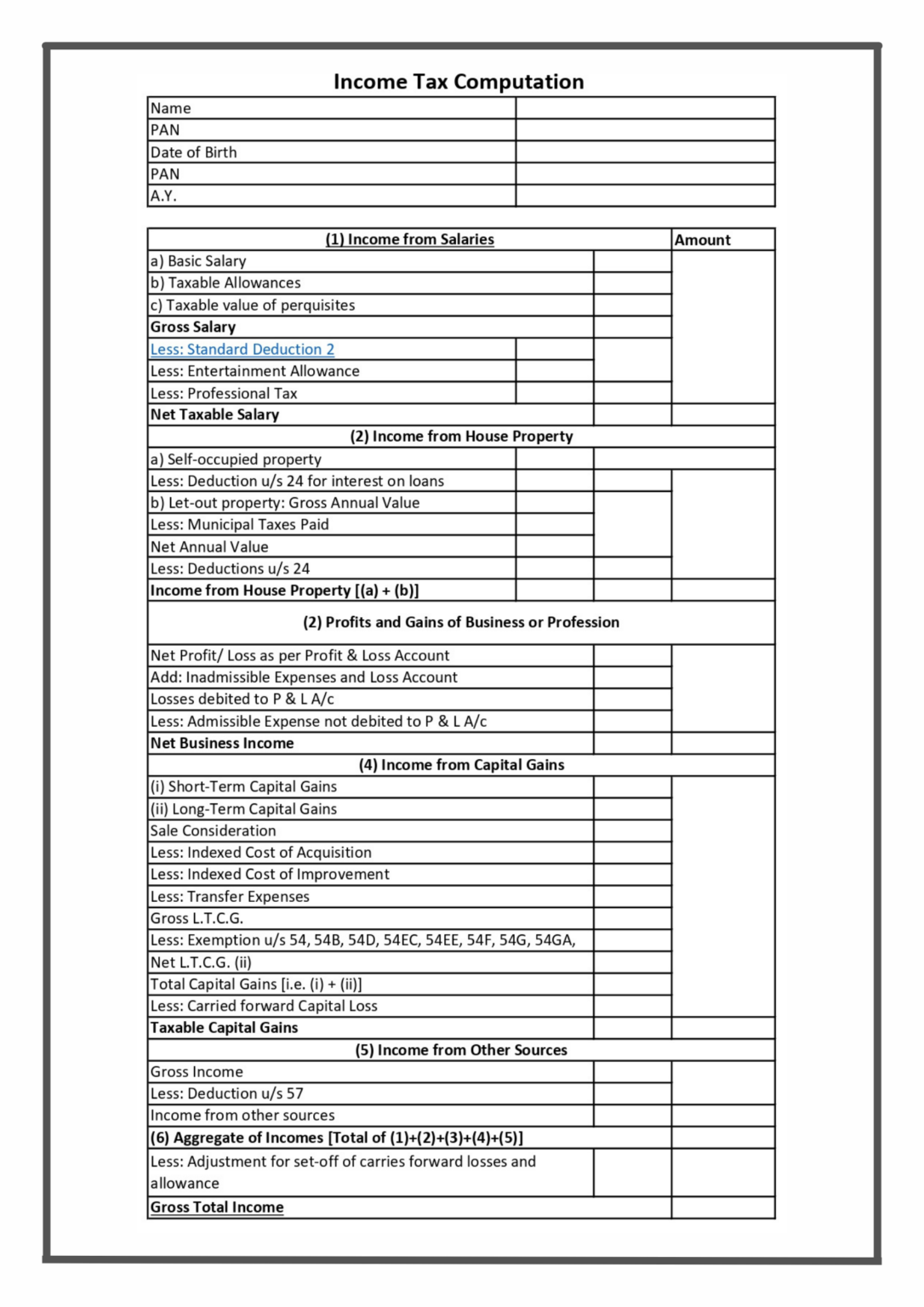

Enter net income or loss after income tax and extraordinary items at amount A page 1 of Schedule 1 Add the taxable items and the non allowable expenses listed on lines 101 to 199 The personal income levels used to calculate your Ontario tax have changed The amount of most provincial non refundable tax credits have changed The alternative minimum tax rate was

More picture related to Income Tax Calculation Sheet For Salaried Employees

How To Calculate Tax On Salary Sale Online Www pennygilley

https://media.geeksforgeeks.org/wp-content/uploads/20221216182234/Income-Tax-on-Salary-2.png

Tax Computation Sheet For Fy 2023 24 Image To U

https://i.ytimg.com/vi/_bM1Y6-JXl4/maxresdefault.jpg

Tax File Declaration Form 2025 Mary J Spillman

https://imgv2-2-f.scribdassets.com/img/document/102055570/original/b2fe0ae5f0/1628940252?v=1

The type of Canadian income that you receive during the tax year determines which income tax package you should use If you receive only income from employment or business use the Income tax Information on taxes including filing taxes and get tax information for individuals

[desc-10] [desc-11]

Tax Owed Calculator 2024 Kori Shalna

https://d6xcmfyh68wv8.cloudfront.net/learn-content/uploads/2022/02/Facebook-post-17-1024x908.png

2025 2025 Tax Formula M Jack Klatt

https://cdn.educba.com/academy/wp-content/uploads/2019/08/Calculate-Income-Tax-in-Excel-1.png

https://www.canada.ca › en › revenue-agency › services › e-services › di…

Change in individual income tax rate The Government of Canada has tabled legislation proposing to reduce the lowest income tax rate effective July 1 2025 For more information Government

https://www.canada.ca › ... › deductions-credits-expenses

Your net income is used to calculate your federal and provincial or territorial non refundable tax credits The CRA also uses your net income and your spouse s or common law partner s net

Income Tax Holiday List 2024 Florry Sheelah

Tax Owed Calculator 2024 Kori Shalna

Unmarried Certificate PDF Format Download

Tax Slab 2024 25 Pakistan Calculator Barbi Carlota

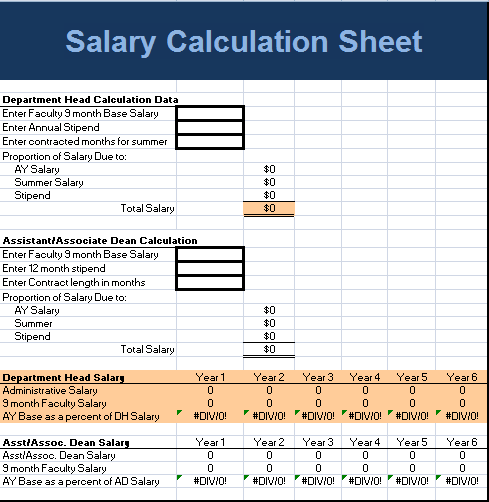

Salary Calculation Sheet Template Free Payslip Templates

Income Tax Calculator For Salary Fy 2023 24 Image To U

Income Tax Calculator For Salary Fy 2023 24 Image To U

Income Tax Calculator 2025 In India Kevin S Hill

Income Calculation Worksheet 2024

Income Calculation Worksheet 2024

Income Tax Calculation Sheet For Salaried Employees - [desc-12]