Income Tax Calculator Australia Canada Disability Benefit The Canada Disability Benefit provides direct financial support to people with disabilities who are between 18 and 64 years old The program is

For amounts based on your specific income use the Old Age Security OAS estimator If you lived in Canada for at least 10 years but less than 40 years after age 18 you will receive a It s never been easier to do your taxes online In fact online filing gets you access to the benefits credits and refunds you may be eligible for even faster Last year approximately 93 of

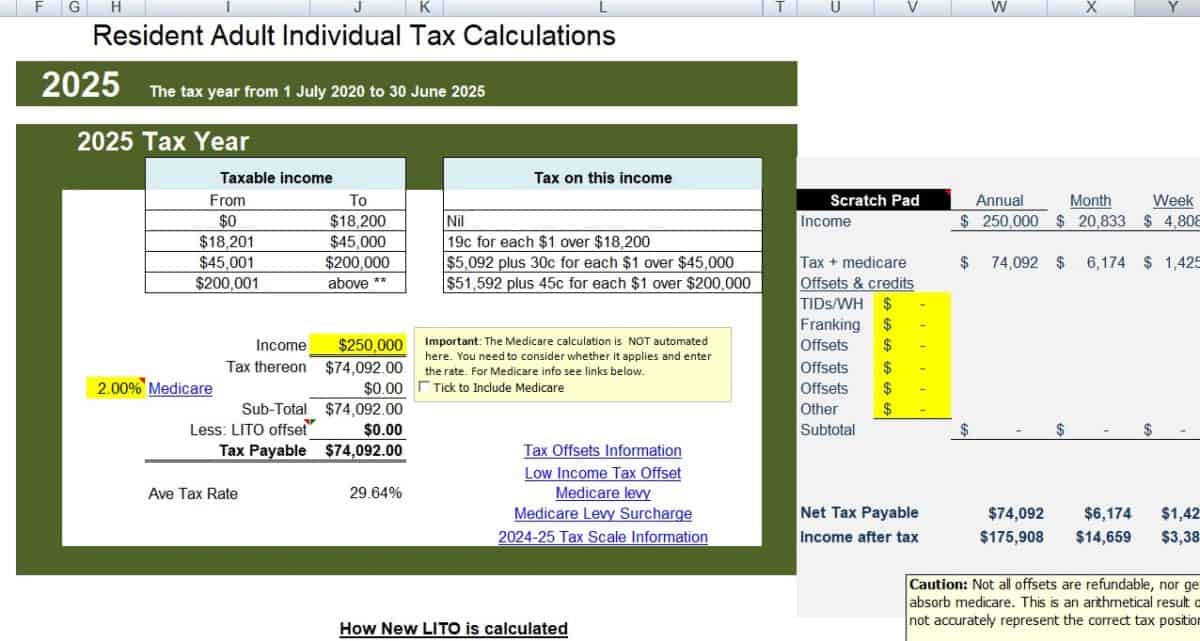

