Tax Free Salary In India Income tax Personal business corporation trust international and non resident income tax

The Government of Canada sets the federal income tax rates for individuals Each province and territory determines their own income tax rates Provincial or territorial income Information on taxes including filing taxes and get tax information for individuals businesses charities and trusts Income tax

Tax Free Salary In India

Tax Free Salary In India

https://razorpay.com/learn-content/uploads/2022/02/Facebook-post-16-1024x538.png

800k Salary After Tax In India IN Tax 2024

https://in.icalculator.com/img/og/IN/267.png

I R S Decides Most Special State Payments Are Not Taxable The New

https://static01.nyt.com/images/2023/02/10/multimedia/10irs-gzbj/10irs-gzbj-videoSixteenByNine3000.jpg

The middle class tax cut would reduce the tax rate that is applied to the first 57 375 in 2025 of an individual s taxable income regardless of their income level As shown This tax season the Canada Revenue Agency CRA has simplified its sign in process making it easier to access the My Account My Business Account and Represent a

Sign in or register for My Account My Business Account or Represent a Client with the CRA and get help with using the CRA sign in services How much tax will I pay on my retirement lump sum withdrawals From age 55 you can take up to one third of your retirement fund Retirement Annuity Company Pension Fund

More picture related to Tax Free Salary In India

Explore The Average Salaries In India Internshala

https://blog.internshala.com/wp-content/uploads/2023/07/Average-Salaries-in-India-Complete-Overview-1.jpg

Income Tax Officer Salary Allowances PayScale And Promotion

https://thinksknowledge.com/wp-content/uploads/2022/10/Income-Tax-Officer-Salary.jpg

How To Calculate Income Tax On Salary With Example

https://razorpay.com/learn-content/uploads/2022/02/Facebook-post-15-1-1024x538.png

When using certified tax software the Auto fill my return service automatically fills in parts of your income tax and benefit return with information that the CRA has available at Canada child benefit The CCB is a non taxable amount paid monthly to help eligible families with the cost of raising children under 18 years of age The CCB may include an additional amount

[desc-10] [desc-11]

26429k Salary After Tax In India IN Tax 2024

https://in.icalculator.com/img/og/IN/230.png

127000k Salary After Tax In India IN Tax 2024

https://in.icalculator.com/img/og/IN/337.png

https://www.canada.ca › en › services › taxes › income-tax

Income tax Personal business corporation trust international and non resident income tax

https://www.canada.ca › en › revenue-agency › services › tax › individual…

The Government of Canada sets the federal income tax rates for individuals Each province and territory determines their own income tax rates Provincial or territorial income

