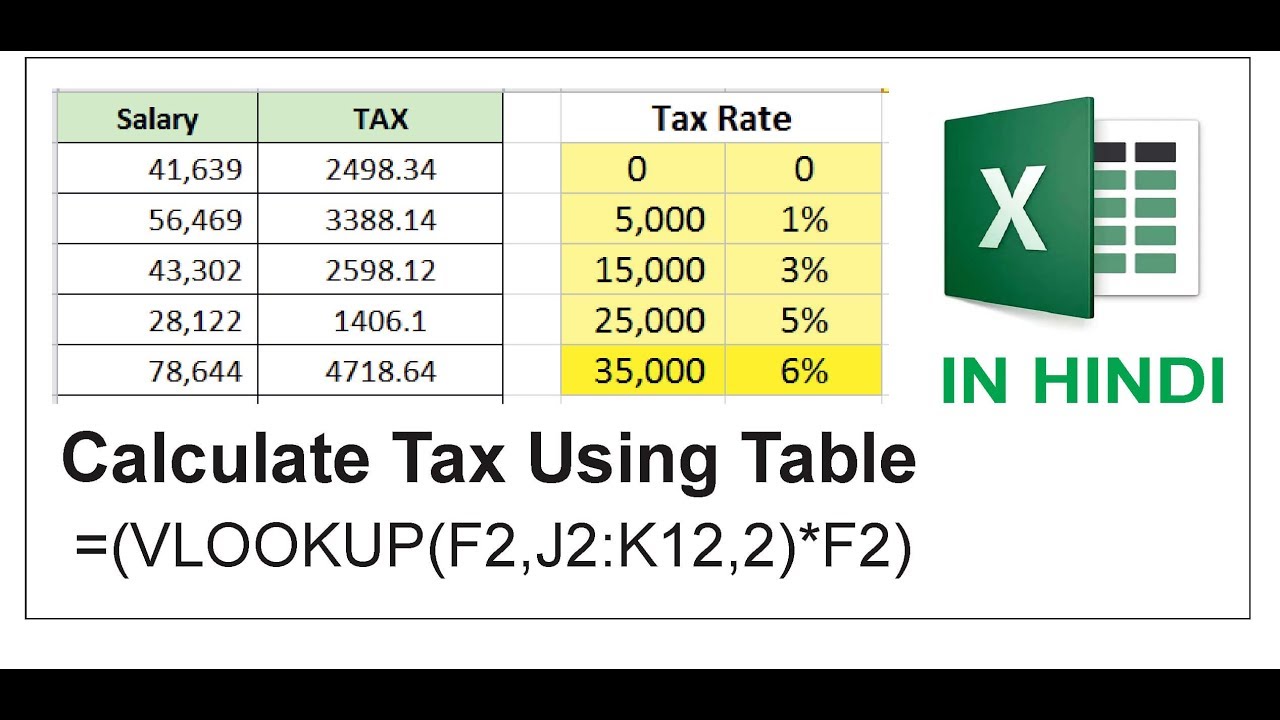

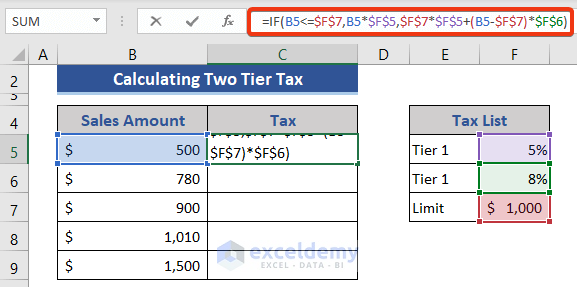

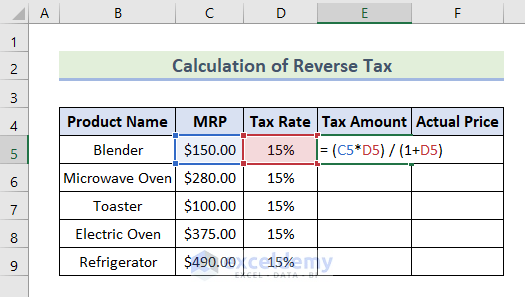

Reverse Sales Tax Formula Excel Here is a sample dataset to calculate the reverse tax calculation formula The dataset comprises product names MRP and Tax rates in cells B4 D9 Calculate the tax amount of each product with this formula Press Enter Calculate the tax amount of other products as well

