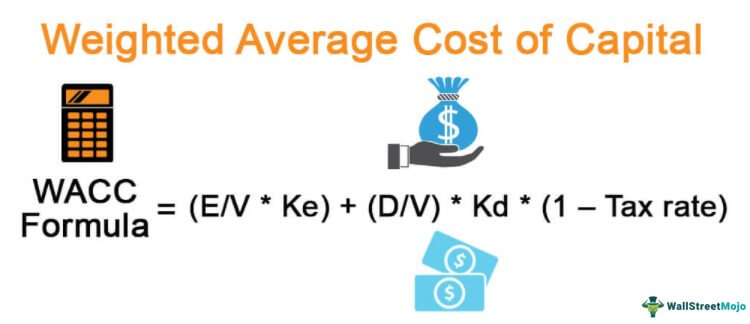

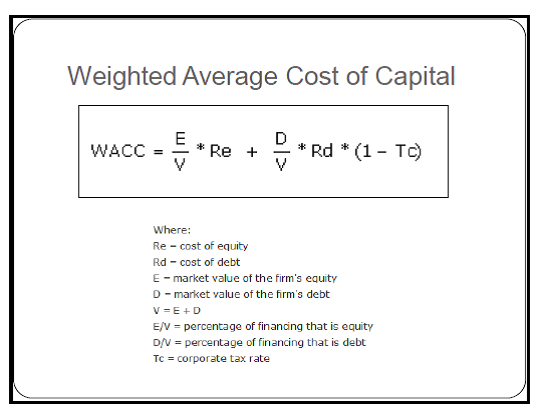

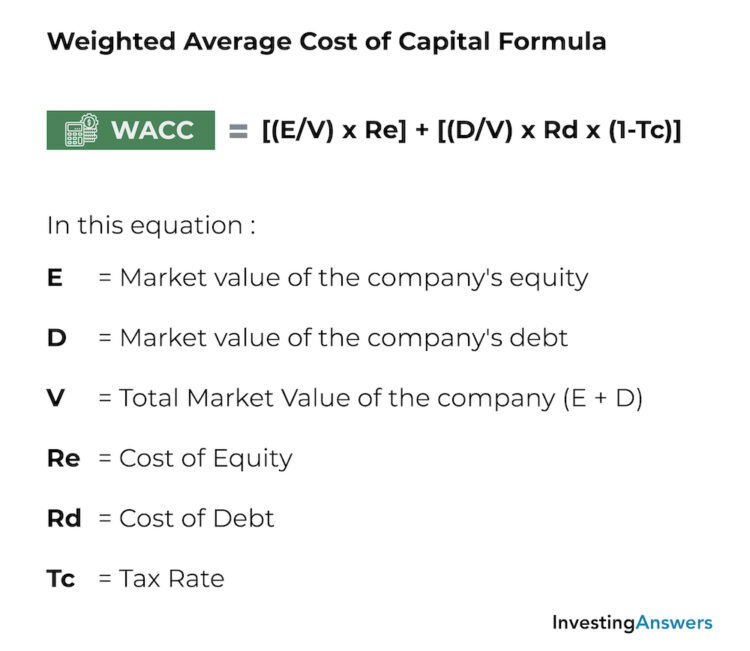

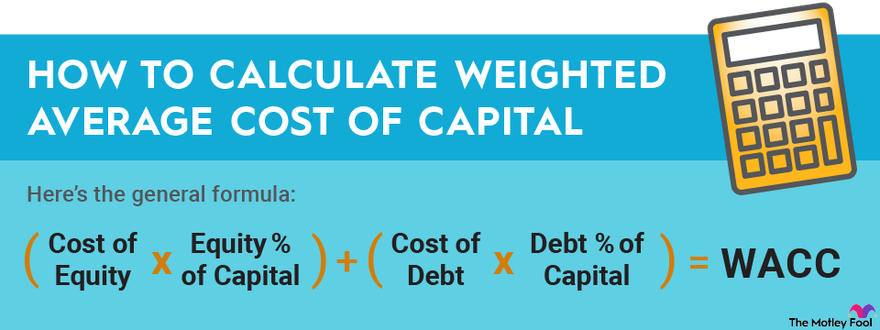

Weighted Cost Of Capital Formula The cost of each type of capital is weighted by its percentage of total capital and then are all added together This guide will provide a detailed breakdown of what WACC is why it is used

The weighted average cost of capital WACC is the average rate of return a company is expected to pay to all its shareholders including debt holders equity shareholders and preferred equity The Weighted Average Cost of Capital WACC is a financial metric that represents the average cost a company pays to finance its operations through various sources