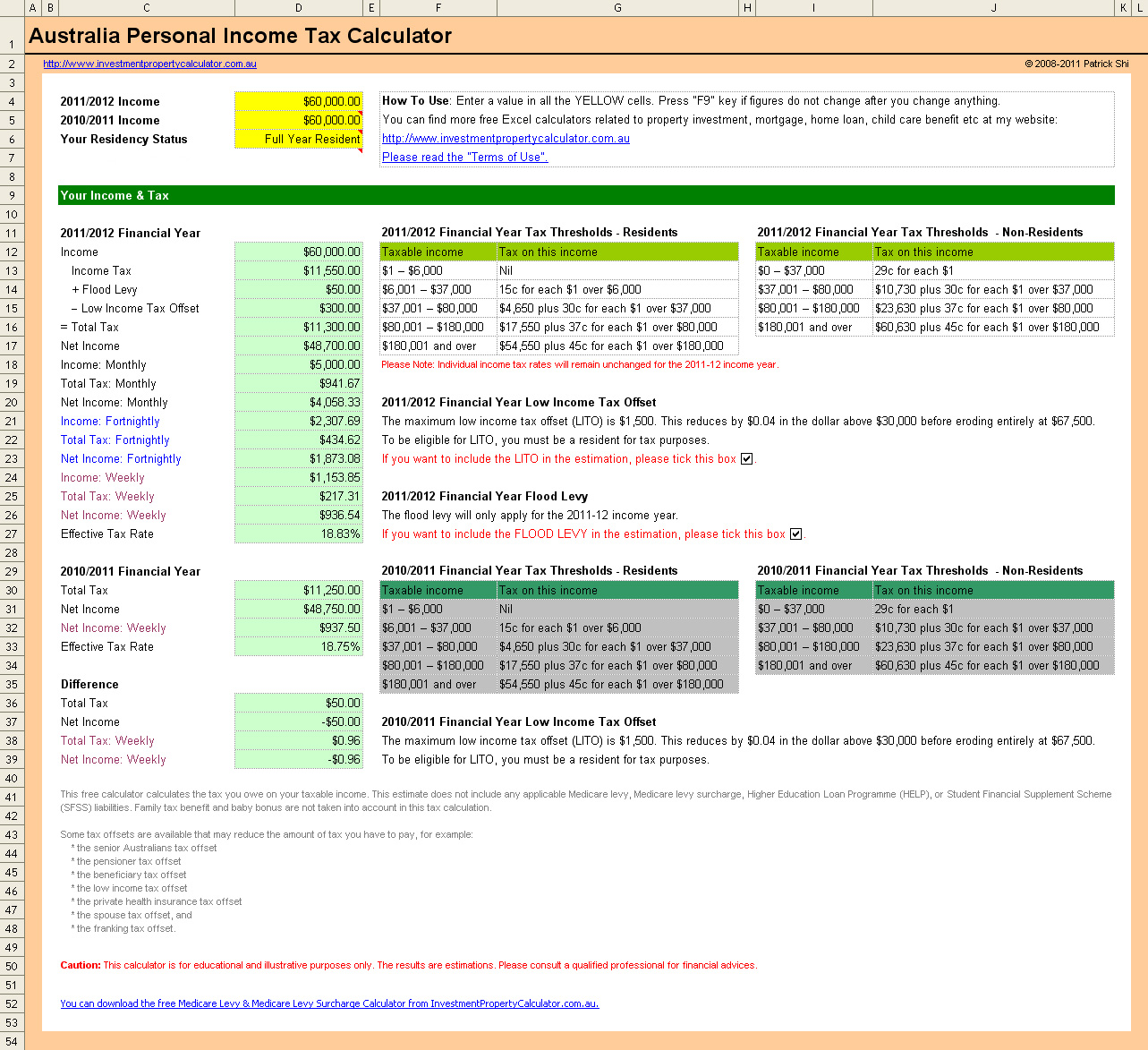

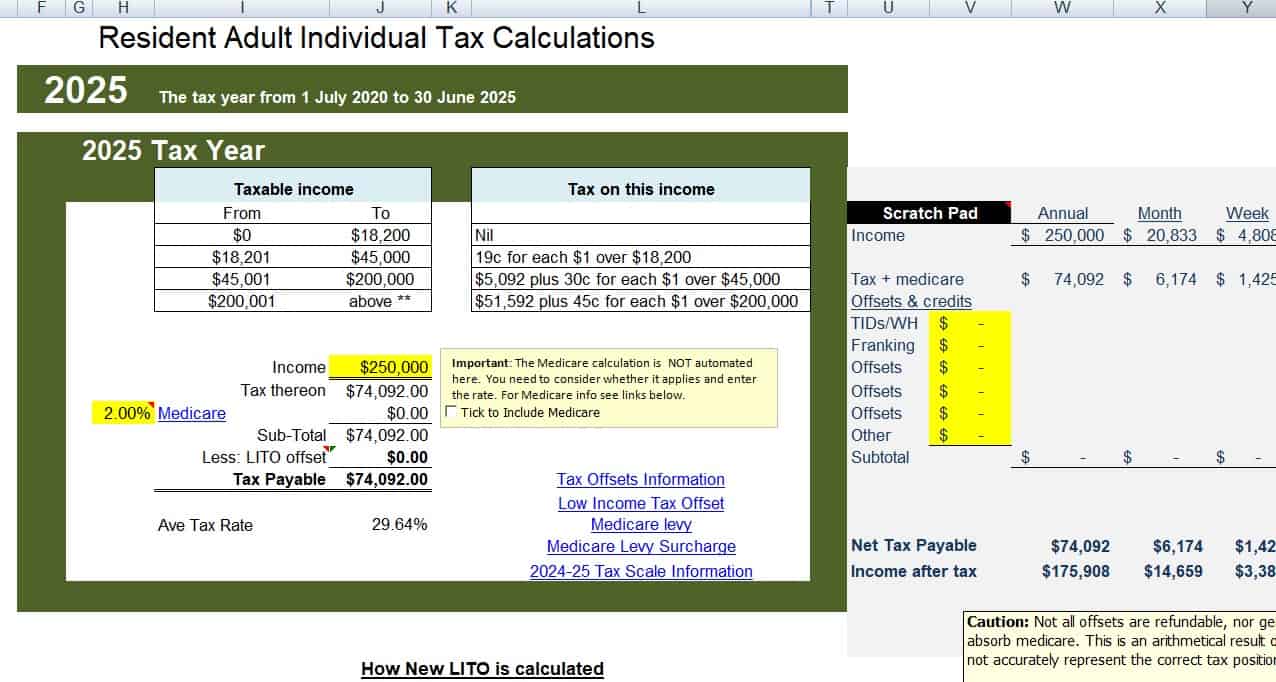

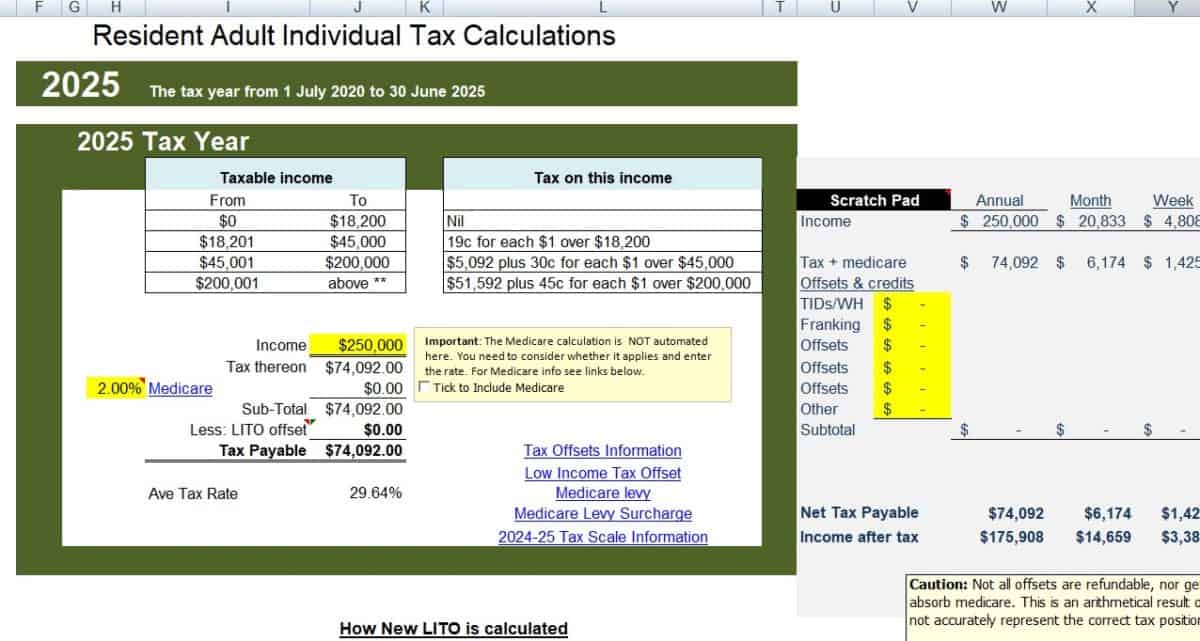

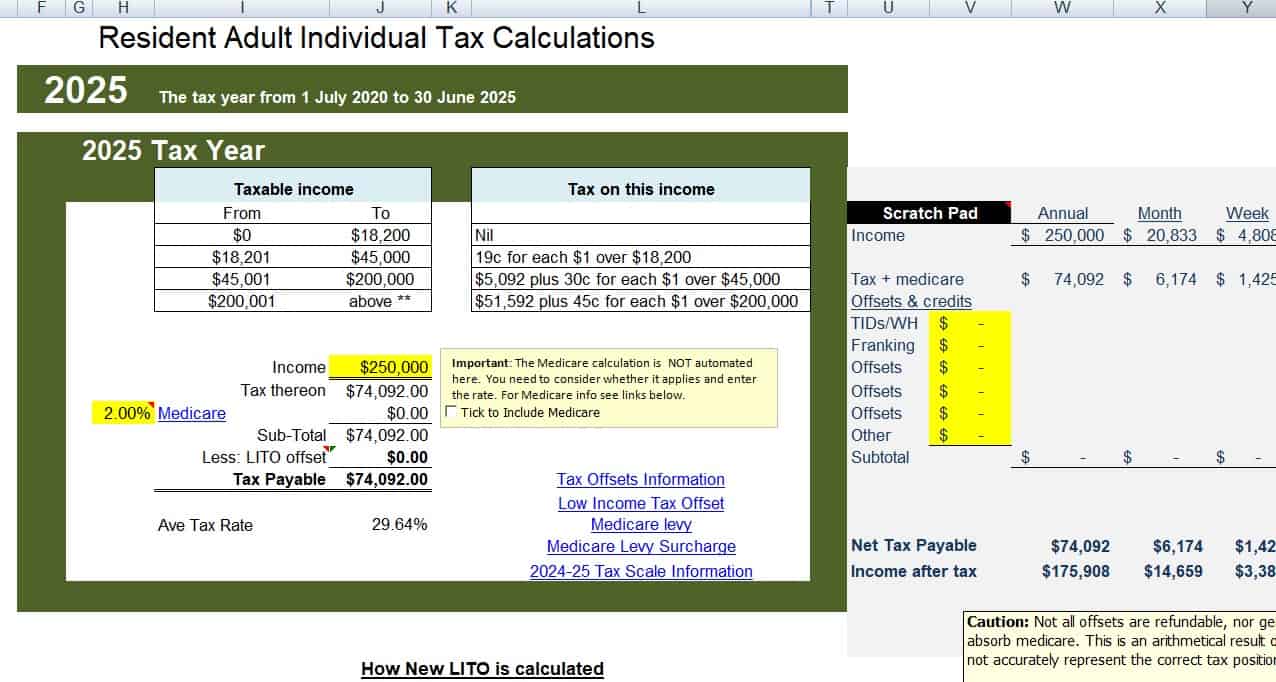

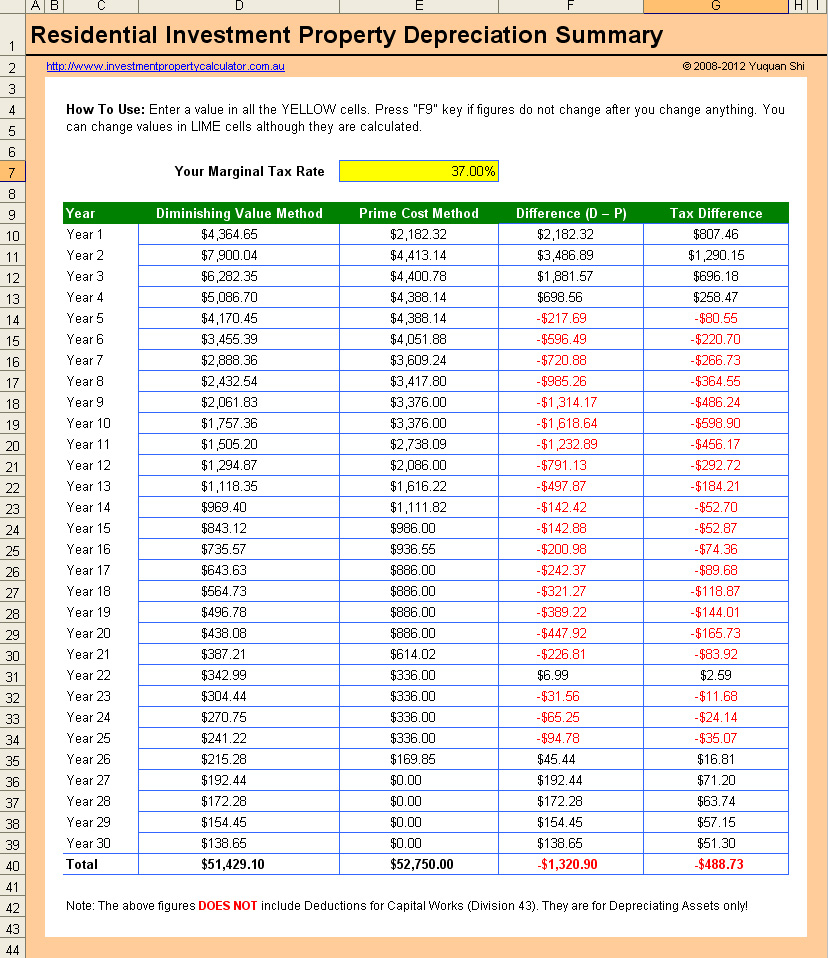