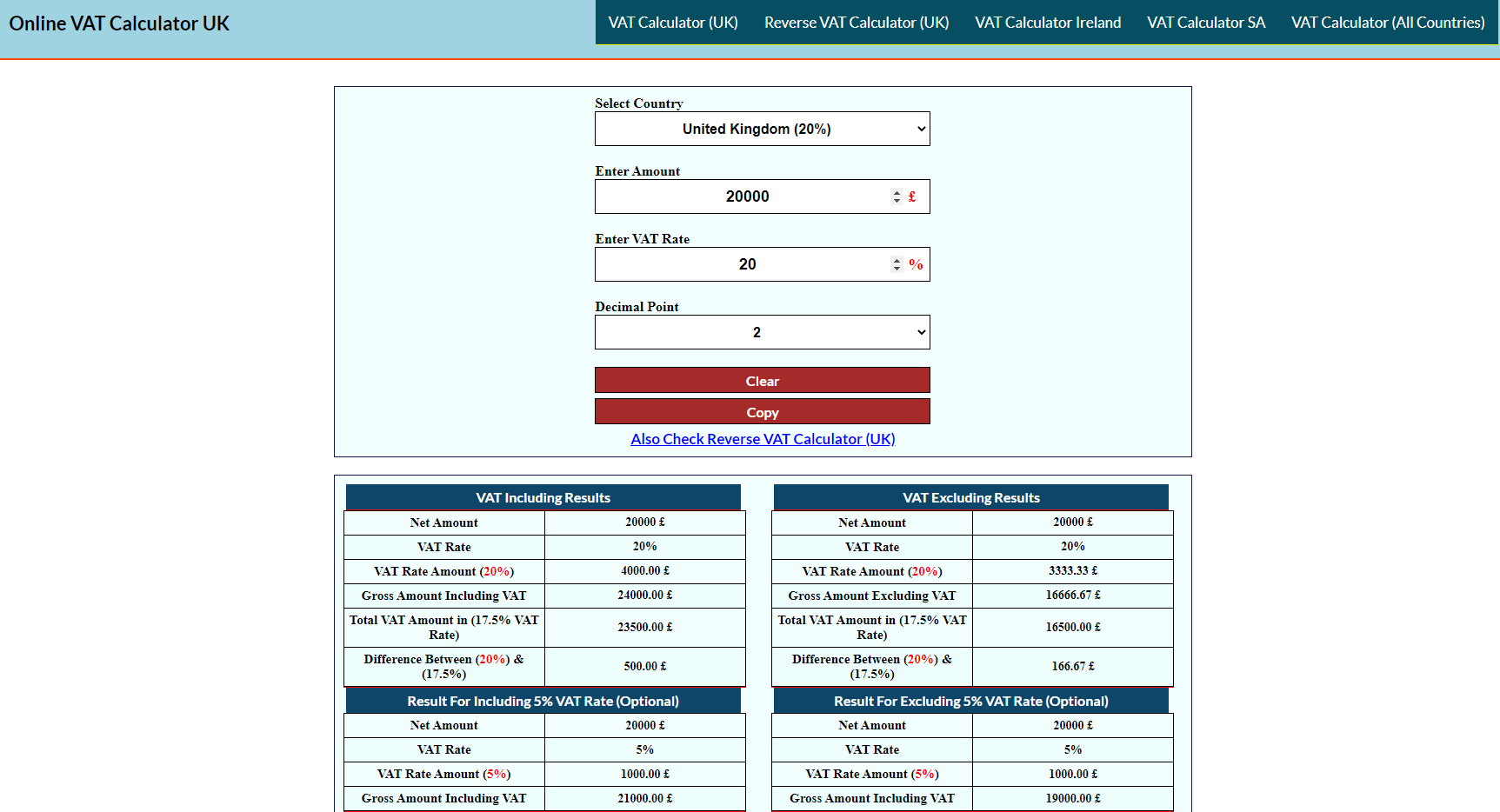

The article provides a detailed guide on reverse sales tax calculation in Microsoft Excel crucial for businesses and individuals to extract pre tax prices from totals with tax Highlighting its importance for financial accuracy pricing and tax compliance it walks through creating a reverse sales tax calculator supplemented with examples First we will show you why you would want to calculate reverse sales tax and with a simple example and then we will show you how to apply the calculation to data in an Excel

