Rmd 10 Year Rule Inherited Ira RMD est l abr viation de la distribution minimale requise et correspond au montant d argent requis que vous devez retirer d un r gime de retraite parrain par l employeur qui est galement

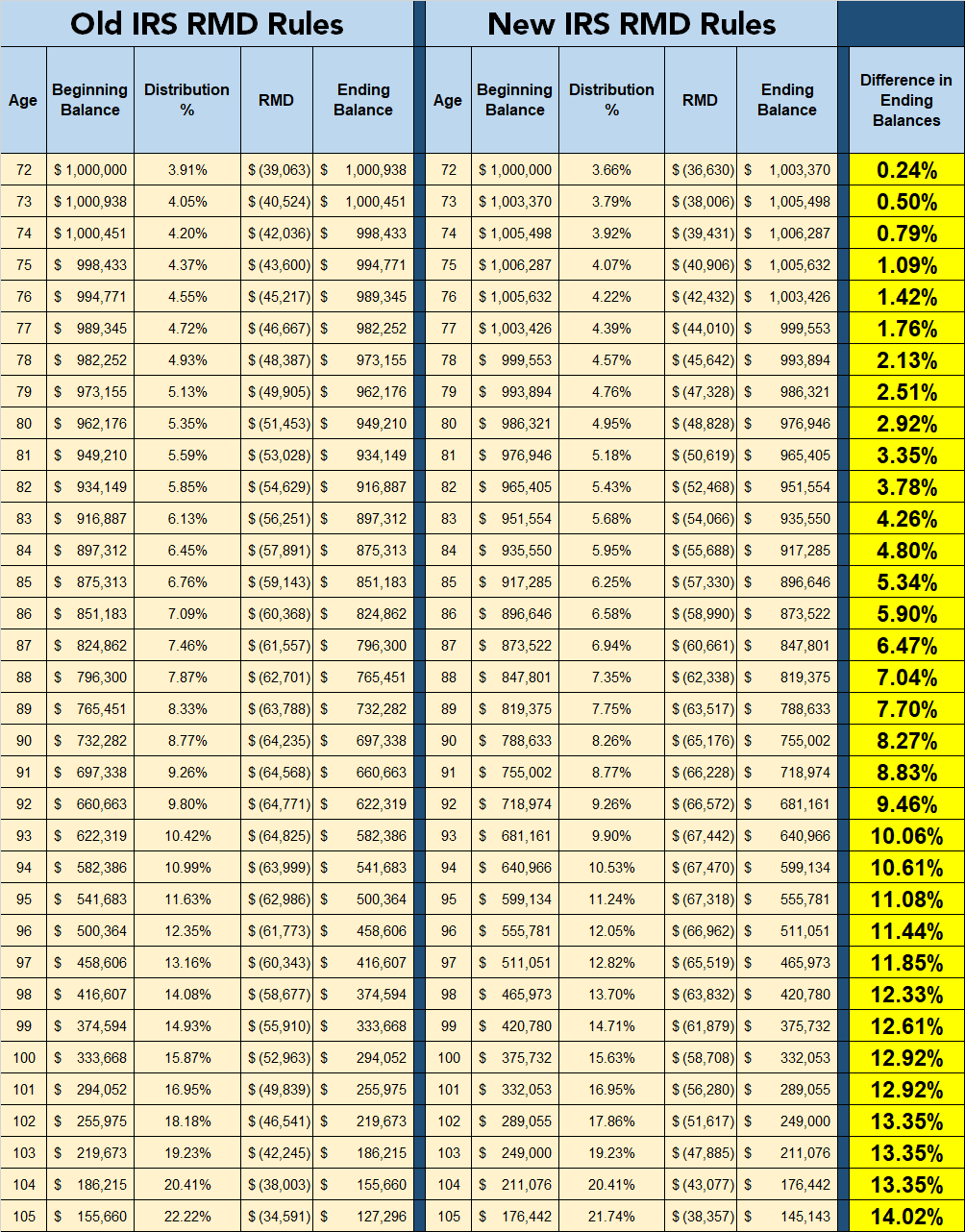

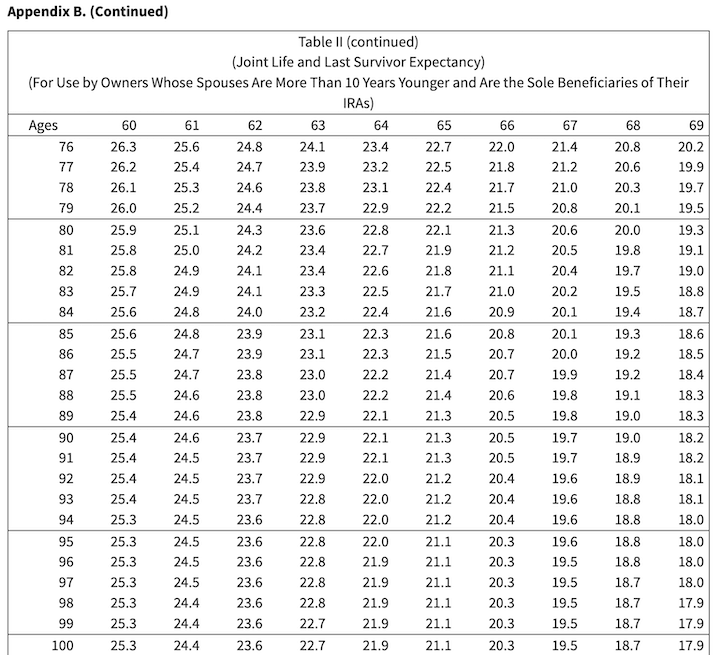

mesure que vous vous approchez de la retraite la compr hension des distributions minimales requises RMD devient essentielle Les RMD sont le montant minimum 1 Les RMD sont bas s sur votre ge et le solde de vos comptes de retraite L IRS fournit un tableau vie uniforme qui d termine la quantit de votre RMD en fonction de

Rmd 10 Year Rule Inherited Ira

Rmd 10 Year Rule Inherited Ira

https://i.ytimg.com/vi/074pHMj7ntk/maxresdefault.jpg

Non spouse Beneficiary Inherited IRA Rules 10 Year Rule RMD

https://i.ytimg.com/vi/ePB9Sf9BtDc/maxresdefault.jpg

Inherited IRA Flowchart J H White Financial

http://www.jhwfs.com/wp-content/uploads/2018/06/Inherited-IRA-Flowchart.jpg

A required minimum distribution RMD is the amount of money that must be withdrawn annually from certain employer sponsored retirement plans like 401 k s and certain A required minimum distribution RMD is the minimum amount the IRS mandates you to withdraw from certain tax deferred retirement accounts The specific amount varies

Use our required minimum distribution RMD calculator to determine how much money you need to take out of your traditional IRA or 401 k account this year Everyone s RMD situation will be different but you must take your full required amount or you could face IRS penalties Planning ahead for what you want to do with the

More picture related to Rmd 10 Year Rule Inherited Ira

Beneficiary Ira Rmd Table 2017 Cabinets Matttroy

https://www.aaii.com/images/journal/12099-figure-2.gif

2024 Rmd Changes Jodie Lynnett

https://levelfa.com/wp-content/uploads/2020/12/RMD-Rule-Changes.png