Income Tax Calculator Australia

Income Tax Calculator Australia

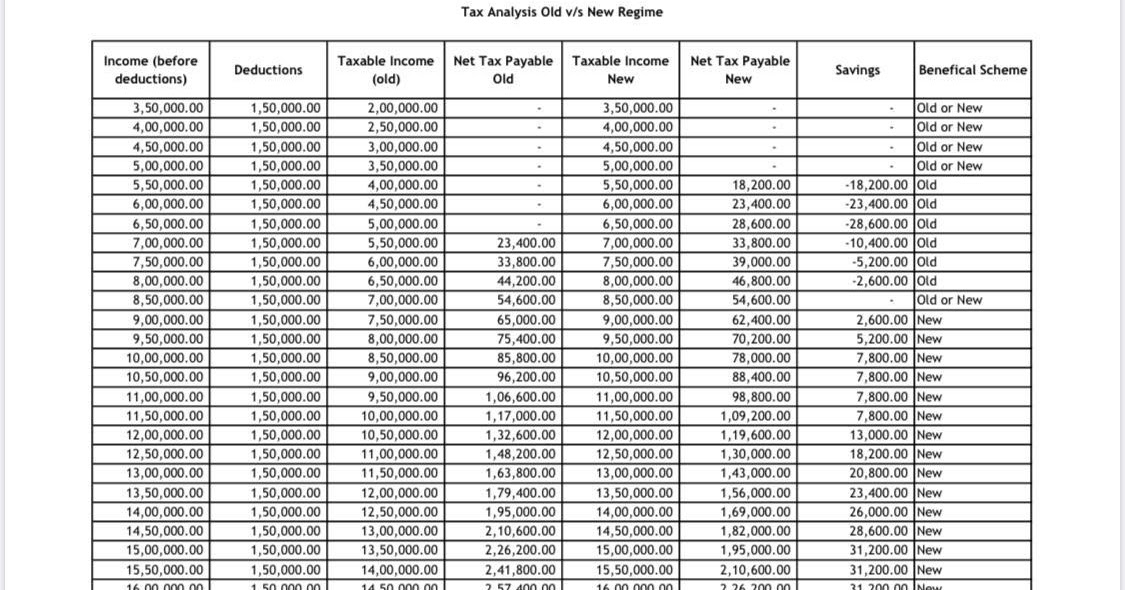

https://fincalc-blog.in/wp-content/uploads/2023/03/income-tax-calculation-examples-FY-2023-24-AY-2024-25-video.webp

