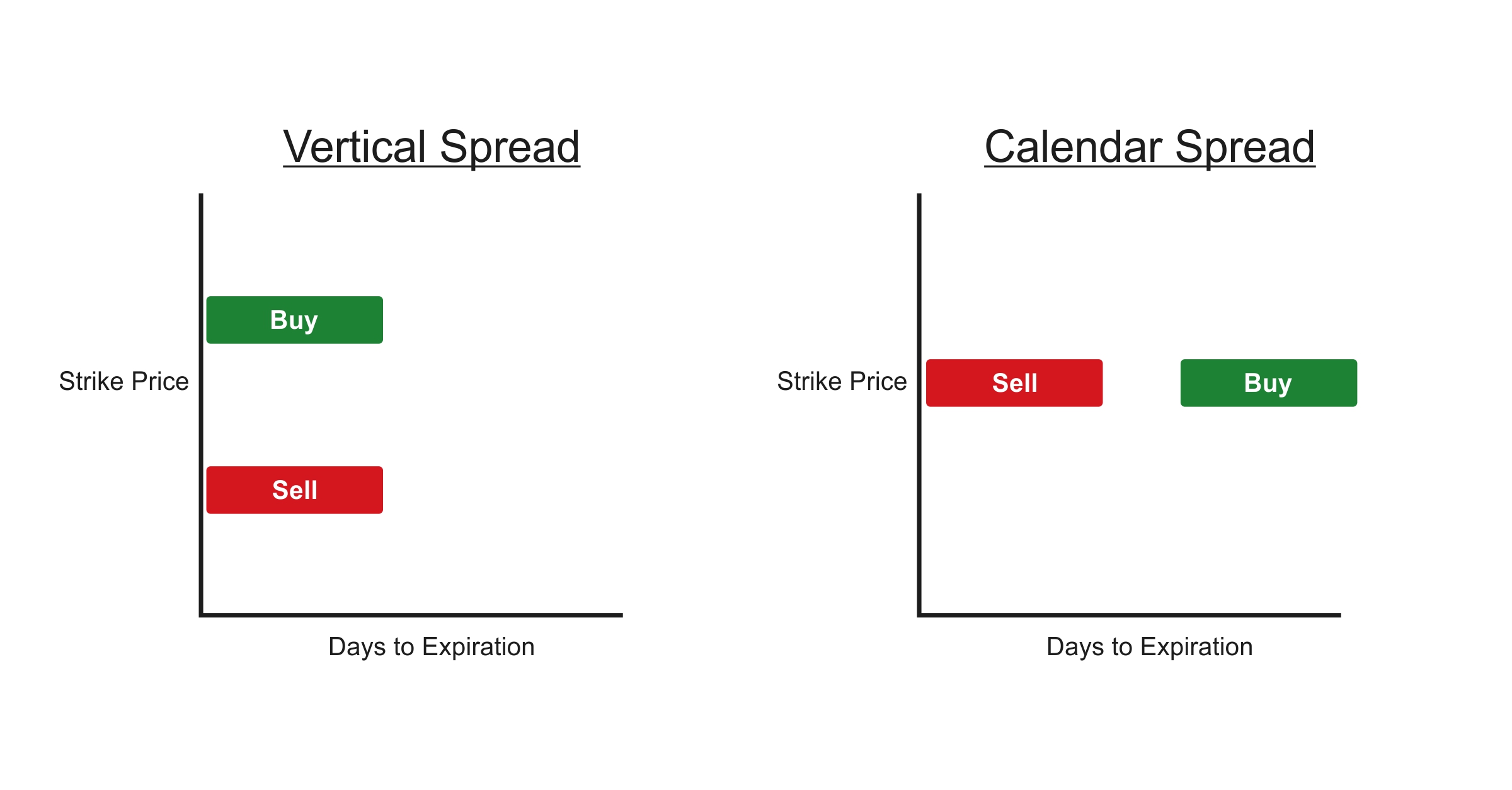

Pricing Calendar Spread Options A calendar spread is an options trading strategy that involves buying and selling two options with the same strike price but different

