Income Tax Deductions For Salaried Employees The Canada Disability Benefit is a monthly payment for working age persons with disabilities who have low income

Income is reported and tax is calculated on an annual basis To reflect a one percentage point cut in the lowest tax rate coming into effect halfway through the year the full Income tax Personal business corporation trust international and non resident income tax

Income Tax Deductions For Salaried Employees

Income Tax Deductions For Salaried Employees

https://1.bp.blogspot.com/-jpmCgjVQiRs/XibOzwlJMyI/AAAAAAAAAvU/cW93XC88Qogx0KxKIV1hZbVzLcxngvFBACLcBGAsYHQ/s1600/income-tax-deductions-for-salaried-employees-fy-2019-20.png

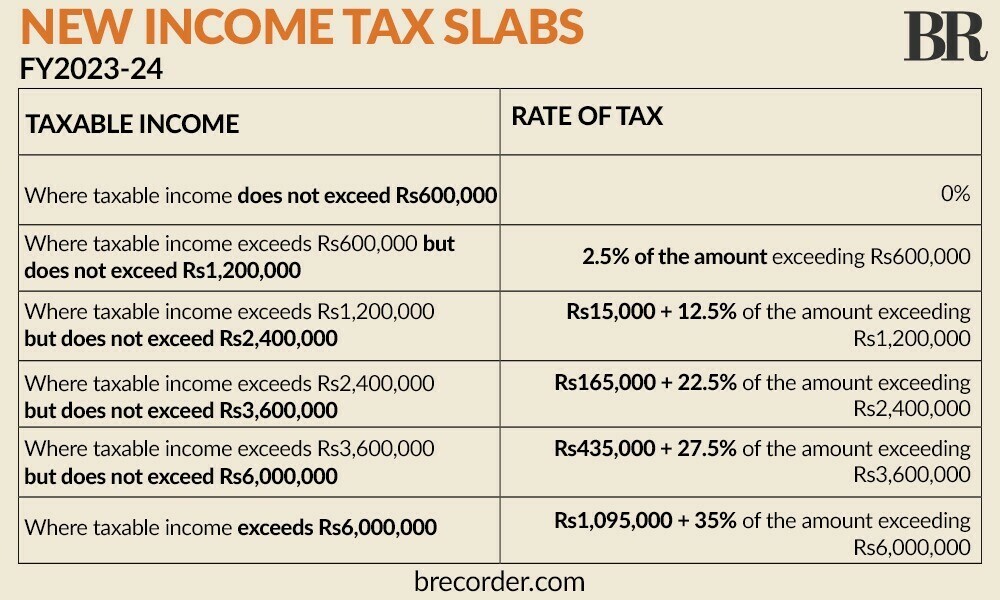

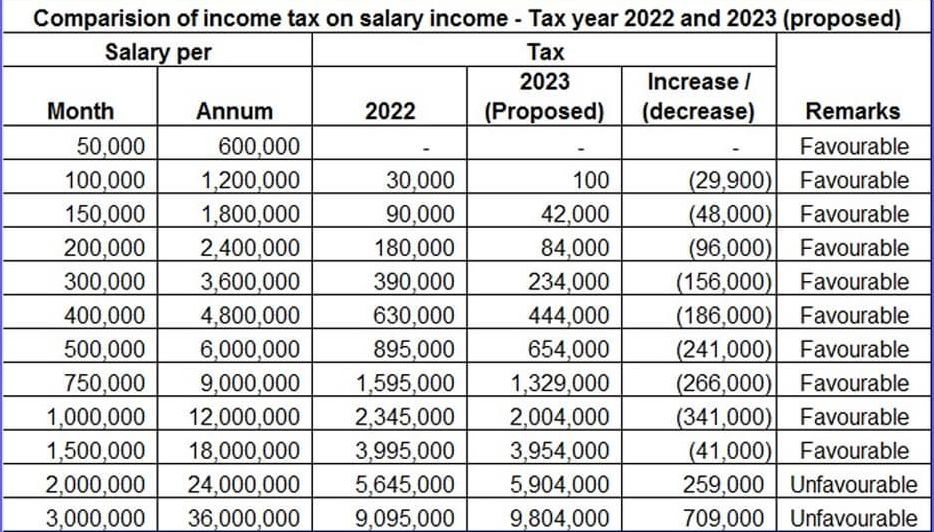

New Tax Regime For Salaried Employee 2024 25 Deductions Exemptions

https://i.ytimg.com/vi/SLd0vB7YtTA/maxresdefault.jpg

Income Tax Deductions For Salaried Employees Tax Planning Guide Old

https://i.ytimg.com/vi/L_jIcaKa11o/maxresdefault.jpg

Filing through a tax preparer If you don t do your taxes on your own an EFILE certified tax preparer like an accountant can file your income tax and benefit return for you Tax preparers NETFILE service in tax software that allows most people to submit a personal income tax return electronically to the Canada Revenue Agency