Tax Calculator 2025 Sales Susan L Graves

https://atotaxrates.info/wp-content/uploads/2020/06/2025-tax-calculator1-1200x641.jpg

Individual Income Tax Rates 2023 In Singapore Image To U

https://i0.wp.com/justonelap.com/wp-content/uploads/2023/06/Tax-rates-2024-1.jpg?w=1526&ssl=1

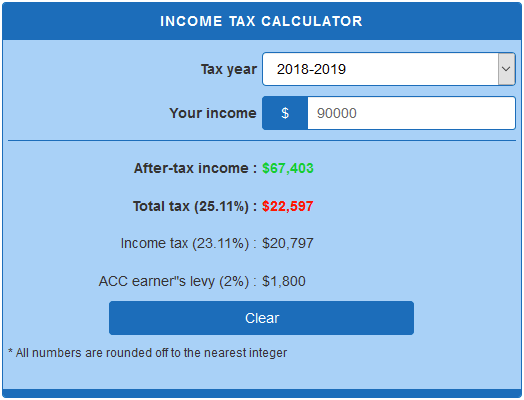

Income tax Personal business corporation trust international and non resident income tax Income tax calculator Updated for 2024 25 tax year how much tax will you pay on your salary in South Africa find out with the SARS income tax calculator updated for 2024 25 tax year

You can get an income tax package online or by mail Certain tax situations may require a specific return or form For tax filing information go to Get ready to do your taxes If Find out the details on how to apply for the Canadian Dental Care Plan

More picture related to Income Tax Calculator Australia

Income Tax Brackets 2024 Namibia Image To U

https://i0.wp.com/justonelap.com/wp-content/uploads/2023/06/Tax-rates-2024-1.jpg?resize=849%2C569&ssl=1

2025 Tax Brackets Australia Calculator Glenda Merrili

https://www.investmentpropertycalculator.com.au/assets/images/free-australia-personal-income-tax-calculator.jpg

2025 Income Tax Calculator Leona Beent

https://atotaxrates.info/wp-content/uploads/2020/06/2025-tax-calculator1-1024x547.jpg

The rates of pay for excluded and unrepresented employees in those parts of the Public Service listed in Schedule I of the Financial Administration Act FAA and other portions of the federal You are responsible for making sure that your payments are received by the CRA on or before the due date Late payments including cheques post dated after the due date may be charged

[desc-10] [desc-11]

Ato Tax Calculator 2025 Arabella Rose

https://atotaxrates.info/wp-content/uploads/2020/06/2025-tax-calculator1.jpg

Tax Bracket 2025 Philippines Ruby Amira

https://governmentph.com/wp-content/uploads/2017/12/Personal-Income-Tax-2023.png

https://www.canada.ca › en › services › benefits › disability › canada-dis…

Canada Disability Benefit The Canada Disability Benefit provides direct financial support to people with disabilities who are between 18 and 64 years old The program is

https://www.canada.ca › en › services › benefits › publicpensions › old-a…

For amounts based on your specific income use the Old Age Security OAS estimator If you lived in Canada for at least 10 years but less than 40 years after age 18 you will receive a