Reverse Sales Tax Formula Excel

Reverse Sales Tax Formula Excel

https://i.ytimg.com/vi/jLK66kBWkZ4/maxresdefault.jpg

Calculate Sales Tax In Excel Using Vlookup Formula YouTube

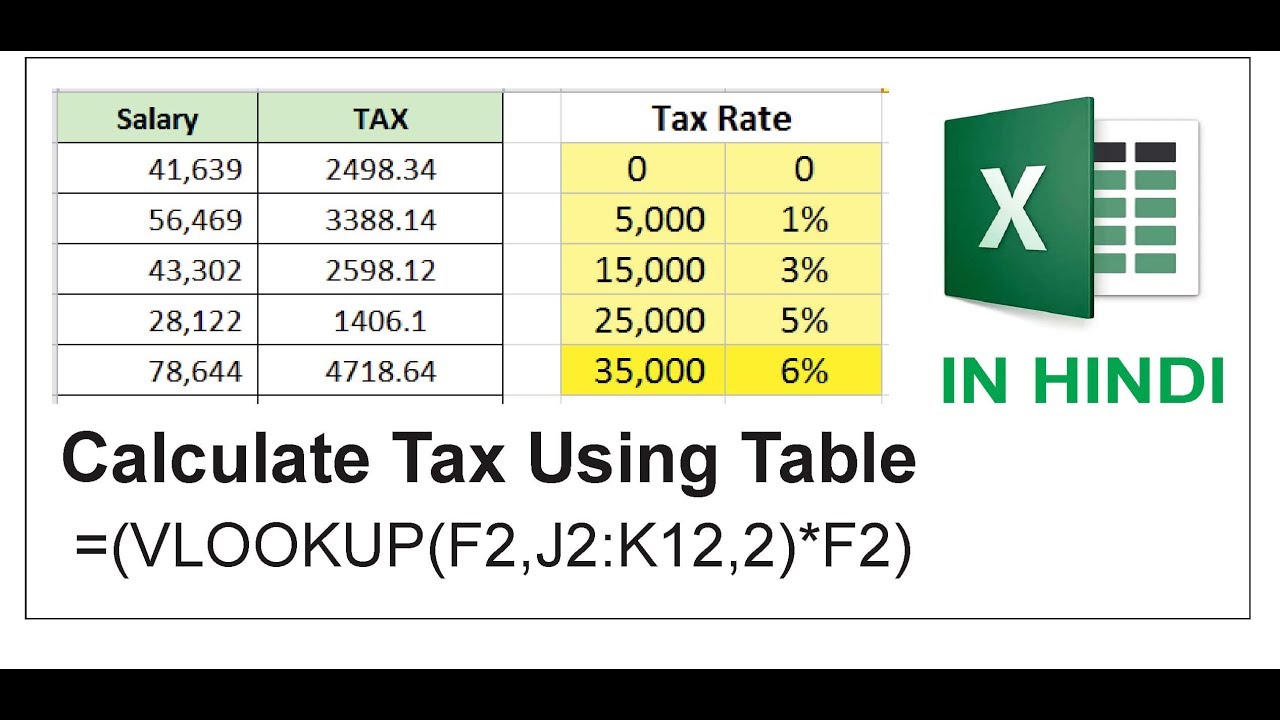

https://i.ytimg.com/vi/m6HtEY-UDac/maxresdefault.jpg

AdVantage Tax Reverse Sales Tax Audit Services YouTube

https://i.ytimg.com/vi/UlfXLsYRQQY/maxresdefault.jpg

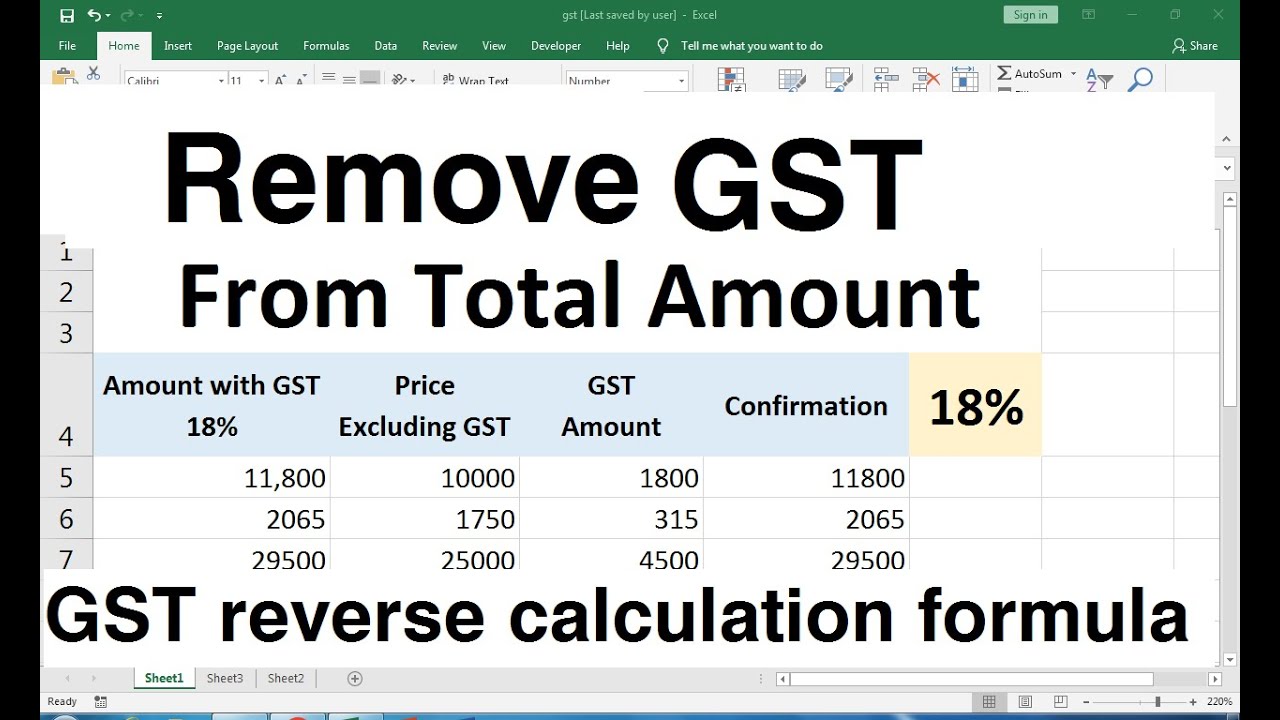

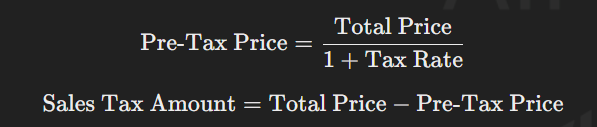

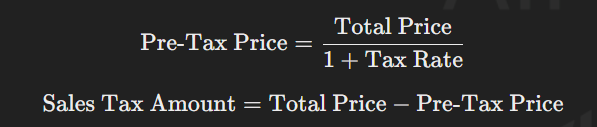

The formula for reverse tax calculation is straightforward divide the total amount by one plus the tax rate expressed as a decimal For instance if the total amount is in cell A2 and the tax rate is in cell B2 the formula in cell C2 for the pre tax amount would be A2 1 B2 I have a product used to sell for 118 which includes value of the product is 100 9 of CGST tax 9 of SGST tax which equals 100 9 9 118 Now I want to calculate the tax from the total cost for example total cost is 118 i need

You can perform a reverse tax calculation to find the price of some item before tax was added You can use the following formula to do so Price Before Tax Price After Tax 1 Tax Rate For example suppose the price of an item after tax You can use the following formulas to add or remove sales tax from prices in Excel Formula 1 Add Sales Tax to Price Formula 2 Remove Sales Tax from Price Both formulas assume the price of a good is located in cell B2 and the sales tax rate is located in cell F1 The following examples show how to use each formula in practice

