Tax Slab For Fy 2023 24 Ay 2024 25 Poreska politika Crne Gore zasniva se na sveobuhvatnosti poreskih obveznika niskim i konkurentnim poreskim stopama i veoma selektivnim poreskim olak icama

Informacije za poreske obveznike Uprava prihoda i carina naplatila je 2 33 milijarde eura u bruto iznosu od januara do kraja novembra to je vi e za 430 miliona eura 22 5 nego u istom pr Tax Administration

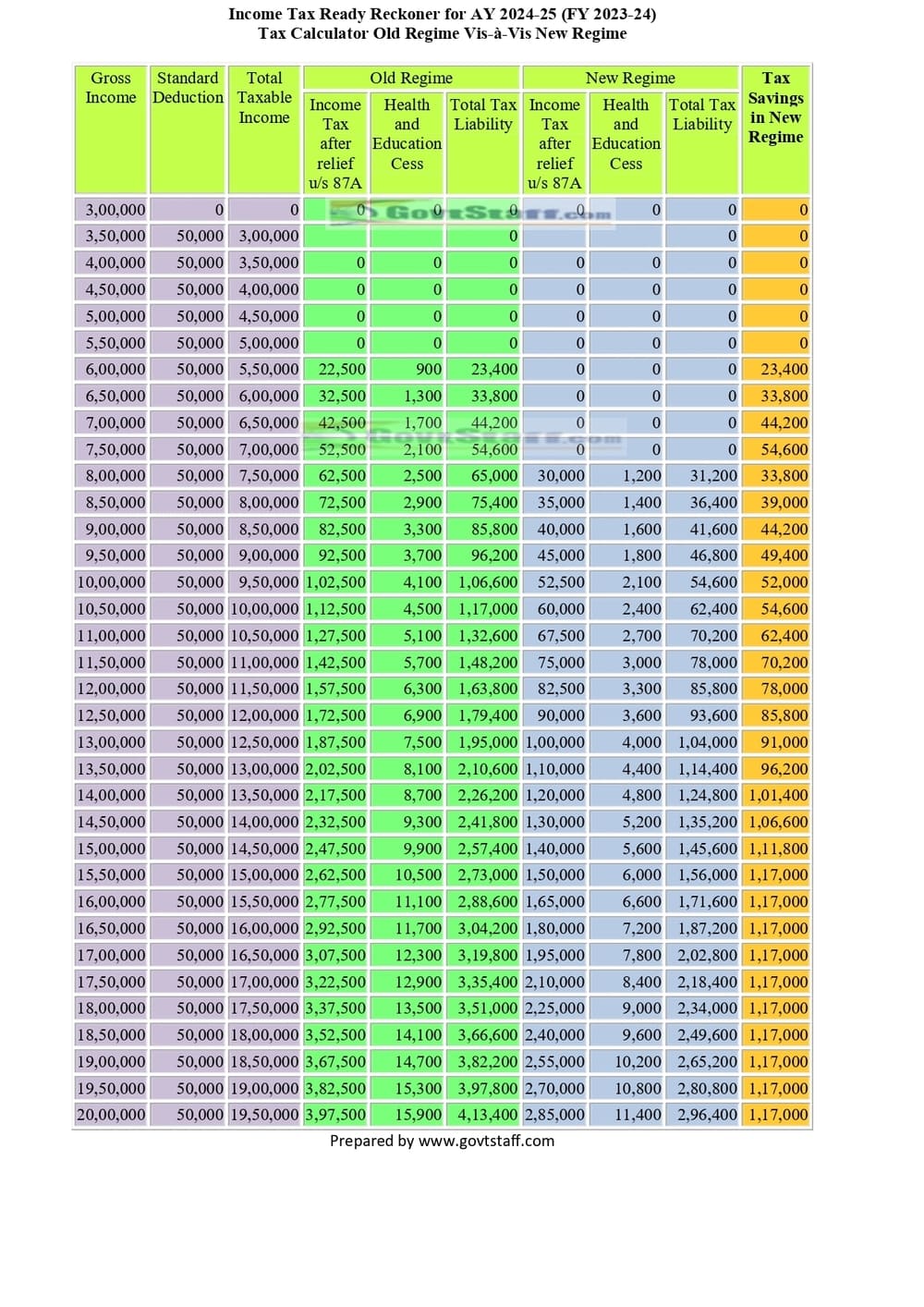

Tax Slab For Fy 2023 24 Ay 2024 25

Tax Slab For Fy 2023 24 Ay 2024 25

https://fincalc-blog.in/wp-content/uploads/2023/03/income-tax-calculation-examples-FY-2023-24-AY-2024-25-video-1024x576.webp

