What Are The Tax Benefits For Salaried Employees The middle class tax cut would reduce the tax rate that is applied to the first 57 375 in 2025 of an individual s taxable income regardless of their income level As shown

File non resident corporations income tax file non residents income tax get information on tax treaties country by country reporting Doing taxes for someone who died Report the date of The first R550 000 of your retirement lump sum is tax free as of 1 March 2024 Any previous withdrawals or retirement lump sums you ve taken will reduce your tax free amount The

What Are The Tax Benefits For Salaried Employees

What Are The Tax Benefits For Salaried Employees

https://lennox-lld.com/wp-content/uploads/2022/04/what-makes-1.png

http://sport600.ru/images/what.png

What Just Happened Jimmy Sticker What Just Happened Jimmy Elvis The

https://media.tenor.com/S2LnWeldyVwAAAAC/what-just-happened-jimmy.gif

If you are signing in on behalf of someone else including friends and family members you must use Represent a Client in your CRA account to access their information Do not use autofill on Tax free savings accounts registered savings plans pooled pension plans and plan administration Excise and specialty taxes Duties customs charges tax on underused

The bulk of tax relief will go to those with incomes in the two lowest tax brackets i e those with taxable income under 114 750 in 2025 including nearly half to those in the Personal information is collected pursuant to the Income Tax Act and Excise Tax Act Personal information is described in program specific Personal Information Banks which can be found

More picture related to What Are The Tax Benefits For Salaried Employees

E Commerce Distribution Channels Explained FigPii Blog

https://www.figpii.com/blog/wp-content/uploads/2022/08/Direct-and-Indirect-channels-1024x1024.png

M L Studios Comedy Podcast Podchaser

https://www.mandlstudios.com/wp-content/uploads/2024/03/What-You-Do-sq-2.jpg

Contact Us

https://whataithinksabout.com/wp-content/uploads/2023/10/WAITA.png

Throughout the following text for purposes of the tax exemption under section 87 of the Indian Act the Canada Revenue Agency CRA uses the term Indian because it has a legal The 25 Part XIII tax also applies to payees in countries with which Canada has a tax treaty that is not yet in effect A Part XIII tax rate of 23 applies to the gross amounts paid credited or

[desc-10] [desc-11]

What Is She Doing Happily Sticker What Is She Doing Happily What Shes

https://media.tenor.com/3s-j_WEDwK8AAAAC/what-is-she-doing-happily.gif

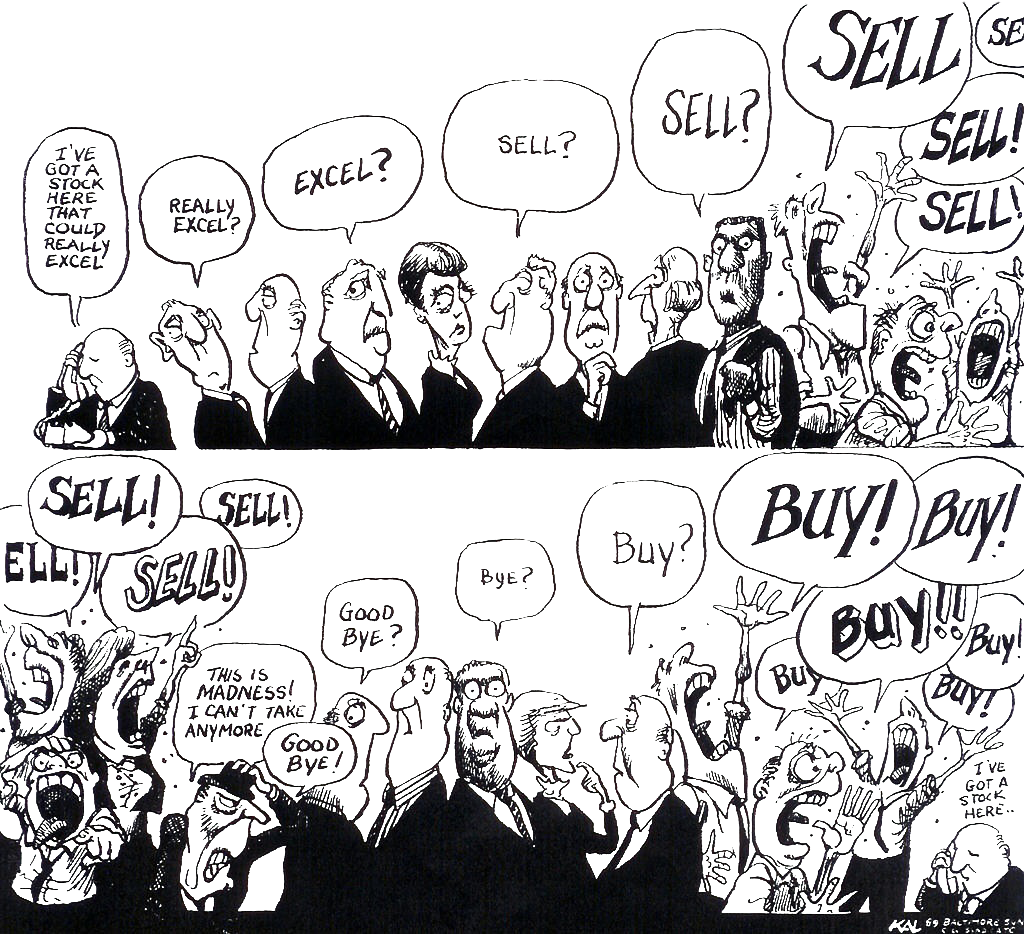

For Your Second Assignment You Will Be Investigating Chegg

https://media.cheggcdn.com/media/2e9/2e9dd536-a7b0-46bf-809c-c29f61cbd552/phpsaFig4

https://www.canada.ca › en › department-finance › news › delivering-a-…

The middle class tax cut would reduce the tax rate that is applied to the first 57 375 in 2025 of an individual s taxable income regardless of their income level As shown

https://www.canada.ca › en › services › taxes › income-tax

File non resident corporations income tax file non residents income tax get information on tax treaties country by country reporting Doing taxes for someone who died Report the date of

What Jim Lake Jr Sticker What Jim Lake Jr Trollhunters Tales Of

What Is She Doing Happily Sticker What Is She Doing Happily What Shes

Getting What You Want Vs What You Need By Arjuna Ishaya Medium

We Print What You Want

The Office Thats What She Said Sticker The Office Thats What She Said

What Causes A Market Crash and What You Can Do Minimalist Trading

Tucker Carlson GIF A Digital Snapshot Of Controversy And Humor

What Is Funneling R ClashOfClansMemes

What Are The Tax Benefits For Salaried Employees - If you are signing in on behalf of someone else including friends and family members you must use Represent a Client in your CRA account to access their information Do not use autofill on