Weighted Cost Of Capital Formula

Weighted Cost Of Capital Formula

https://i.ytimg.com/vi/zirujoiyL28/maxresdefault.jpg

WACC Weighted Average Cost Of Capital WACC Formula And Cost Of

https://i.ytimg.com/vi/MUpCQyKeFgI/maxresdefault.jpg

Weighted Average Cost Of Capital WACC Formula Examples 60 OFF

https://study.com/cimages/videopreview/uixfbmk0mf.jpg

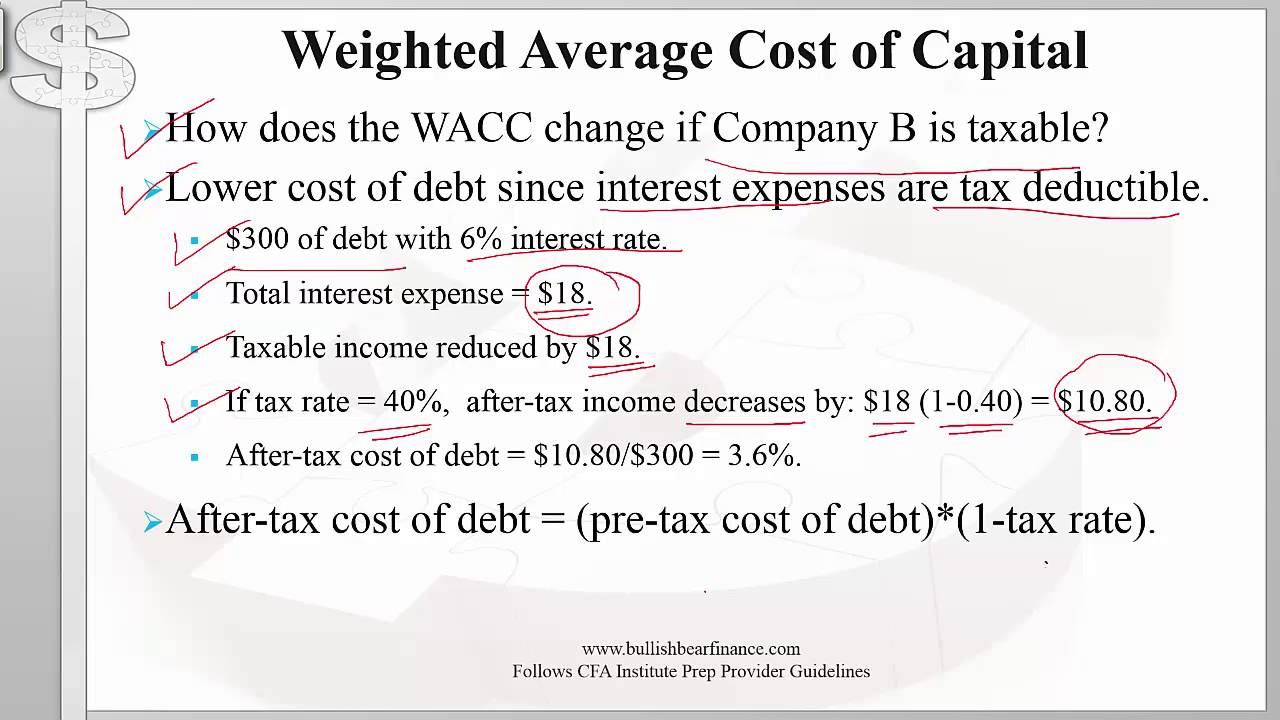

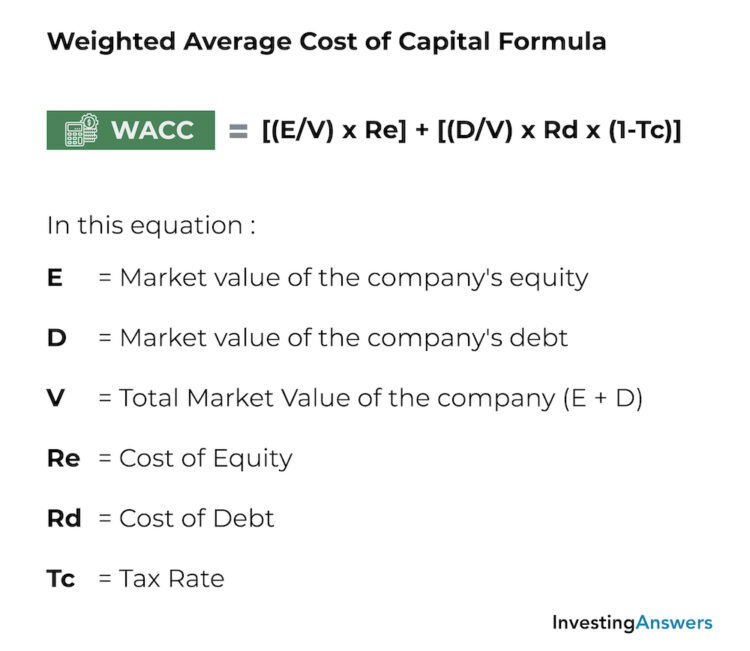

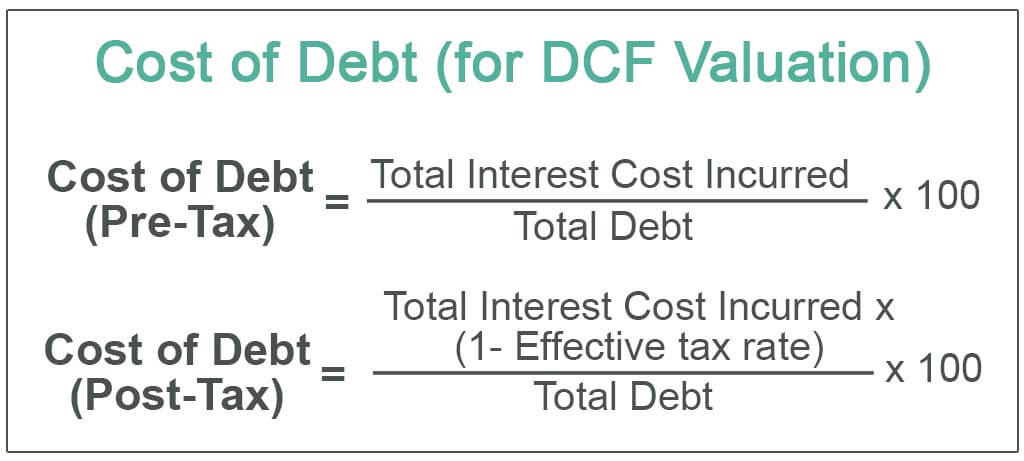

Given the WACC the projected free cash flows FCFs can be discounted to arrive at a present value PV for the business The WACC reflects the perceived riskiness of the The formula for calculating the weighted average cost of capital is the proportion of total equity E to total financing E D multiplied by the cost of equity Re plus the

Weighted average cost of capital WACC is defined as the weighted average of the cost of various sources of finance weight being the market value of each source of finance WACC Calculator Click Here or Scroll Down The weighted average cost of capital WACC is the average cost that a company has incurred or will incur for access to capital

More picture related to Weighted Cost Of Capital Formula

Weighted Average Cost Of Capital WACC Definition And 50 OFF

https://www.wallstreetmojo.com/wp-content/uploads/2016/12/Weighted-Average-Cost-of-Capital-1.jpg

Weighted Average Cost Of Capital WACC Definition And 50 OFF

https://www.universalcpareview.com/wp-content/uploads/2021/11/wacc-v2.png

Weighted Average Cost Of Capital WACC Excel Formula Cost Of Capital

https://i.pinimg.com/originals/4c/91/c4/4c91c4a1dff94466f89bf17d7e291cc0.jpg

