Rmd 10 Year Rule Start Your RMD is the minimum amount you must withdraw from your account each year You can withdraw more than the minimum required amount Your withdrawals will be included in your

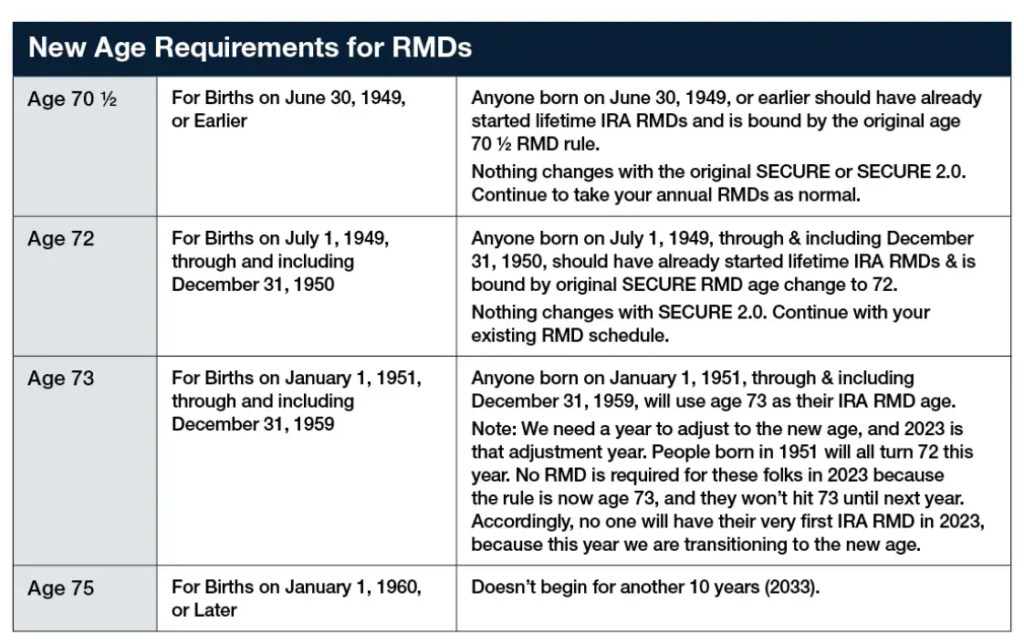

What Is a Required Minimum Distribution RMD A required minimum distribution RMD is a yearly amount of money required by the Internal Revenue Service IRS to be An RMD is the minimum amount of money you must withdraw from a tax deferred retirement plan which is subject to ordinary income tax rates The age to begin RMDs is

Rmd 10 Year Rule Start

Rmd 10 Year Rule Start

https://blogs-images.forbes.com/mattcarey/files/2018/09/blueprint-income-rmds-wide.png

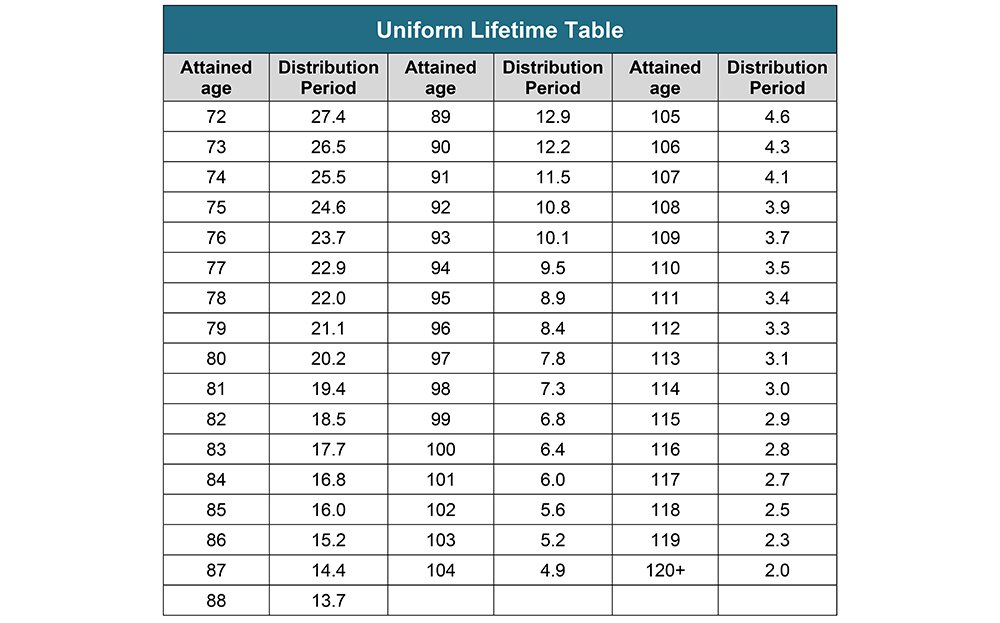

Rmd Table 2024 Deana Estella

https://michaelryanmoney.com/wp-content/uploads/2022/07/RMD-New-Uniform-Lifetime-Tables-2022-750x579.jpg