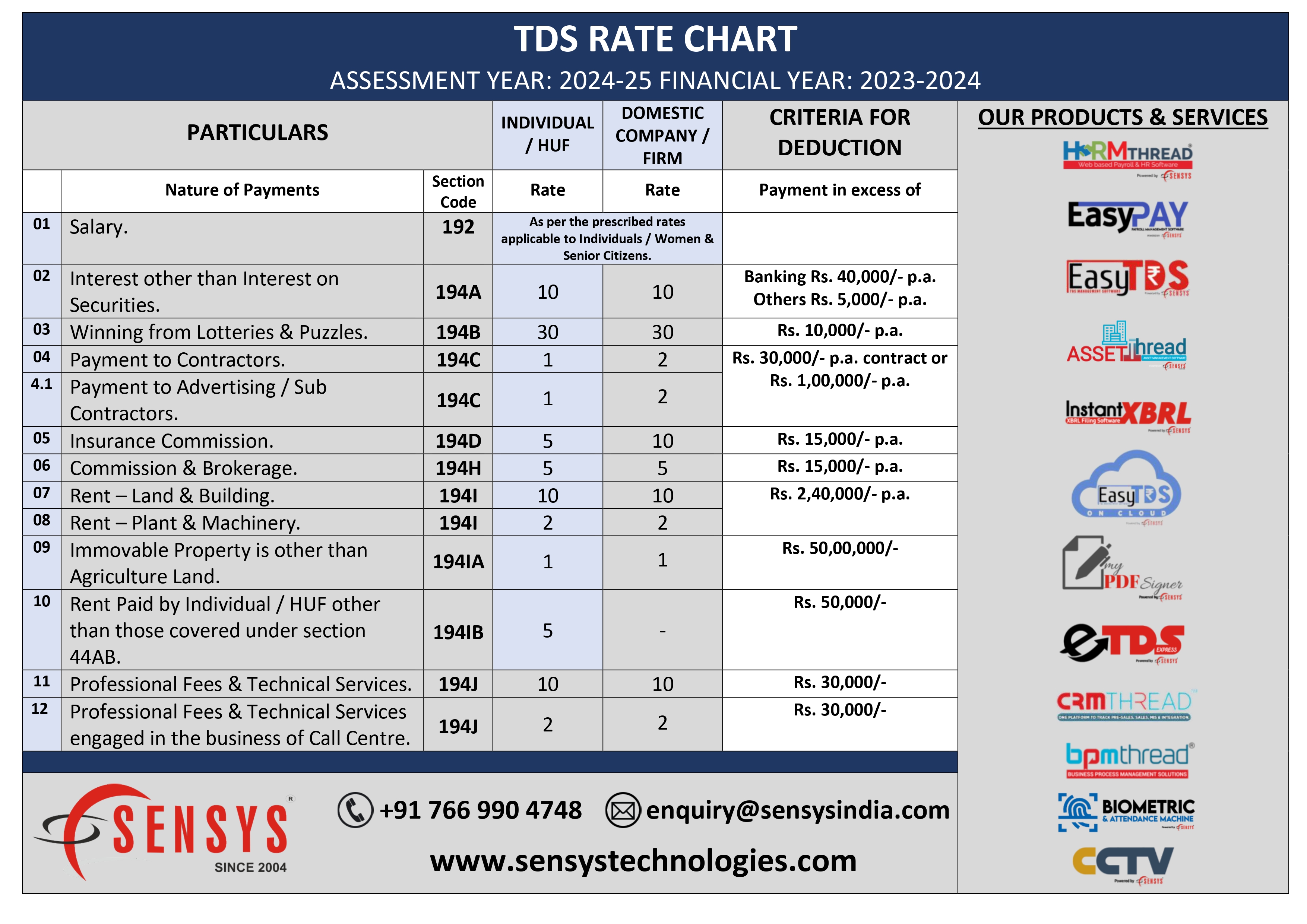

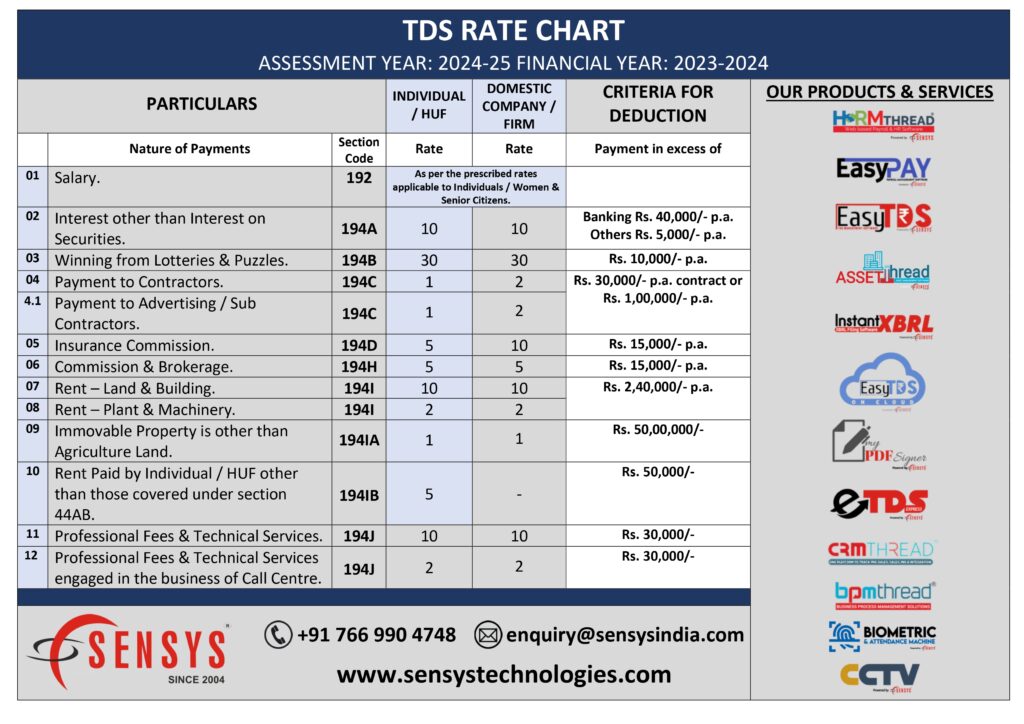

TDS Rate Chart AY 2023 2024 FY 2022 2023 Sensys Blog

http://www.sensystechnologies.com/blog/wp-content/uploads/2022/04/20220429_120210.jpg

TDS Rate Chart AY 2024 2025 FY 2023 2024 Sensys Blog

https://www.sensystechnologies.com/blog/wp-content/uploads/2023/05/TDS-RATE-CHART-AY-24-25-FY-23-24_page-0001.jpg

3 U okvir Add Dodaj ovu veb lokaciju unesite URL lokacije https eprijava tax gov me i kliknite na stavku Add Dodaj Corporate income tax amounts to 9 while the tax rate on personal income is 9 or 11 Upon payment of the corporate income tax business entities operating in Montenegro have the

Each tax is handled differently and there are often exceptions and qualifications for whom the tax pertains to What Are Different Types of Taxes Taxes can be classified in A tax is a mandatory financial charge or levy imposed on an individual or legal entity by a governmental organization to support government spending and public expenditures

More picture related to Tax Slab For Fy 2023 24 Ay 2024 25

TDS Rate Chart AY 2024 2025 FY 2023 2024 Sensys Blog

https://www.sensystechnologies.com/blog/wp-content/uploads/2023/05/TDS-RATE-CHART-AY-24-25-FY-23-24_page-0001-1024x724.jpg

2023 2024

https://fincalc-blog.in/wp-content/uploads/2023/03/income-tax-calculation-examples-FY-2023-24-AY-2024-25-video.webp

2024 25 Tax Calculator Sibby Othella

https://www.apnaplan.com/wp-content/uploads/2020/02/New-Regime-Income-Tax-Slabs-for-FY-2020-21-AY-2021-22-1024x547.png

The objective of stabilization implemented through tax policy government expenditure policy monetary policy and debt management is that of maintaining high Taxation refers to the act of levying or imposing a tax by a taxing authority Taxes include income capital gains or estate

[desc-10] [desc-11]

Tax Rates 2025 25 Uk 2025 James Aadil

https://d3l793awsc655b.cloudfront.net/blog/wp-content/uploads/2022/09/Income-Tax-Slab-for-Senior-and-Super-Senior-Citizons-FY-2022-23-AY-2023-24.jpg