Your income It is considered taxable income and is subject to a recovery tax if your individual net annual income is higher than the net world income threshold set for the year 90 997 for Change in individual income tax rate The Government of Canada has tabled legislation proposing to reduce the lowest income tax rate effective July 1 2025 For more

More picture related to Income Tax Deductions For Salaried Employees

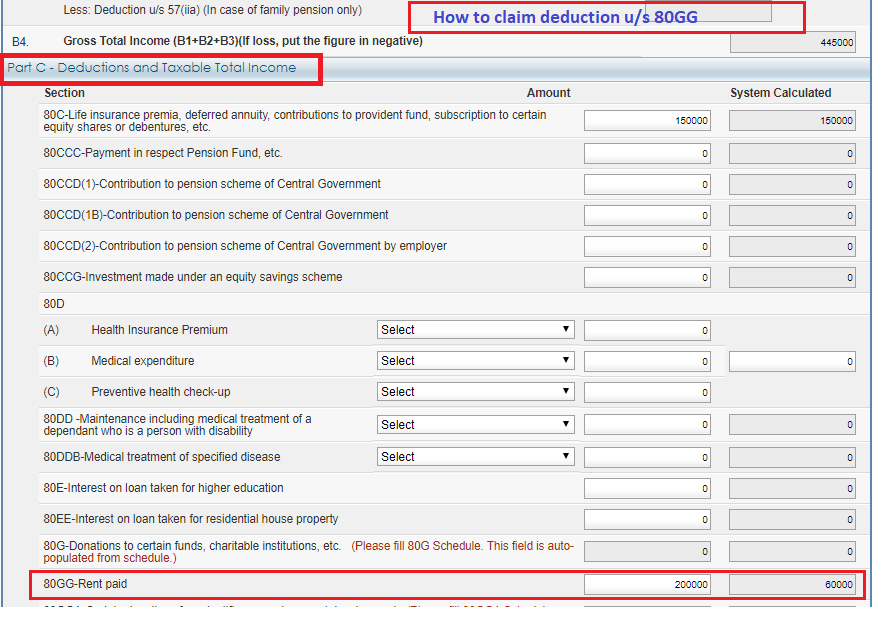

Deduction From Gross Total Income Income Tax Deduction For Salaried

https://i.ytimg.com/vi/VC55qw5i8So/maxresdefault.jpg

2025 Income Tax Calculator James C Burroughs

https://i.ytimg.com/vi/z2YPRyH8_xo/maxresdefault.jpg

80c Deductions

https://www.taxhelpdesk.in/wp-content/uploads/2022/07/DEDUCTIONS-UNDER-SECTION-80C-80CCC-80CCD1-80CCD1b-80CCD2--819x1024.png

How to make a full or partial payment to the CRA online by mail or in person Sign in or register for My Account My Business Account or Represent a Client with the CRA and get help with using the CRA sign in services

[desc-10] [desc-11]

