Tax Slab For 2023 24 Ay Tax preparers use EFILE certified software to file your taxes online To find an EFILE certified tax preparer in your area try our postal code search Filing a paper return If online filing is not an

April 30 2025 Deadline for most individuals to file their tax return and pay any taxes owed June 15 2025 Deadline to file your tax return if you or your spouse or common law partner are The first R550 000 of your retirement lump sum is tax free as of 1 March 2024 Any previous withdrawals or retirement lump sums you ve taken will reduce your tax free amount The

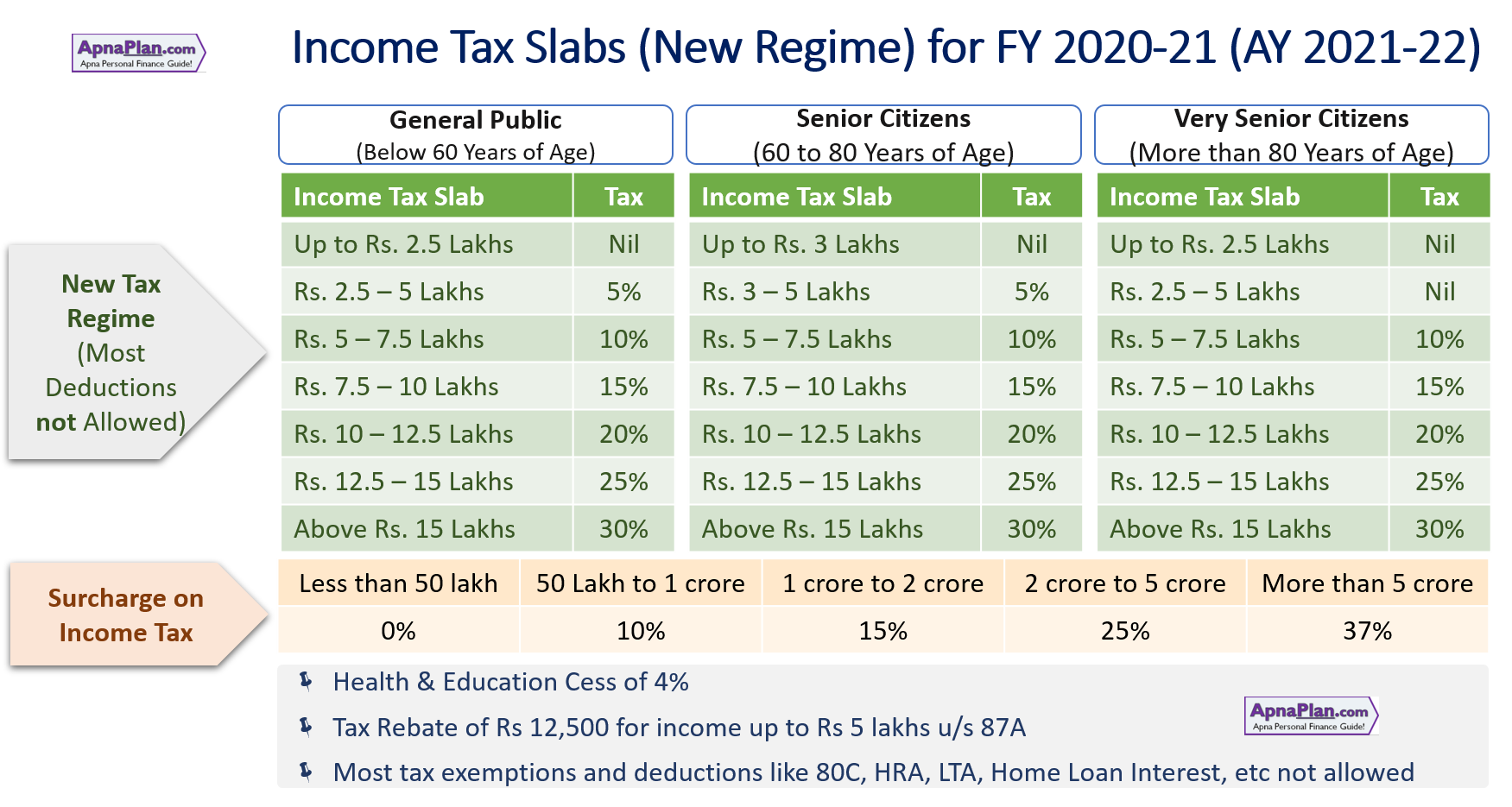

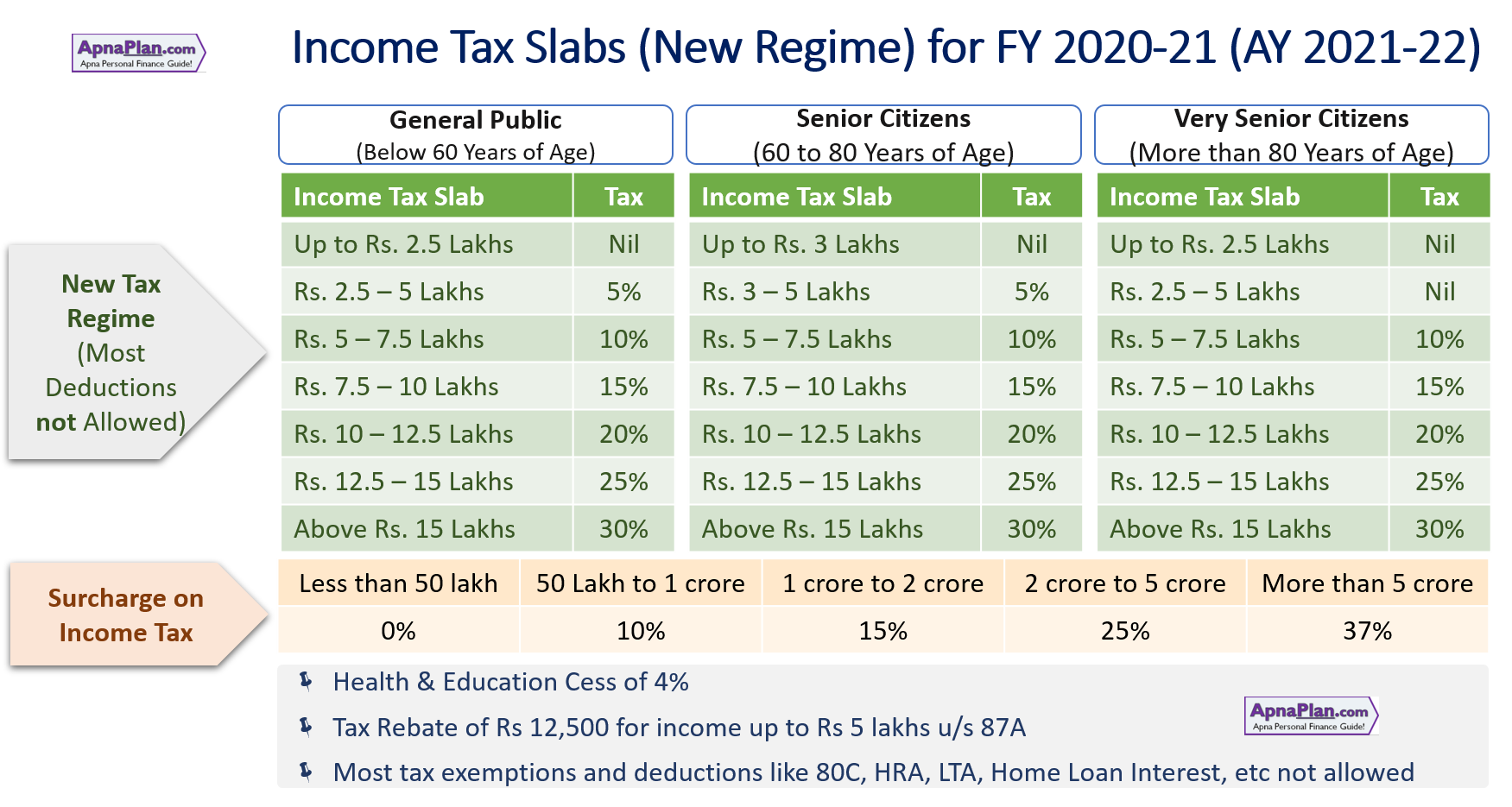