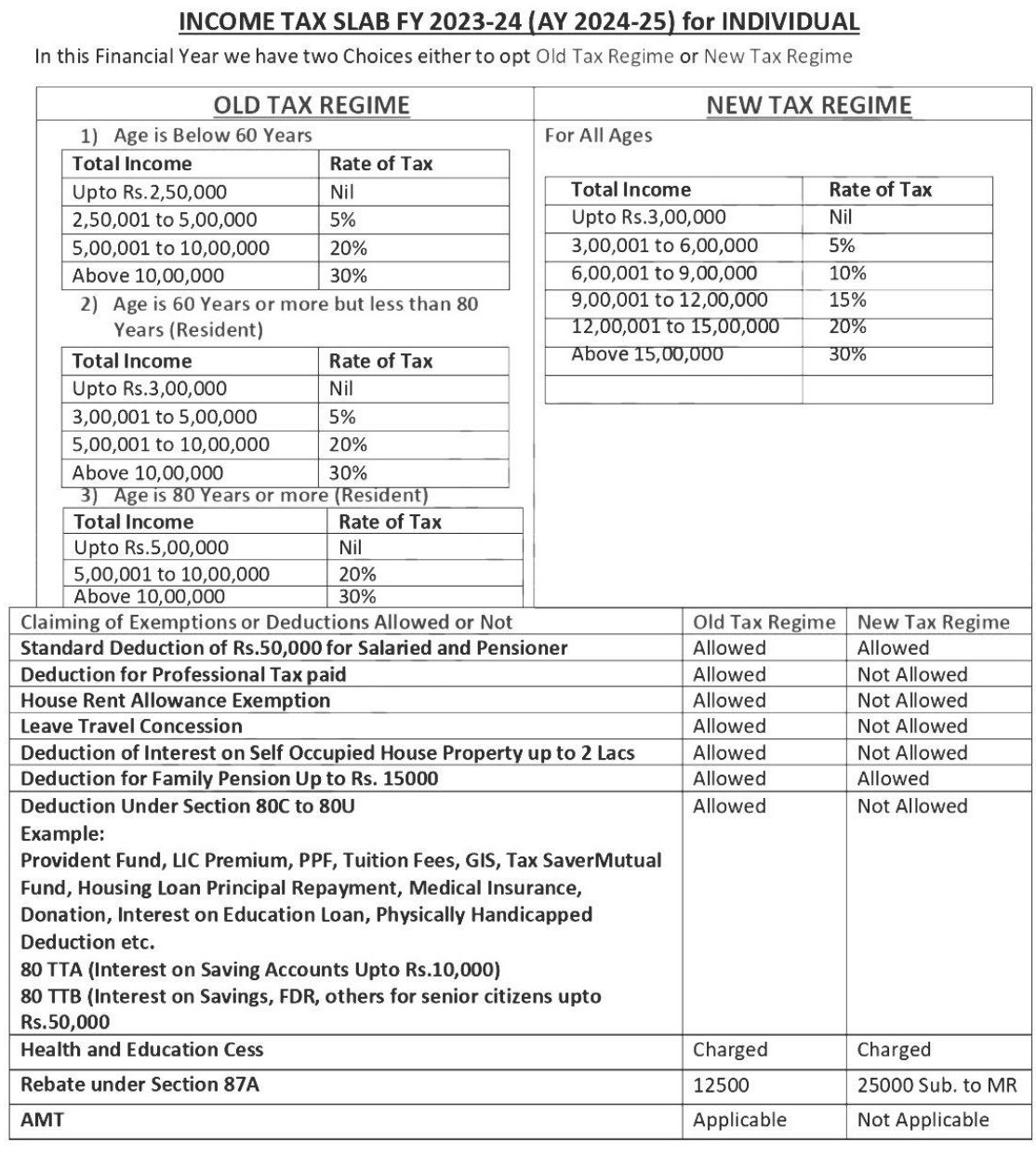

INCOME TAX SLAB FY 2023 24 AY 2024 25 For INDIVIDUAL

https://carajput.com/blog/wp-content/uploads/2023/12/INCOME-TAX-SLAB-FY-2023-24-AY-2024-25-for-INDIVIDUAL.jpg

https://www.gov.me › mif › porezi-i-carine

Poreska politika Crne Gore zasniva se na sveobuhvatnosti poreskih obveznika niskim i konkurentnim poreskim stopama i veoma selektivnim poreskim olak icama

https://www.gov.me › poreskauprava › porezi

Informacije za poreske obveznike Uprava prihoda i carina naplatila je 2 33 milijarde eura u bruto iznosu od januara do kraja novembra to je vi e za 430 miliona eura 22 5 nego u istom pr