Rmd Age For 2025 Adrien Hunt

https://bestpathforward.com/wp-content/uploads/2023/06/RMD-chart-1024x644.png

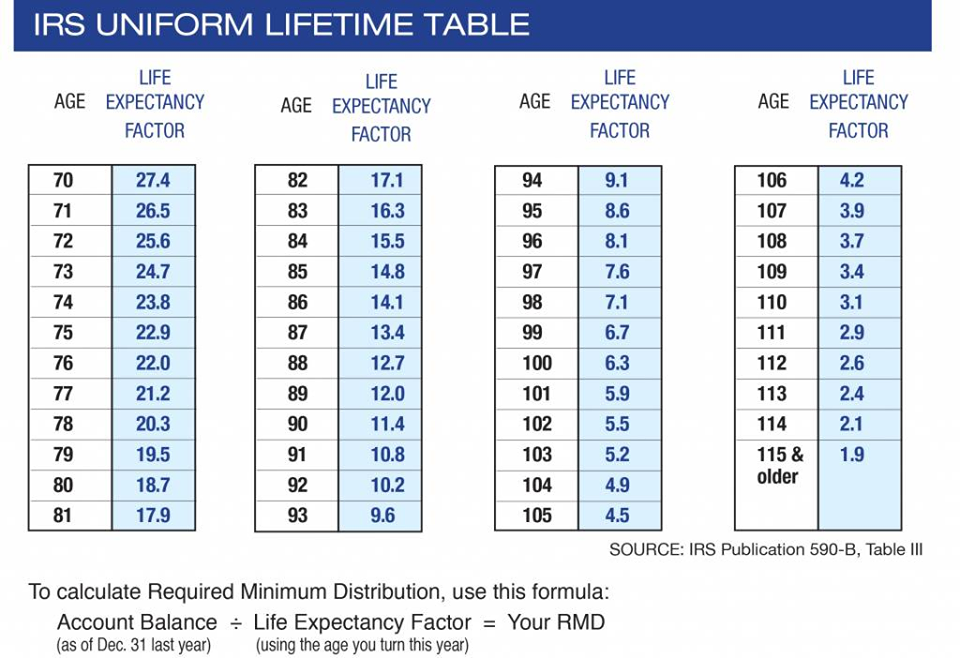

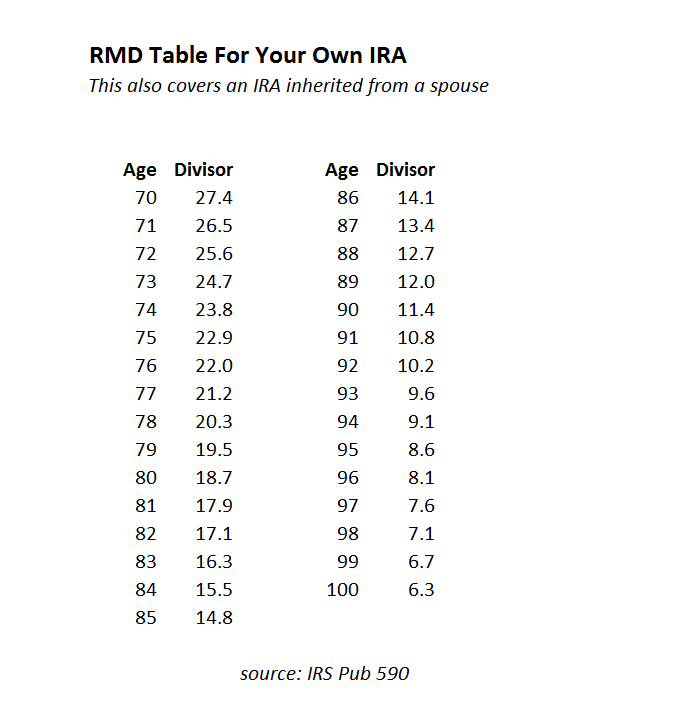

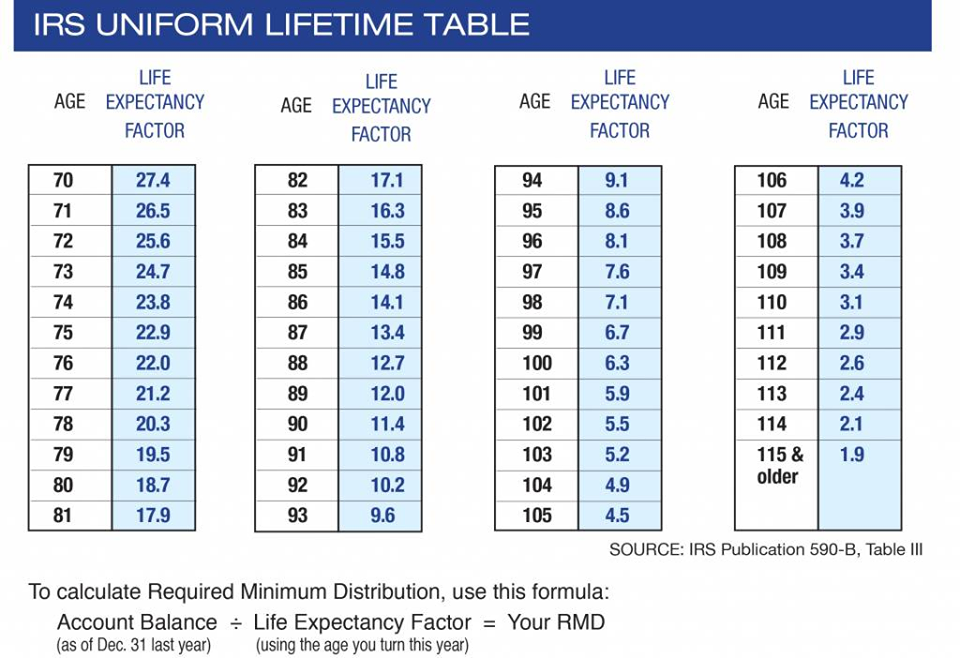

This calculator computes the Required Minimum Distribution RMD of your retirement accounts It also predicts future distributions which can be used to plan ahead In general you must take your first RMD by April 1 of the year after you reach RMD age though there are some exceptions as we ll see below For every year after that

Use our required minimum distribution RMD calculator to determine how much money you need to take out of your traditional IRA or 401 k account this year For those who reached age 72 after Dec 31 2022 and age 73 before Jan 1 2033 the RMD age would be 73 For those who reach age 74 after Dec 31 2032 the RMD

More picture related to Rmd 10 Year Rule Start

Rmd Requirements 2024 For Age 72 Silva Dulcinea

https://bestpathforward.com/wp-content/uploads/2023/06/RMD-chart.png

Rmd Calculator 2025 Table Pdf 2025 Marla Lauren

https://azirarealestate.com/wp-content/uploads/2017/11/IRS-Uniform-Lifetime-Table-1024x702.jpg?2f2645&2f2645

Rmd Calculator 2025 Table Pdf 2025 Easton Nasir

https://michaelryanmoney.com/wp-content/uploads/2022/07/RMD-New-Uniform-Lifetime-Tables-2022.jpg