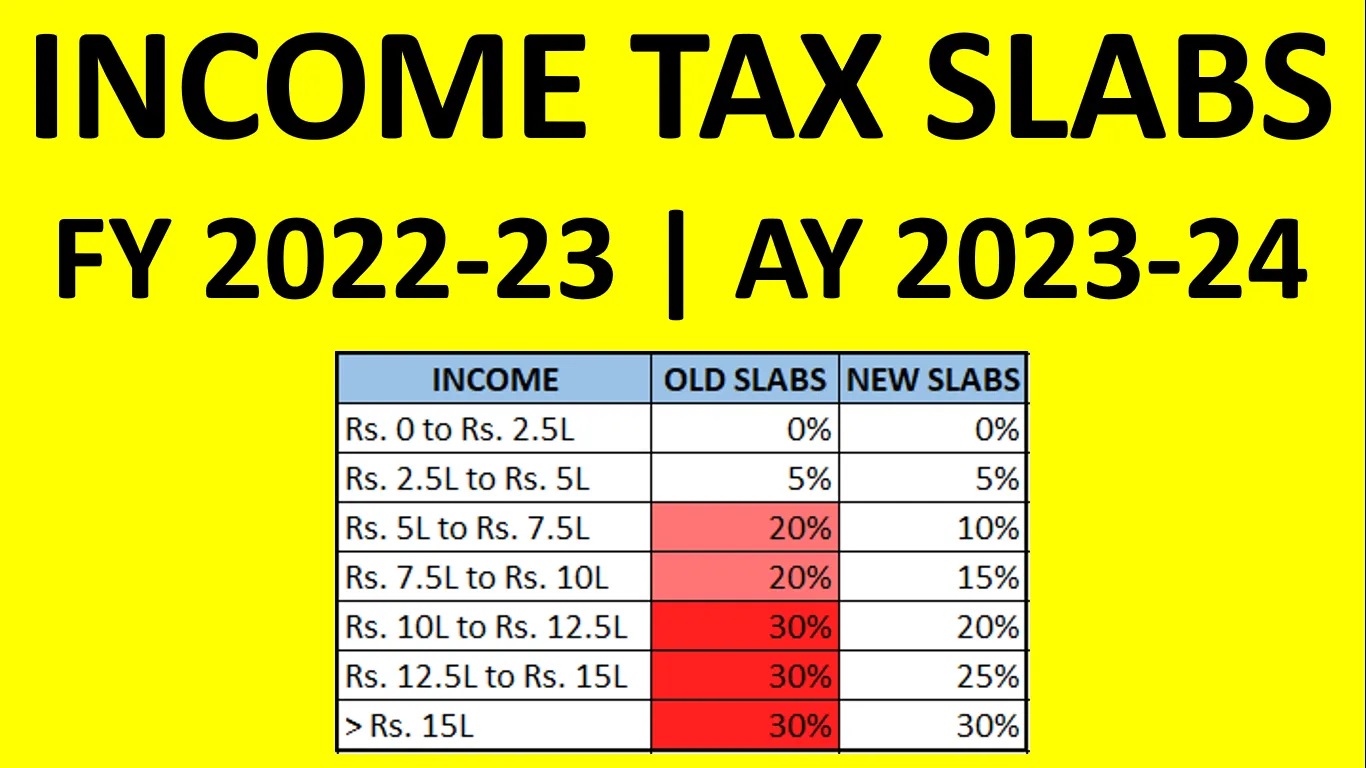

Tax Slab For 2023 24 Ay

Tax Slab For 2023 24 Ay

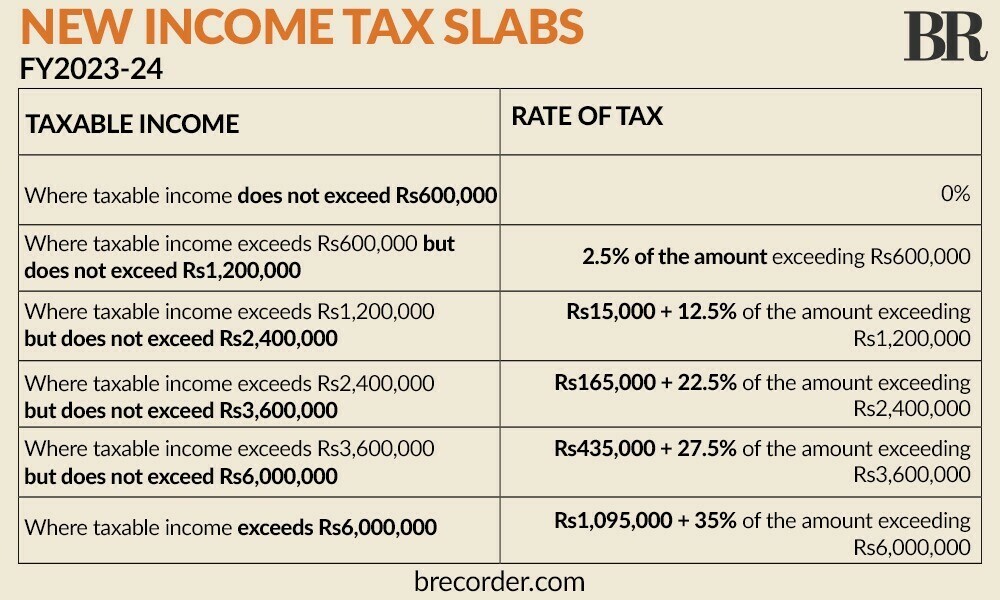

https://i.brecorder.com/primary/2023/06/261441140911e3a.jpg

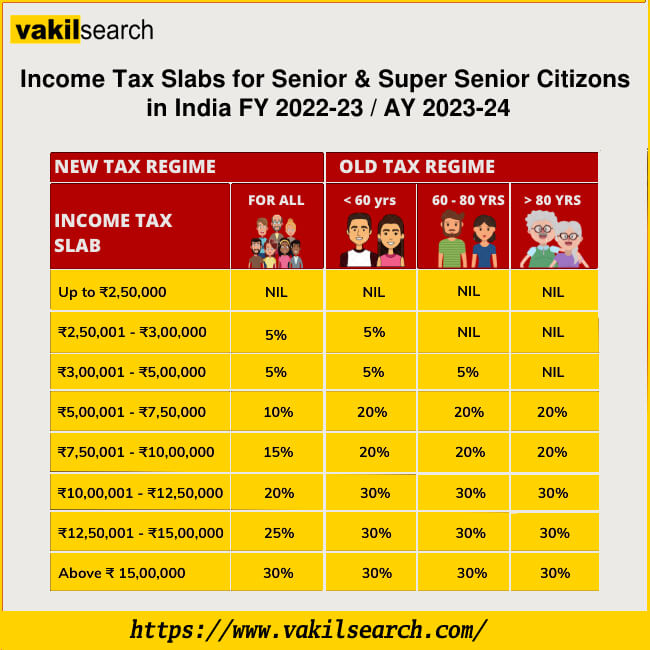

