What Fica Mean There is no senior citizen exemption to paying FICA taxes As long as you work in a job that is covered by Social Security payroll taxes will be collected

La FICA Federal Insurance Contributions Act o Ley de la Contribuci n Federal al Seguro Social se refiere a los impuestos que mayormente financian los beneficios del Seguro Social Self employed persons have to pay FICA taxes on their income Parts of the self employment tax can be taken as a deduction elsewhere on your tax return

What Fica Mean

What Fica Mean

https://lookaside.fbsbx.com/lookaside/crawler/threads/C8csHJxKz-N/0/image.jpg

Decoding The Net Promoter Score Its Significance And Calculation Blog

https://www.novelvox.com/wp-content/uploads/2024/04/What-is-Net-Promoter-Score.jpg

FICA Pay Stub Deductions And How They Fund Social Security YouTube

https://i.ytimg.com/vi/iQf25mQoybc/maxresdefault.jpg

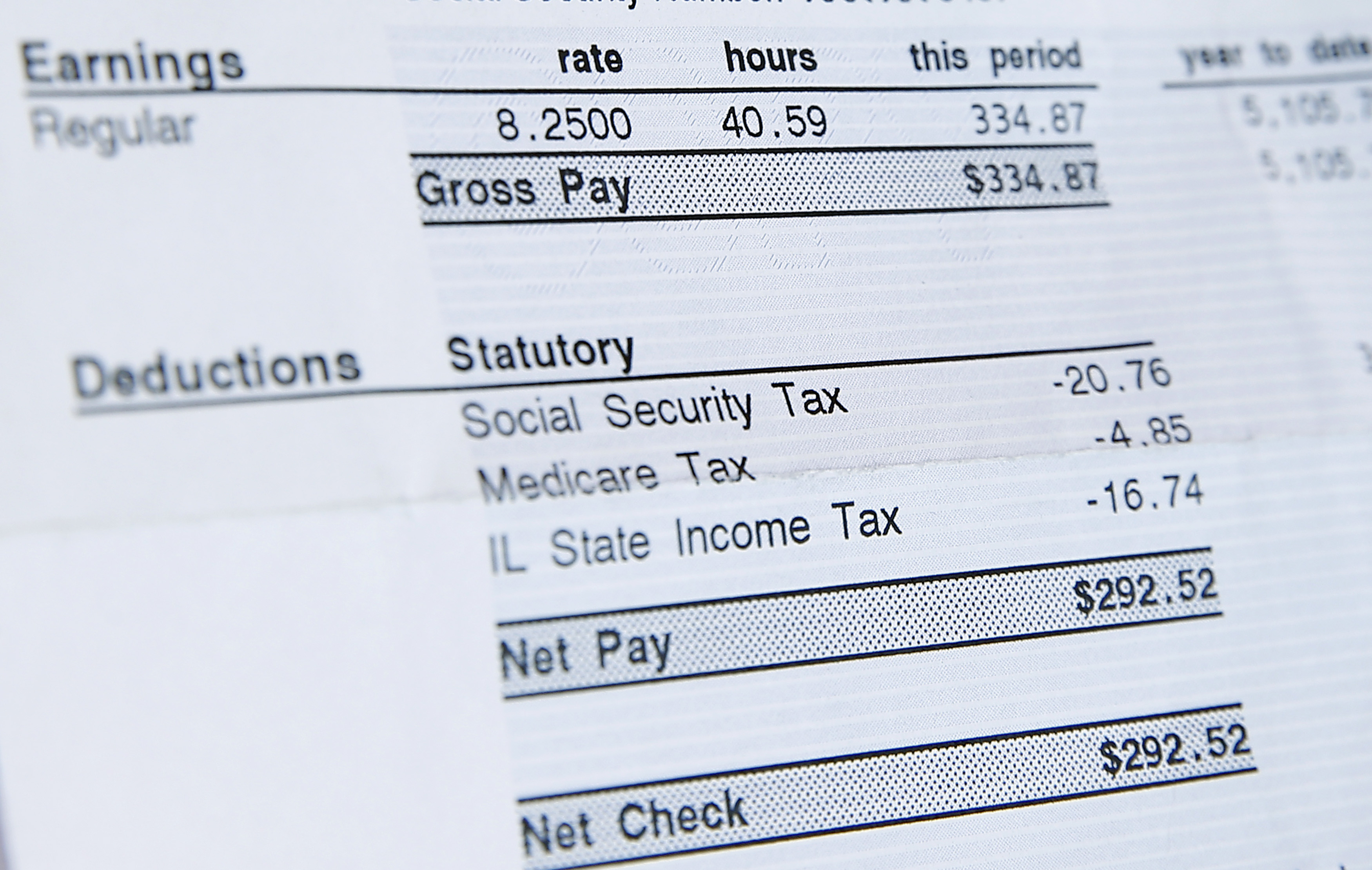

The maximum taxable income for Social Security for 2025 is 176 100 Under FICA the Federal Insurance Contributions Act 6 2 percent of your gross pay is withheld from This calculator estimates your monthly Social Security retirement benefits based on your earnings history and the age when you start to claim benefits

Medicare payroll taxes like Social Security taxes are automatically deducted from your paycheck under the Federal Insurance Contributions Act FICA The COLA isn t the only thing changing for Social Security next year Here are seven important ways Social Security will be different in 2025

More picture related to What Fica Mean

Miscellaneous Charge Huntington Bank 34

https://assets-global.website-files.com/63e56114746188c54e2936e0/641181fb84bd9957d62c524c_img-purchase-order-template.jpeg

What Is FICA On A Paycheck FICA Tax Defined Bizagility

https://www.chime.com/wp-content/uploads/2023/11/what-is-fica-on-a-paycheck-1.png

Family Finance Favs Don t Leave Teens Wondering What The FICA

https://3.bp.blogspot.com/-G6Y_L0BZAW8/VxGcZD-ALcI/AAAAAAAAA6o/nxfT6IgXeIUrIpv3z-JbeSXvPlUJeD6hQCLcB/s1600/WhatTheFICA.jpg

Contrary to popular myth Social Security is taxable How much you pay in taxes depends on your income and the state you live in Age is not a factor Social Security s COLA helps beneficiaries keep pace with inflation with adjustments since 1975 These vary yearly reflecting economic changes

[desc-10] [desc-11]

Fica 2025 Limits Tina L Tang

https://www.chime.com/wp-content/uploads/2023/11/fica-taxes-explained.png

Pin Di Trifan Rodica Su Ginduri Auguri Di Compleanno

https://i.pinimg.com/originals/70/5d/85/705d856e703bcd9410e2bd14e04c57c3.jpg

https://www.aarp.org › social-security › faq › tax-while-collecting-benefits

There is no senior citizen exemption to paying FICA taxes As long as you work in a job that is covered by Social Security payroll taxes will be collected

https://www.aarp.org › ... › preguntas-respuestas › ley-de-la-contribucio…

La FICA Federal Insurance Contributions Act o Ley de la Contribuci n Federal al Seguro Social se refiere a los impuestos que mayormente financian los beneficios del Seguro Social

Madisyn Shipman R NickBabes

Fica 2025 Limits Tina L Tang

Sources Of Real Wage Stagnation

FICA What Does FICA Mean Slang

2023 FICA Tax Limits And Rates How It Affects You

What Does De Que Mean In Spanish Catalog Library

What Does De Que Mean In Spanish Catalog Library

How Much Is Fica Tax 2025 Celeste Wood

What Did He Sayyy R school memes

What Does FICA Mean R WrongAnswersOnly

What Fica Mean - [desc-13]