More picture related to Reverse Sales Tax Formula Excel

Excel Basic Operations And References YouTube

https://i.ytimg.com/vi/TRlBnO6Ffmw/maxresdefault.jpg

How To Add I Tax In Rate Analysis Reverse Formula Find Original

https://i.ytimg.com/vi/nVKzFnnFW04/maxresdefault.jpg

How To Calculate Gst Amount From Total Amount In Excel YouTube

https://i.ytimg.com/vi/ptTea5xLrXY/maxresdefault.jpg

Method 1 Getting the Sales Tax using a Subtraction The receipt shows price tax rate and total price Steps Subtract the price value from the total price to get the tax amount Go to C7 and enter the following formula The Excel sales tax decalculator works by using a formula that takes the following steps Step 1 take the total price and divide it by one plus the tax rate Step 2 multiply the result from step one by the tax rate to get the dollars of tax

[desc-10] [desc-11]

Reverse Sales Tax Calculator 2025 Find Cost Before Tax With Ai Tips

https://reversesalestaxcalculator.pro/wp-content/uploads/2025/02/Reverse-Sales-Tax-Calculation.png

Reverse Sales Tax Calculator

https://htmlcalculator.com/wp-content/uploads/2021/06/reverse-sales-tax-calculator.png

https://www.exceldemy.com › reverse-tax-calculation-formula-in-excel