2025 Tax Deductions Alvera Katrina

https://carajput.com/blog/wp-content/uploads/2023/05/Deduction-913x1024.jpg

Budget 2023 24 high Earners To Pay A Higher Income Tax As Govt

https://i.brecorder.com/primary/2023/06/261441140911e3a.jpg

https://www.canada.ca › en › services › benefits › disability › canada-dis…

The Canada Disability Benefit is a monthly payment for working age persons with disabilities who have low income

https://www.canada.ca › en › department-finance › news › delivering-a-…

Income is reported and tax is calculated on an annual basis To reflect a one percentage point cut in the lowest tax rate coming into effect halfway through the year the full

2025 Tax Slabs Usa Carl Criswell

2025 Tax Deductions Alvera Katrina

2025 Tax Formula Barbara E Gomez

Income Tax Taxmani

Tax Calculator 2024 Kenya Salary Cris Michal

Standard Deduction For 2025 Indian Income Hassan Amelia

Standard Deduction For 2025 Indian Income Hassan Amelia

Hra Rules For Tax Exemption Factzone

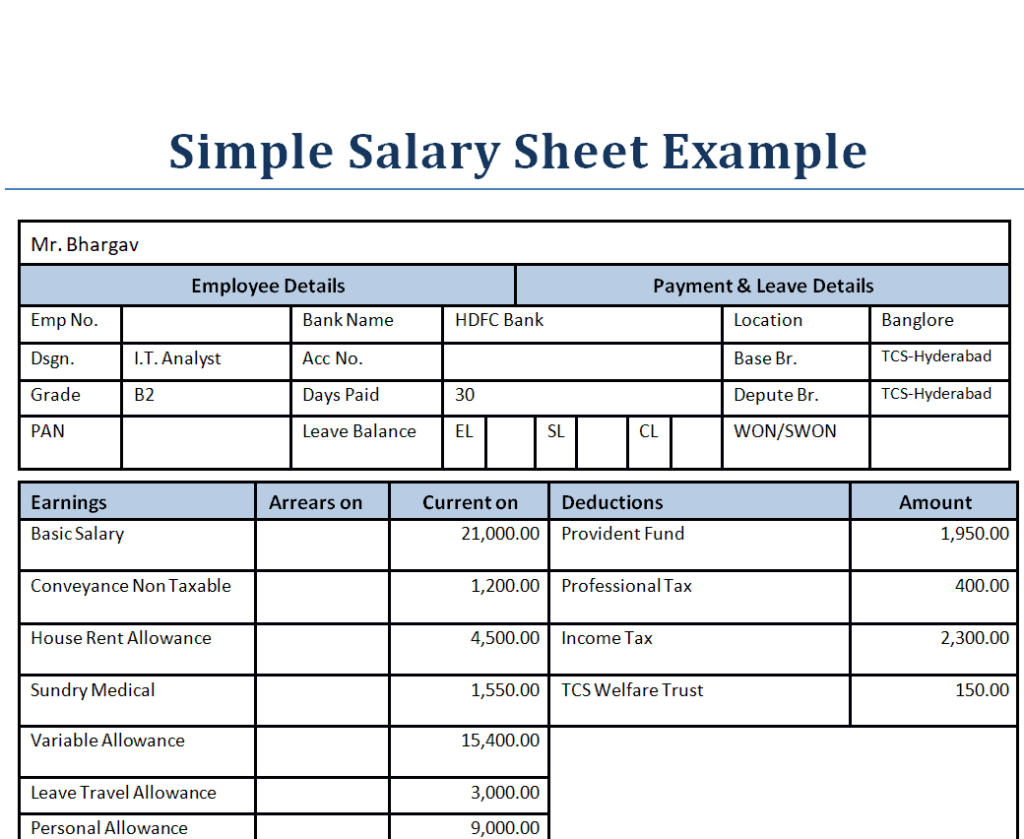

10 Salary Sheet Templates In Pdf Vrogue co

5 Tax Saving Options For Salaried Employees Zaggle Save Employee

Income Tax Deductions For Salaried Employees - [desc-14]