The purpose of the RMD rules is to ensure that people do not accumulate retirement accounts defer taxation and leave these retirement funds as an inheritance Instead required minimum When you put money into your TSP or other tax advantaged retirement accounts the contributions you make have not been subject to income tax by the federal government

[desc-10] [desc-11]

Rmd Table For 2025 Distribution Age Kay Sarajane

http://www.mrbaccounting.com/uploads/7/1/9/8/7198582/rmd-table_orig.png

Irs Rmd Factor Tables 2023

https://www.financialsamurai.com/wp-content/uploads/2014/03/RMD-table.png

https://www.irs.gov › retirement-plans › plan...

Your RMD is the minimum amount you must withdraw from your account each year You can withdraw more than the minimum required amount Your withdrawals will be included in your

https://www.financestrategists.com › retirement...

What Is a Required Minimum Distribution RMD A required minimum distribution RMD is a yearly amount of money required by the Internal Revenue Service IRS to be

Irs Rmd Tables 2025 Printable Birgit M Zimmer

Rmd Table For 2025 Distribution Age Kay Sarajane

Life Expectancy Tables 2025 Irs Elena Harper

IRS Finalizes Beneficiary RMD 10 Year Rule On Inherited IRAs

[img_title-12]

[img_title-13]

[img_title-13]

[img_title-14]

[img_title-15]

[img_title-16]

Rmd 10 Year Rule Start - [desc-13]