What Does Pst Apply To PST is a retail sales tax that s payable when a taxable good software or service is acquired for personal or business use unless a specific exemption applies The general PST

Generally you pay PST when you purchase or lease taxable goods from your supplier If your supplier does not charge you PST you must self assess the PST due Unlike In Manitoba Provincial Sales Tax PST is known as Retail Sales Tax RST whereas in Quebec it is known as Quebec Sales Tax QST The table below summarizes the type of tax and the

What Does Pst Apply To

What Does Pst Apply To

https://upload.wikimedia.org/wikipedia/commons/e/e8/Timezoneswest.PNG

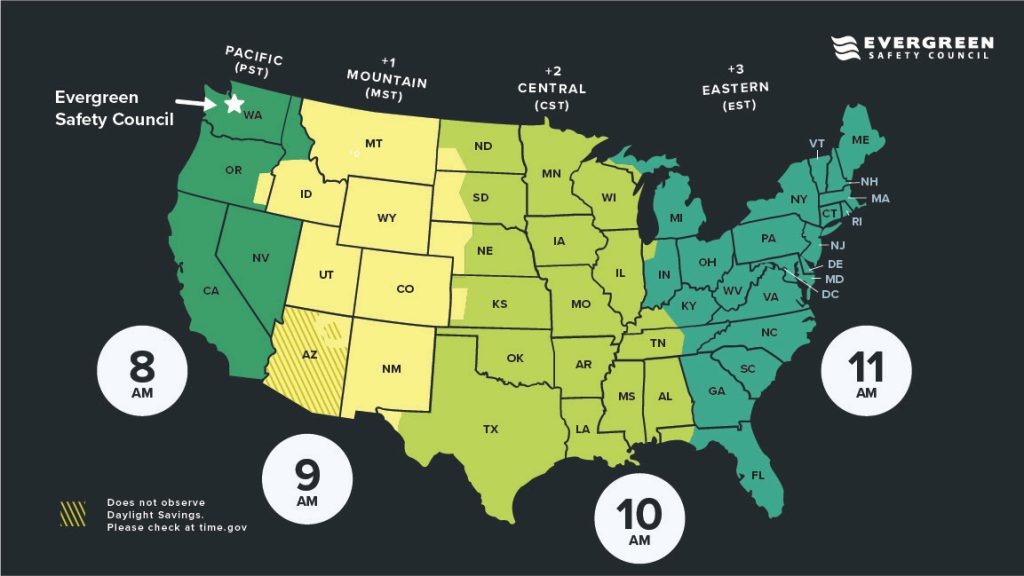

8 Am Pst To Est Time Conversion Ostomy Lifestyle

https://www.ostomylifestyle.org/wp-content/uploads/2021/03/Time-Zone-Map-v3-1024x576.jpg

8 Am Pst To Est Time Conversion Ostomy Lifestyle

https://www.ostomylifestyle.org/wp-content/uploads/2021/03/Time-Zone-Map-v3-746x420.jpg

PST A provincial tax that varies by province and is administered separately from the GST HST A combined tax that merges the GST with the PST in participating provinces Find out when you should charge and collect Provincial Sales Tax PST determine the PST rate in your province and identify goods that are exempt from PST

The PST in BC is generally charged when a taxable good software or service is obtained for personal or business use unless there is an exemption The BC PST general rate is 7 but can be higher on certain items In 2024 Canadian business owners must navigate a complex landscape of sales taxes which includes the provincial sales tax PST goods and services tax GST and

More picture related to What Does Pst Apply To

World Time Buddy Est To Pst At James Dennis Blog

http://pediaa.com/wp-content/uploads/2017/01/Difference-Between-PST-and-EST-2.png

[img_title-5]

[img-5]

[img_title-6]

[img-6]

British Columbia BC Provincial Sales Tax PST previously called Social Services Tax SST is a retail sales tax charged on most products both new and used and many services when they are purchased or leased in BC How does PST work and how is it different from GST PST Provincial Sales Tax is a provincially levied retail sales tax that is generally applied to goods or services acquired for

The basics of PST in BC are outline Find links to exemption certificates Information on real property contractors small sellers out of province purchases Businesses can apply for a PST number through the B C Ministry of Finance website There is no fee to obtain a basic PST registration number In summary the PST

[img_title-7]

[img-7]

[img_title-8]

[img-8]

https://www2.gov.bc.ca › gov › content › taxes › sales...

PST is a retail sales tax that s payable when a taxable good software or service is acquired for personal or business use unless a specific exemption applies The general PST

https://www2.gov.bc.ca › gov › content › taxes › sales-taxes › pst › faqs

Generally you pay PST when you purchase or lease taxable goods from your supplier If your supplier does not charge you PST you must self assess the PST due Unlike

[img_title-9]

[img_title-7]

[img_title-10]

[img_title-11]

[img_title-12]

[img_title-13]

[img_title-13]

[img_title-14]

[img_title-15]

[img_title-16]

What Does Pst Apply To - Provincial Sales Tax PST is a sales tax that applies to goods and services and is unique to each province territory in Canada The PST rate and the goods and services that are