Calendar spreads are also known as time spreads counter spreads and horizontal spreads In the options strategy version calendar spreads are set up within the same underlying asset and strike price but different expiration dates A calendar spread is an options strategy that involves buying and selling options on the same underlying security with the same strike price but with different expiration dates

Pricing Calendar Spread Options

Pricing Calendar Spread Options

https://i.ytimg.com/vi/o6tHCsW_Plw/maxresdefault.jpg

How To Trade Options Calendar Spreads Visuals And Examples

https://www.projectfinance.com/wp-content/uploads/2021/10/Long-Call-Calendar-Spread-1-1024x1024.jpg

Calendar Spread Options Strategy How To Trade Weekly Options YouTube

https://i.ytimg.com/vi/VqXuRuRNkaU/maxresdefault.jpg

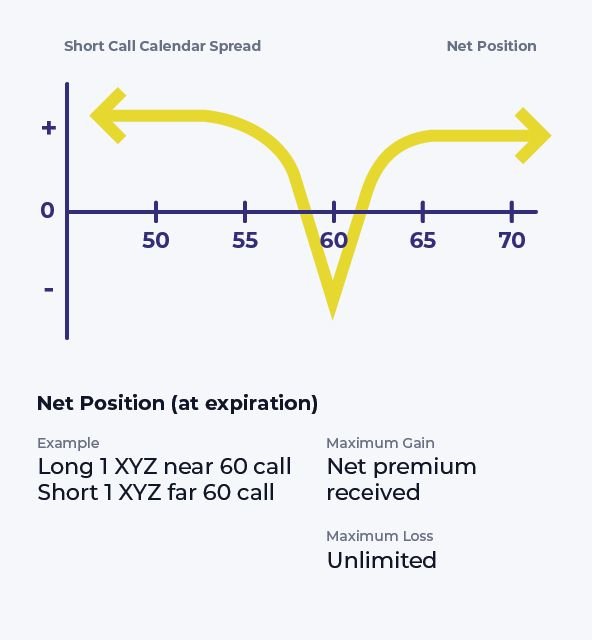

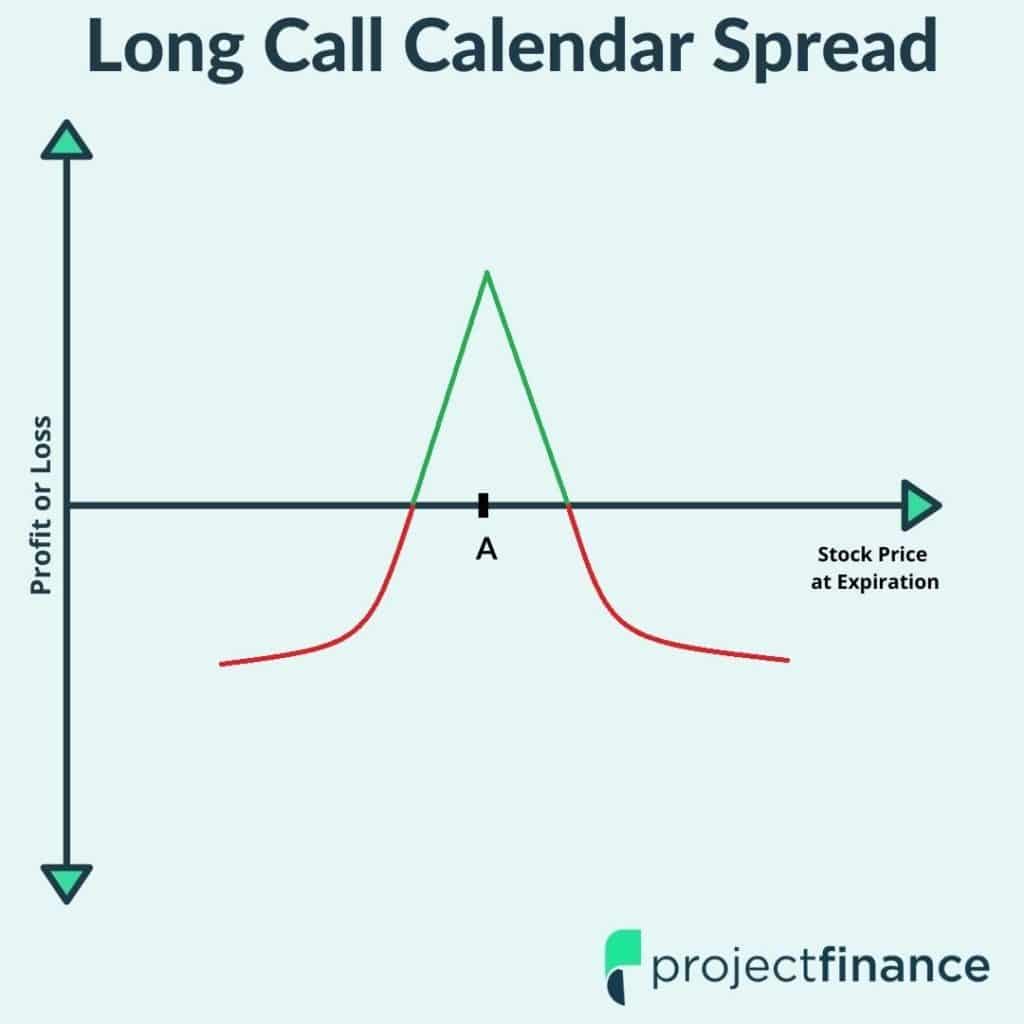

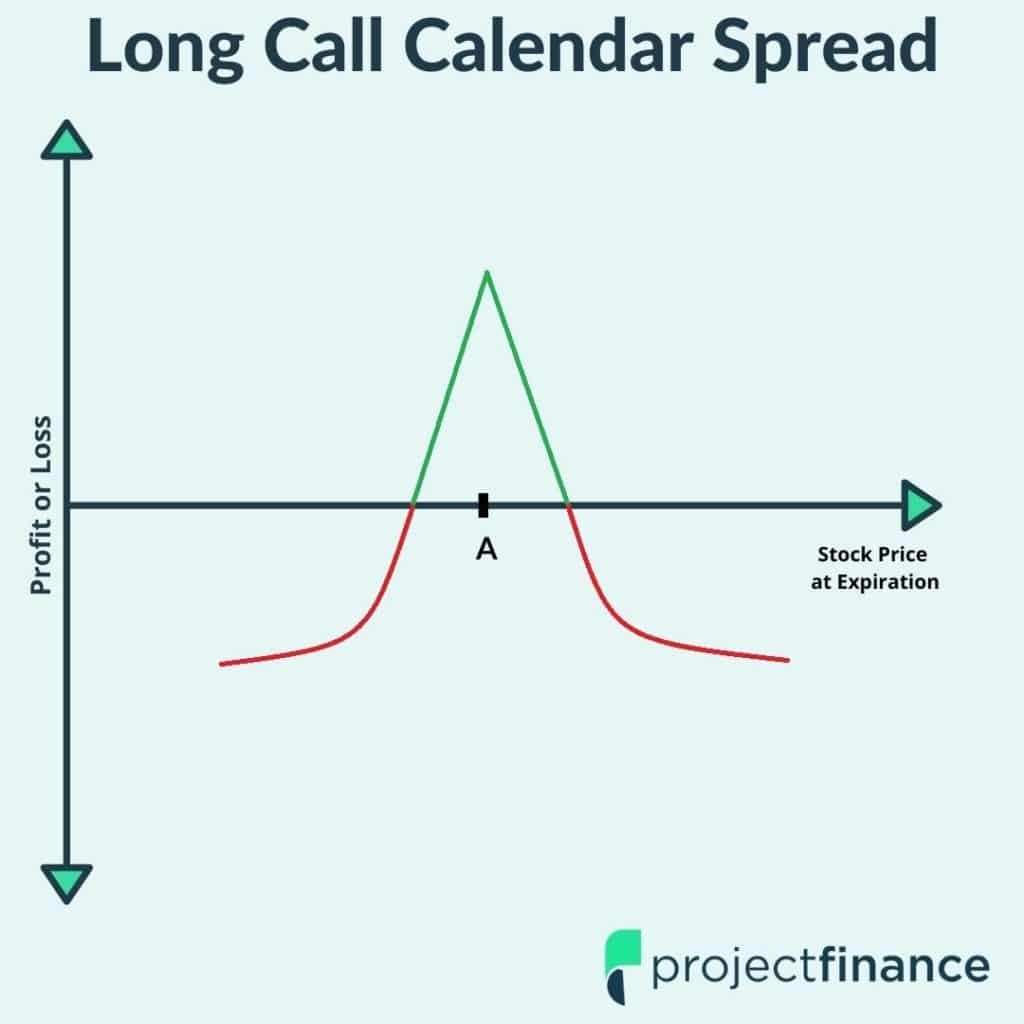

A calendar spread is an options strategy that is constructed by simultaneously buying and selling an option of the same type calls or puts and strike price but different expirations If the trader sells a near term option and A calendar spread consists of two primary parts the long leg with a distant expiration date and the short leg with a near term expiration date These components share identical strike prices and