Here is a sample dataset to calculate the reverse tax calculation formula The dataset comprises product names MRP and Tax rates in cells B4 D9 Calculate the tax amount of each product with this formula Press Enter Calculate the tax amount of other products as well

https://www.myexcelonline.com › blog › reverse-sales-tax-calculator

The article provides a detailed guide on reverse sales tax calculation in Microsoft Excel crucial for businesses and individuals to extract pre tax prices from totals with tax Highlighting its importance for financial accuracy pricing and tax compliance it walks through creating a reverse sales tax calculator supplemented with examples

Excel Formula For Reverse Tax Calculation Excel Formula Excel Reverse

Reverse Sales Tax Calculator 2025 Find Cost Before Tax With Ai Tips

Cmty blog detail

Sales Tax Calculator Price Before Tax After Tax More

How To Calculate The Sales Tax In Excel 4 Methods ExcelDemy

Cmty blog detail

Cmty blog detail

6 Reverse Sales Tax Calculator MohiemenLaeona

Tax Back Calculator VhairiMaizie

Sales Tax Recovery Services Reverse Sales Tax Audit TaxMatrix

Reverse Sales Tax Formula Excel - You can use the following formulas to add or remove sales tax from prices in Excel Formula 1 Add Sales Tax to Price Formula 2 Remove Sales Tax from Price Both formulas assume the price of a good is located in cell B2 and the sales tax rate is located in cell F1 The following examples show how to use each formula in practice