How To Calculate Income Tax On Salary With Example In Excel FinCalC Blog

26429k Salary After Tax In India IN Tax 2024

300k Salary After Tax In India IN Tax 2024

50 LACS SALARY IN INDIA VS 144000 SALARY IN AUSTRALIA YouTube

Salary 9000 10000 India Low Salary

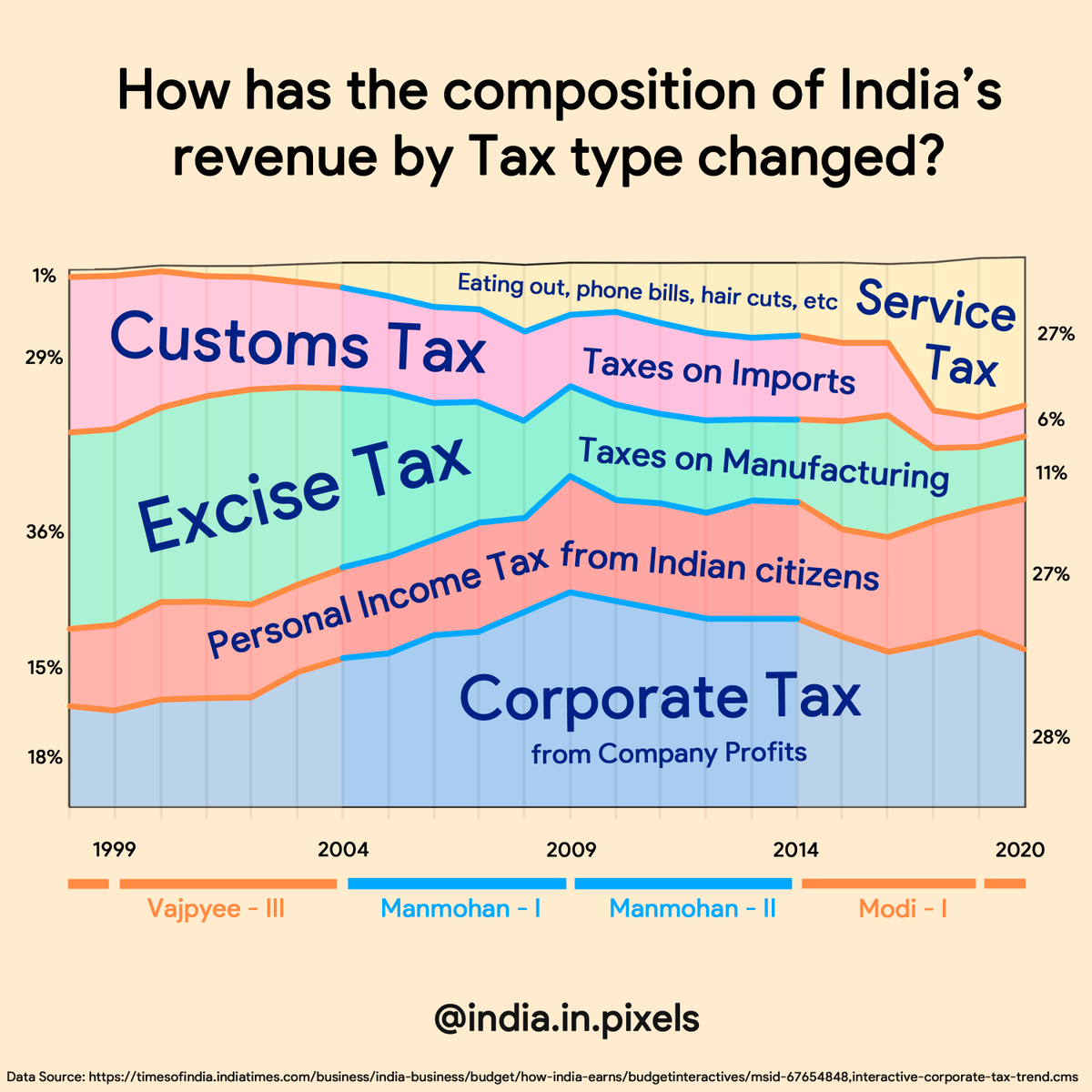

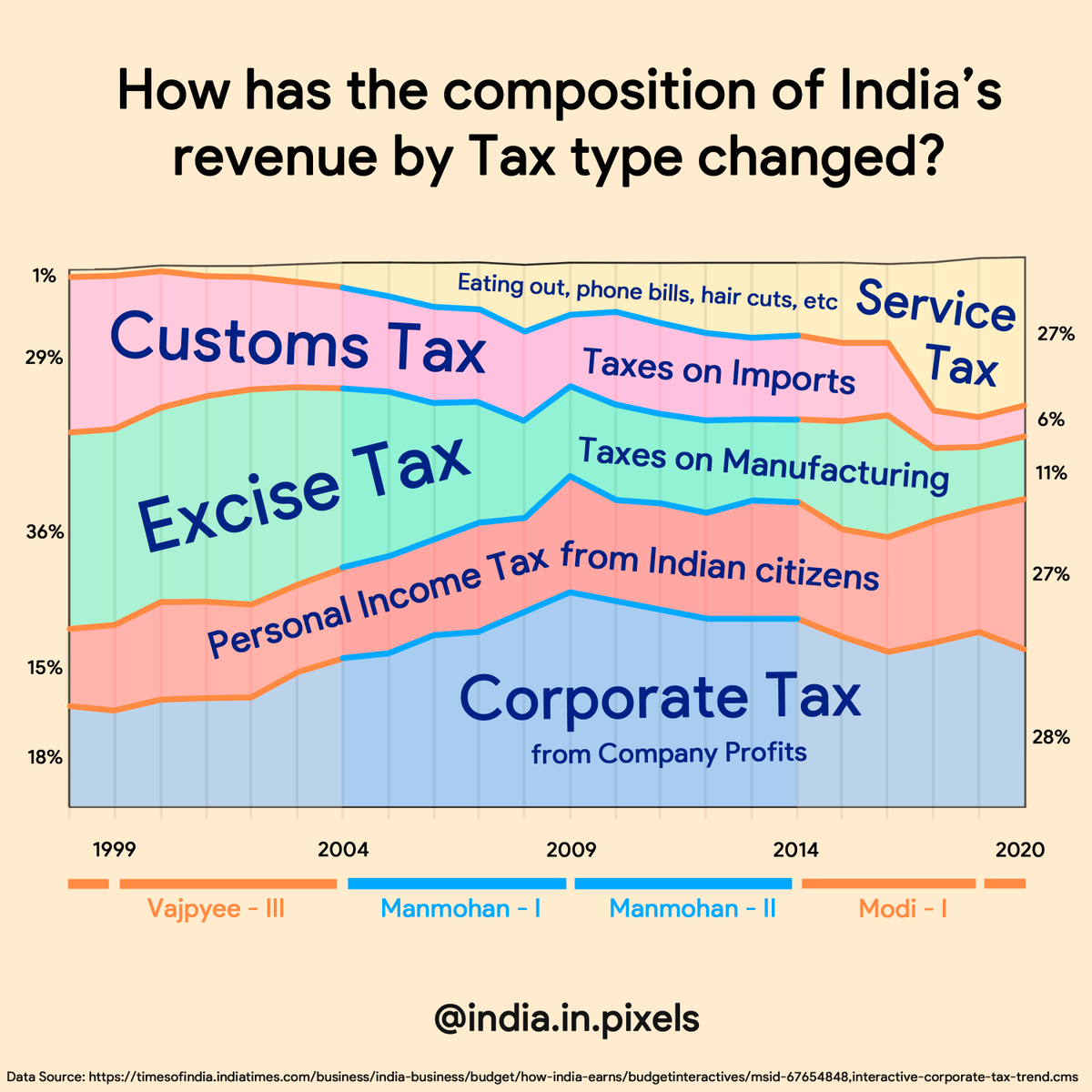

How Has India s Revenue Composition Changed In The Last 20 Years By The

How Has India s Revenue Composition Changed In The Last 20 Years By The

Digital Marketing Job Salary In India 2024 Qualification Required

Data Scientist Salary In India In 2023 Freshers Experienced

Standard Deduction For Salary Ay 2021 22 Standard Deduction 2021

Tax Free Salary In India - [desc-13]