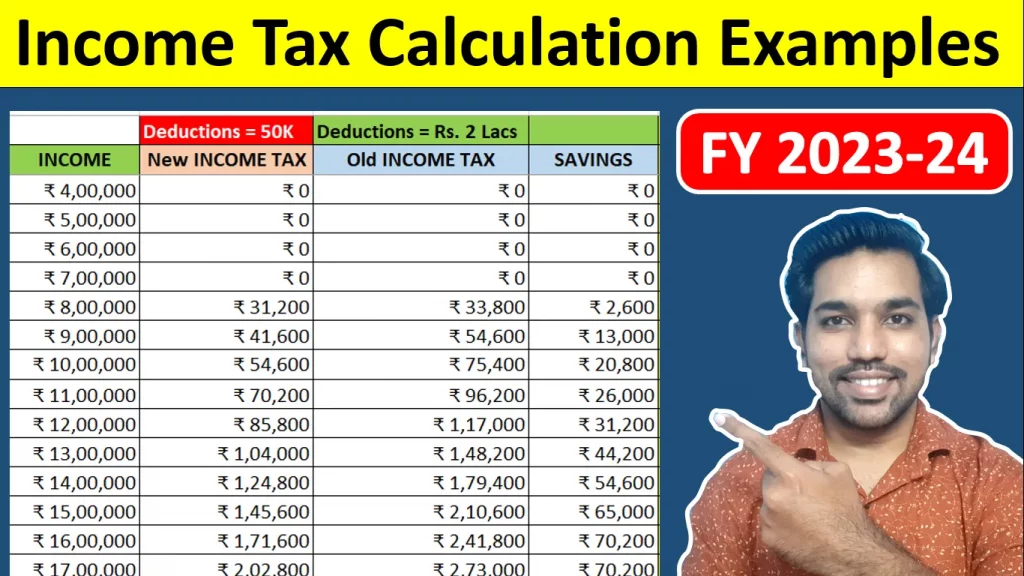

Tax Calculator 2023 24 In India Image To U

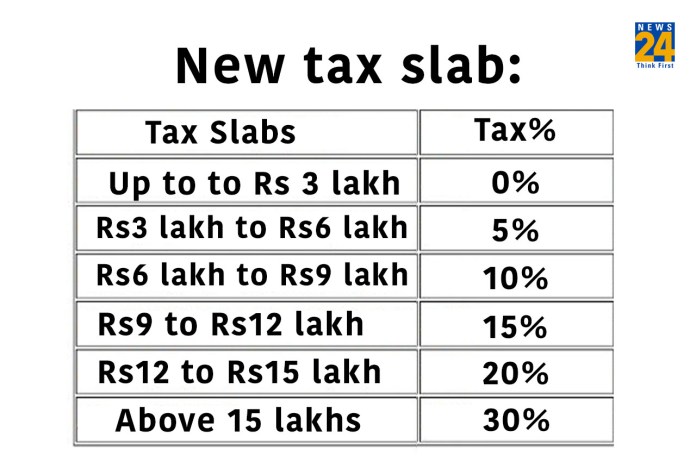

https://news24online.com/wp-content/uploads/2023/02/New-tax-slab.jpg?w=696&h=0&crop=1