Calendar spreads are a great way to combine the advantages of spreads and directional options trades in the same position A long calendar spread is a good strategy to use when you expect the A calendar spread is a versatile options trading strategy that involves buying and selling certain options contracts at the same time Find out exactly how calendar spreads work

More picture related to Pricing Calendar Spread Options

Calendar Spread Options Strategy VantagePoint

https://www.vantagepointsoftware.com/wp-content/uploads/2022/11/Calendar-spread-graphic-1024x708.png

Pair Trading Strategy Spread Trading Strategy Calendar Spread

https://www.ifcmarkets.com/uploads/page_covers/2c6dd8c5f753a8e7647408e1d541e9abab55cfba.jpg

Calendar Spread Options Trading Strategy In Python

https://d1rwhvwstyk9gu.cloudfront.net/test/2019/05/calendar.PNG

The simple definition of a calendar spread is that it is basically an options spread that involves options contracts with different expiration dates There are several types including horizontal A calendar spread or time spread refers to a market neutral strategy of buying a long term call option and selling a short term call option of the same derivative simultaneously having the

The core concept of a calendar spread involves selling a short term option and buying a longer dated option at the same strike price There s a number of considerations involved when structuring a calendar spread The calendar spread options strategy is a market neutral strategy for seasoned options traders that expect different levels of volatility in the underlying stock at varying points