7 Photos Inherited Ira Rmd Table 2018 And Description Alqu Blog

https://alquilercastilloshinchables.info/wp-content/uploads/2020/05/The-Mystery-of-Traditional-IRA-Withdrawals-Cascade-Investment-....png

Required Minimum Distributions kick in when you turn 73 In the year that you turn 73 you will have until April 1 of the following year to take your initial RMD but in all An RMD is the minimum amount of money you must withdraw annually from your qualified retirement plans after reaching age 73 age 75 for people born in 1960 or later How

[desc-10] [desc-11]

Inherited Ira Tax Rules 2025 Angela D Roney

http://www.jhwfs.com/wp-content/uploads/2018/06/Inherited-IRA-Flowchart.jpg

What Are The Rmd Factors For 2025 Claudia J McCay

https://michaelryanmoney.com/wp-content/uploads/2022/07/RMD-New-Uniform-Lifetime-Tables-2022.jpg

https://ichi.pro › fr › qu-est-ce-qu-un-rmd-et-comment-cela-vous...

RMD est l abr viation de la distribution minimale requise et correspond au montant d argent requis que vous devez retirer d un r gime de retraite parrain par l employeur qui est galement

https://fastercapital.com › fr › contenu › Soutenir-la-retraite...

mesure que vous vous approchez de la retraite la compr hension des distributions minimales requises RMD devient essentielle Les RMD sont le montant minimum

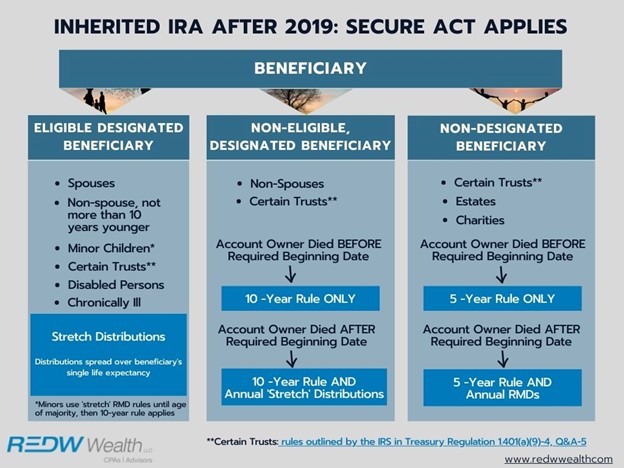

Inherited IRA Required Distributions REDW Financial Advisors CPAs

Inherited Ira Tax Rules 2025 Angela D Roney

Ira Rmd Table For 2025 Rosie Rosaline

IRS Finalizes Beneficiary RMD 10 Year Rule On Inherited IRAs

What Are The Latest Inherited IRA Rules

The Impact Of New IRS Proposed Regulations On The SECURE Act

The Impact Of New IRS Proposed Regulations On The SECURE Act

[img_title-14]

[img_title-15]

[img_title-16]

Rmd 10 Year Rule Inherited Ira - [desc-12]