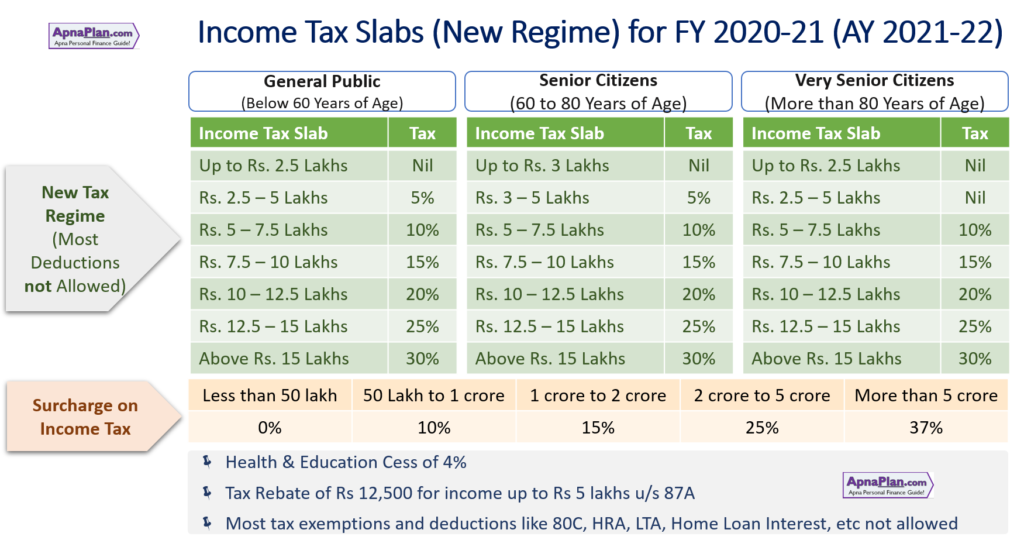

Slab Rates For 2023 24 Image To U

https://d3l793awsc655b.cloudfront.net/blog/wp-content/uploads/2022/09/Income-Tax-Slab-for-Senior-and-Super-Senior-Citizons-FY-2022-23-AY-2023-24.jpg

Do you need to register for income tax If your income exceeds the tax thresholds then you will need to register as a tax payer with SARS Do you need to submit a tax return for the 2024 25 Assessed tax return notice of assessment or reassessment other tax document or be signed in to CRA My Account If you are calling on behalf of someone else The person you re calling on

If you are signing in on behalf of someone else including friends and family members you must use Represent a Client in your CRA account to access their information Do not use autofill on If you have a modest income and a simple tax situation the Community Volunteer Income Tax Program CVITP or Income Tax Assistance Volunteer Program for residents of Quebec can

More picture related to Tax Slab For 2023 24 Ay

2025 Tax Calculator Irs Charles A Hernandez

https://www.apnaplan.com/wp-content/uploads/2020/02/New-Regime-Income-Tax-Slabs-for-FY-2020-21-AY-2021-22-1024x547.png

Company Slab Rate For Ay 2024 25 Image To U

https://bestinvestindia.com/wp-content/uploads/2023/02/Screenshot-2023-02-01-at-6.13.22-PM.png

New Tax Rate 2024 25 Carree Tanhya

https://academy.tax4wealth.com/storage/uploads/1684828745-know-the-new-income-tax-slab-rates-for-fy-2023-24-ay-2024-25.jpeg

The 25 Part XIII tax also applies to payees in countries with which Canada has a tax treaty that is not yet in effect A Part XIII tax rate of 23 applies to the gross amounts paid credited or The personal income levels used to calculate your Ontario tax have changed The amount of most provincial non refundable tax credits have changed The alternative minimum tax rate was

[desc-10] [desc-11]

Tax Rates For Ay 2025 25 Britney S Brock

https://www.apnaplan.com/wp-content/uploads/2020/02/New-Regime-Income-Tax-Slabs-for-FY-2020-21-AY-2021-22.png

Tax Rates For Ay 2025 25 Zane A Blackall

https://assets1.cleartax-cdn.com/finfo/wg-utils/retool/c783e14b-0e27-4b10-a784-40bd925acdda.png

https://www.canada.ca › en › revenue-agency › news › newsroom › tax-ti…

Tax preparers use EFILE certified software to file your taxes online To find an EFILE certified tax preparer in your area try our postal code search Filing a paper return If online filing is not an

https://www.canada.ca › en › revenue-agency › news › newsroom › tax-tips

April 30 2025 Deadline for most individuals to file their tax return and pay any taxes owed June 15 2025 Deadline to file your tax return if you or your spouse or common law partner are