What is the WACC formula WACC E V Re D V Rd 1 T where This formula calculates a weighted average by factoring in the proportions of equity and debt To calculate WACC one must first find the cost of debt and then determine the required rate of return for equity WACC E V x Re D V x Rd x 1 T

[desc-10] [desc-11]

Roblox SVG Roblox Logo Roblox New Logo Roblox PNG 53 OFF

https://investinganswers.com/sites/www/files/_750x651_crop_center-center_none/wacc-formula.jpg

Weighted Average Cost Of Capital RM NISPEROS

https://rmnisperos.com/wp-content/uploads/2016/05/Weighted-Average-Cost-of-Capital.png

https://corporatefinanceinstitute.com › resources...

The cost of each type of capital is weighted by its percentage of total capital and then are all added together This guide will provide a detailed breakdown of what WACC is why it is used

https://www.wallstreetmojo.com › weighted-average-cost-capital-wacc

The weighted average cost of capital WACC is the average rate of return a company is expected to pay to all its shareholders including debt holders equity shareholders and preferred equity

Wacc Calculator Cheap Sale Cityofclovis

Roblox SVG Roblox Logo Roblox New Logo Roblox PNG 53 OFF

Weighted Average Cost Of Capital WACC Calculator

Images Of NPV JapaneseClass jp

Average Cost Formula

:max_bytes(150000):strip_icc()/TermDefinitions_wacc_final-626b8af9bfc741d6a9792fe0568242cd.png)

Weighted Average Formula

:max_bytes(150000):strip_icc()/TermDefinitions_wacc_final-626b8af9bfc741d6a9792fe0568242cd.png)

Weighted Average Formula

How To Lower Wacc Phaseisland17

Cost Of Debt Definition Formula Calculate Cost Of Debt For WACC

What Is The Weighted Average Cost Of Capital

Weighted Cost Of Capital Formula - [desc-13]