Individual Tax Rates 2025 Ato Zahra Quinn

Ato Tax Calculator 2025 Arabella Rose

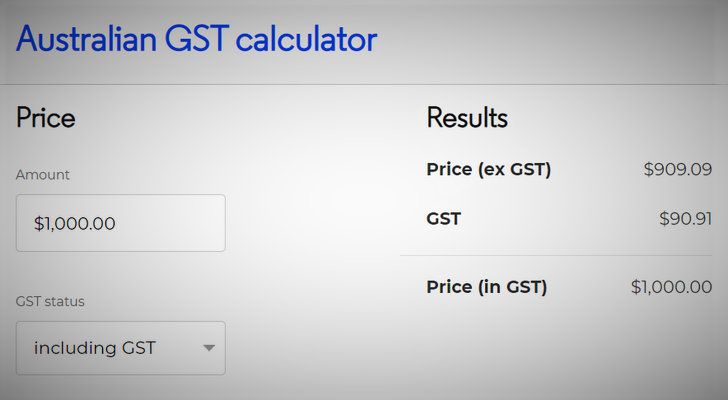

How To Calculate Gst Australia Image To U

New Road Tax Rates 2025 Canada Peggy J Canty

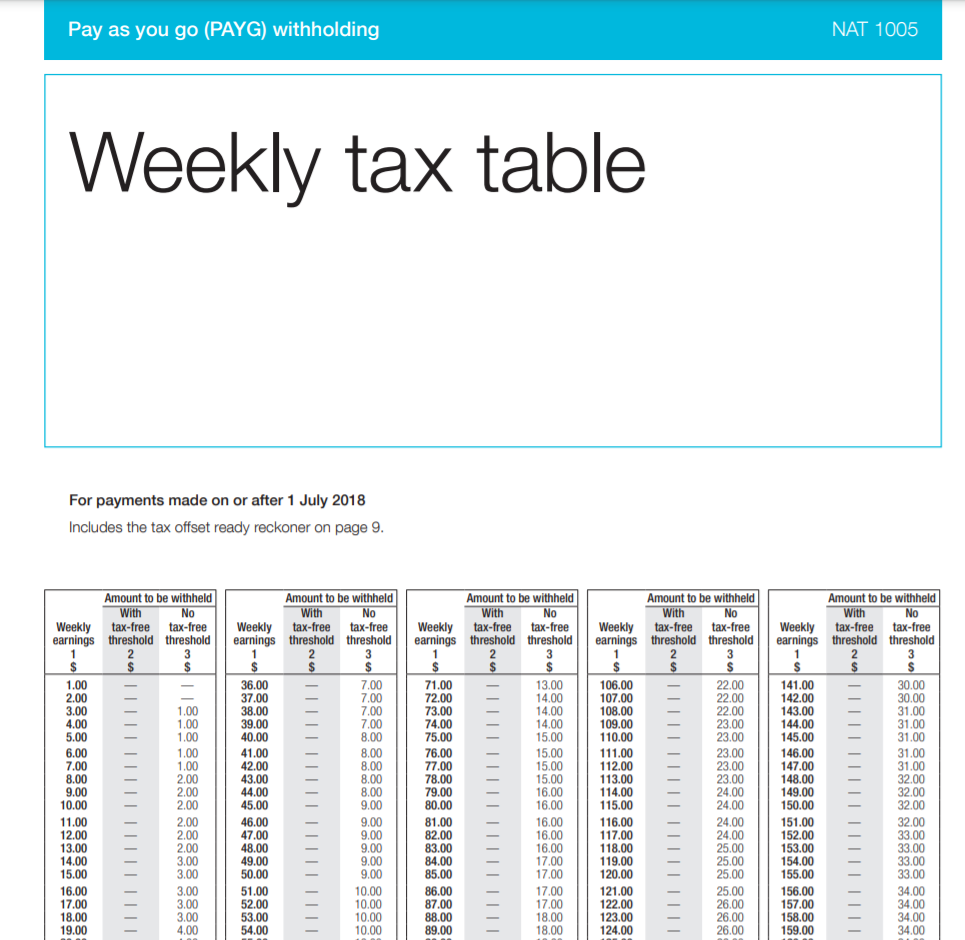

Ato Weekly Withholding Tax Tables 2017 Brokeasshome

Bah Calculator 2025 Dfas Retirement Lucia Kane

Bah Calculator 2025 Dfas Retirement Lucia Kane

Tax Brackets 2025 Australia Calculator Sherri W Bruce

Tax Calculator 2025 25 New Regime In India Images References Amelia

Weekly Tax Table 2021 Pdf

Income Tax Calculator Australia - [desc-13]