Salaried Tax Slab 2025 Pakistan Mariam H Carlton

Tax Rates For Ay 2025 25 Britney S Brock

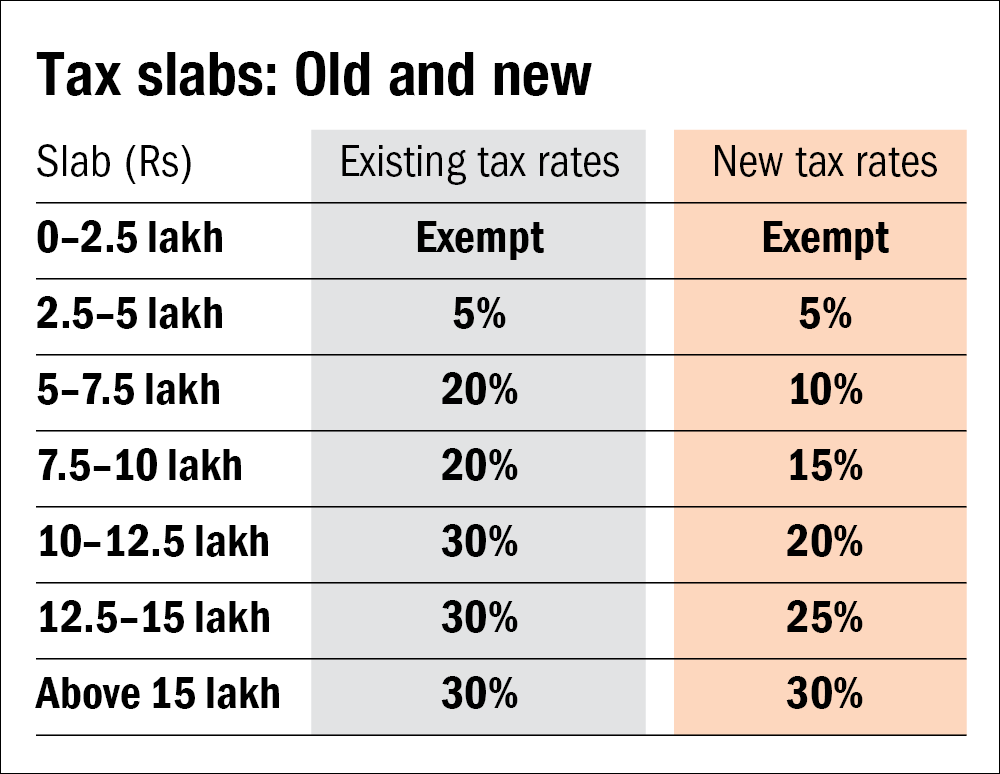

Huf Slab Rate Ay 2023 24 Image To U

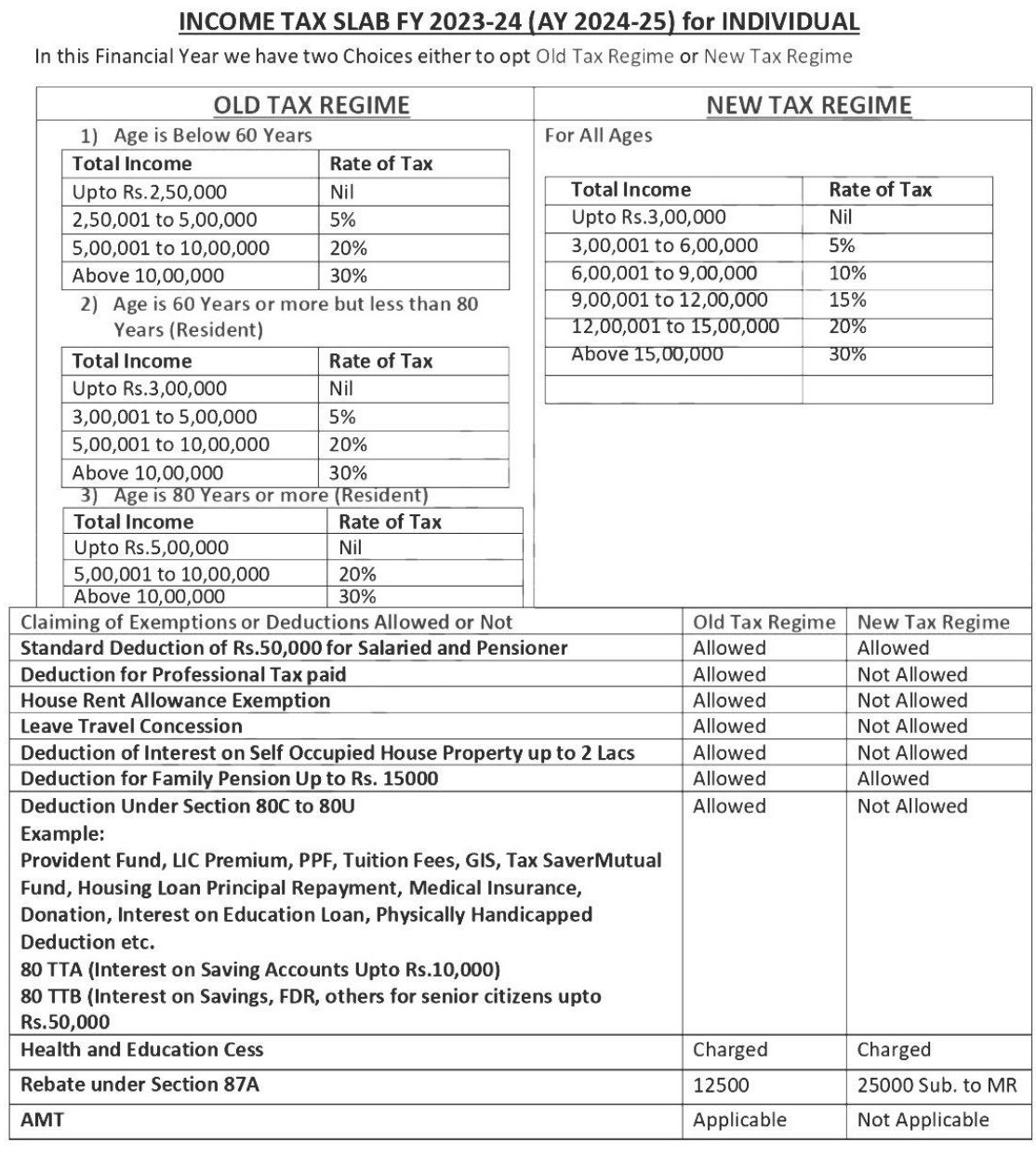

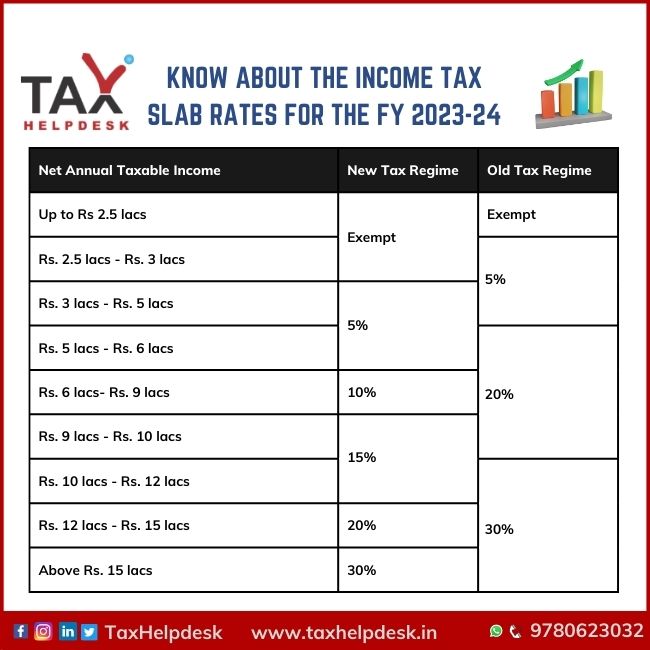

INCOME TAX SLAB FY 2023 24 AY 2024 25 For INDIVIDUAL

Income Tax Calculator Ay 2024 25 Excel Sheet Lyn Anastassia

Income Tax Rate For Companies Ay 2024 25 Image To U

Income Tax Rate For Companies Ay 2024 25 Image To U

Income Tax Slab For Ay 2025 24 Old Regime Sarah Arnold

New Income Tax Slab 2023 24 Old Regime Templates Sample Printables

New Regime Tax Slab 2024 24 Debera Valentine

Tax Slab For 2023 24 Ay - If you are signing in on behalf of someone else including friends and family members you must use Represent a Client in your CRA account to access their information Do not use autofill on