Calculate 2023 Taxable Income

Tax Rates 2025 25 Uk 2025 James Aadil

Tax Calculator 2024 Paycheck Calculator Goldie Millicent

Income Tax Slab For Ay 2025 26 202526 In India Dorry Jenilee

Tax Slabs For Ay 2025 24 Old Regime Austin Carr

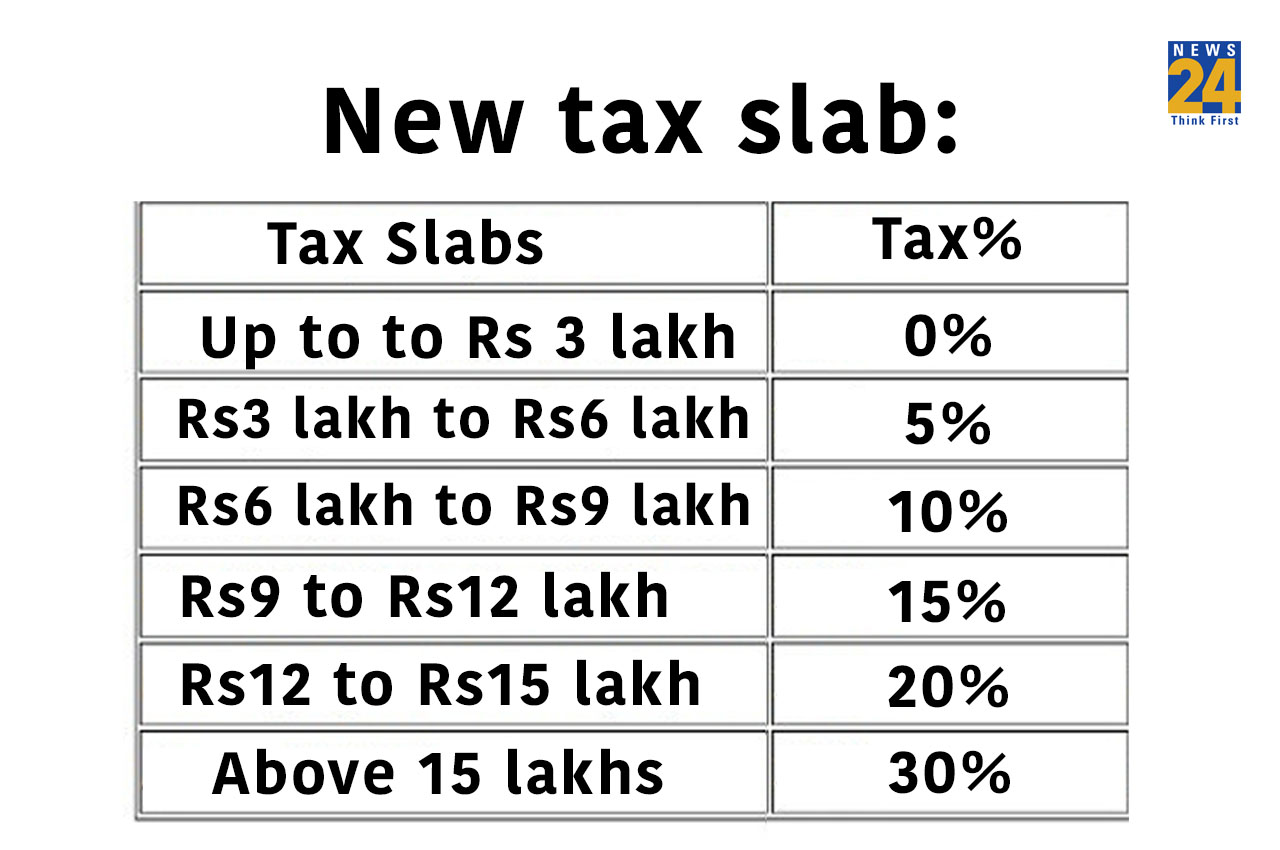

Know The New Income Tax Slab Rates For FY 2023 24 AY 2024 25

Know The New Income Tax Slab Rates For FY 2023 24 AY 2024 25

Income Tax Exemption For Senior Citizens 2023 24 Intelhub

Budget 2023 Top 12 Highlights Affecting Financial Life BestInvestIndia

Budget 2023 Good News For MIDDLE CLASS Change In Tax Slab

Tax Slab For Fy 2023 24 Ay 2024 25 - 3 U okvir Add Dodaj ovu veb lokaciju unesite URL lokacije https eprijava tax gov me i kliknite na stavku Add Dodaj