Nifty Option Strategy Calendar Spread For September 21 2023 Expiry

https://www.tradepik.com/content/images/wordpress/2023/04/Calendar-Spread-Options-Strategy-in-Nifty.jpg

Short Call Calendar Spread Options Strategy

https://cdn.builder.io/api/v1/image/assets/b96d1a45947743debd70f5130ae8e1d1/d1d3e90514694a71bf9b0de1c0235bfd

https://optionstradingiq.com › calendar-spreads

A calendar spread is an options trading strategy that involves buying and selling two options with the same strike price but different

https://www.tastylive.com › ... › calendar-spread

Calendar spreads are also known as time spreads counter spreads and horizontal spreads In the options strategy version calendar spreads are set up within the same underlying asset and strike price but different expiration dates

CALENDAR SPREAD Simpler Trading

Nifty Option Strategy Calendar Spread For September 21 2023 Expiry

What Is The Calendar Spread In Options Trading

What Are Calendar Spread And Double Calendar Spread Strategies

Paradigm Insights Save The Date A Comprehensive Overview Of The

What Is A Calendar Spread

What Is A Calendar Spread

Glossary Definition Horizontal Call Calendar Spread Tackle Trading

Calendar Spread Options Strategy Forex Systems Research And Reviews

Trading Guide On Calendar Call Spread AALAP

Pricing Calendar Spread Options - A calendar spread also known as a time spread is an options trading strategy that involves buying and selling two options of the same type either calls or puts with the same