What Is A Spread Rate What Is the Net Interest Rate Spread The net interest rate spread is the difference between the yield that a financial institution receives from loans and other interest accruing

What Is a Yield Spread A yield spread is the difference between yields on differing debt instruments of varying maturities credit ratings issuers or risk levels A yield For any business that lends money the interest rate spread is what the company charges on a loan compared to its cost of money A bank runs on interest rate spreads

What Is A Spread Rate

What Is A Spread Rate

https://images.finecobank.com/pub-uk/img/newsroom/spread-in-forex/spread-in-forex-lg.jpg

What Is A Spread In Forex Trading 47 OFF

https://assets.thetradingbible.com/guides/37/spread-in-forex-explained.png

What Is A Spread Footing Explained CivilMint Com

https://civilmint.com/wp-content/uploads/2023/03/GridArt_20230327_225652224.jpg

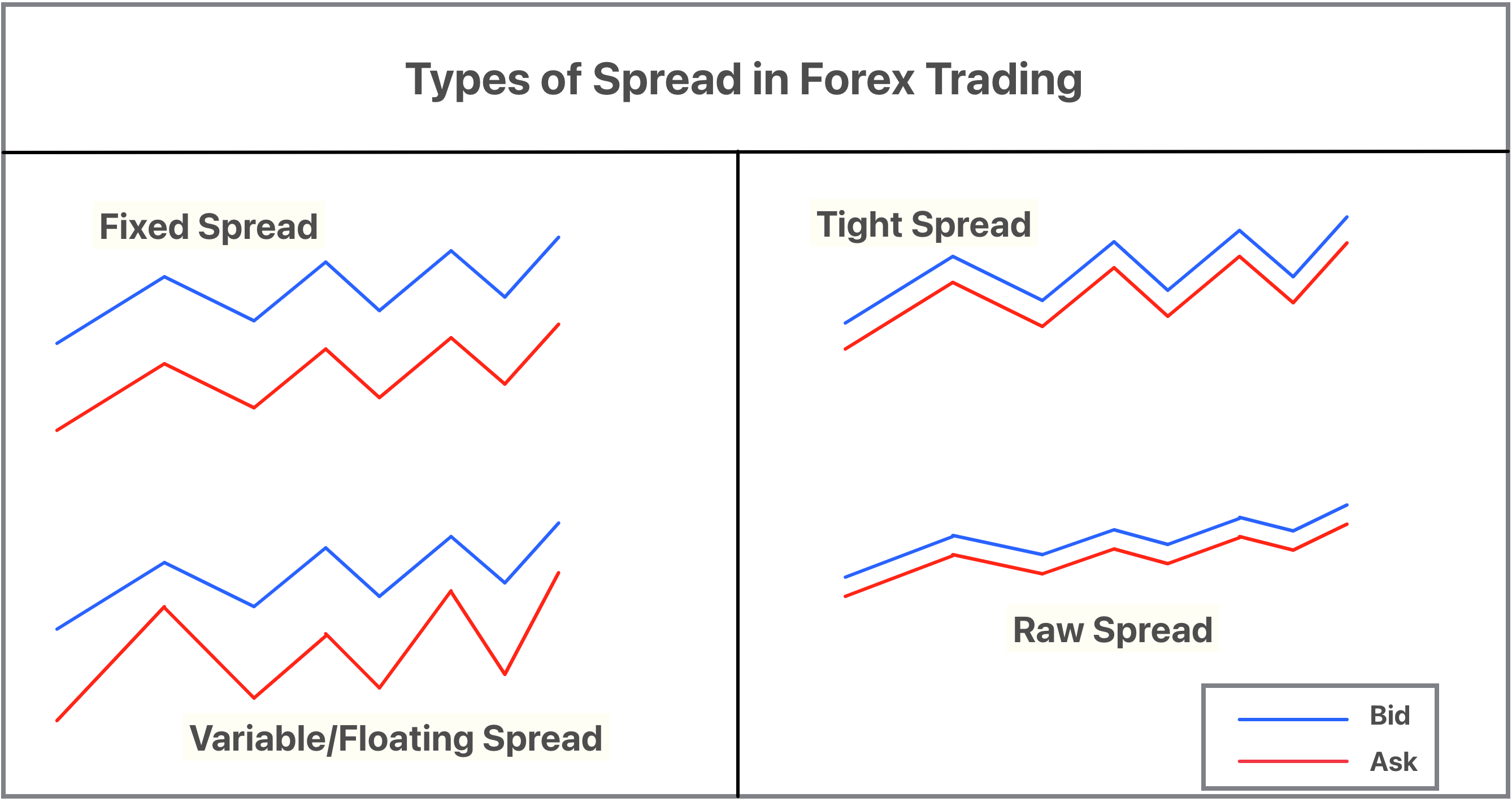

Spread is the price interest rate or yield differentials of stocks bonds futures contracts options and currency pairs of related quantities It also represents the lowest price movement that a At its core the spread is the difference between the interest rate a financial institution charges borrowers and the rate it pays to depositors This differential is a primary

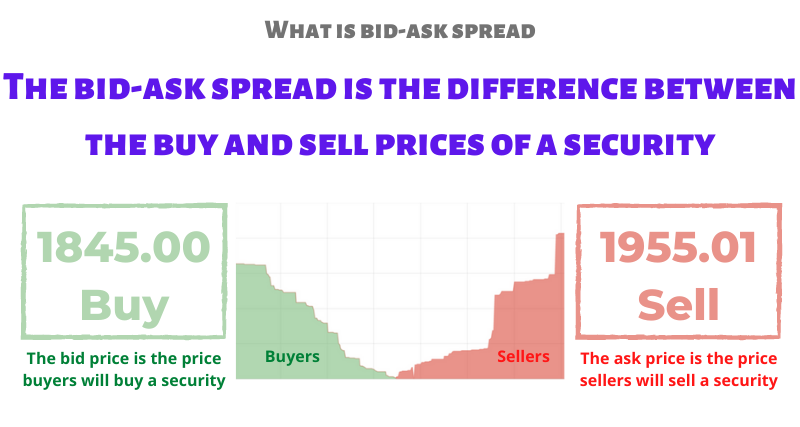

In finance the spread is the difference between the bid and ask prices of the same security or asset The bid price is the highest price that a buyer is willing to pay for an asset while the ask A spread in finance refers to the difference between two related values such as prices yields or interest rates Bid ask spreads are a strong indicator of liquidity in stock and

More picture related to What Is A Spread Rate

What Is Bid Ask Spread The Trading Strategist

https://www.publicfinanceinternational.org/wp-content/uploads/bid-ask-spread-wikimedia.png

What Is A Spread Trading Spread Definition

https://www.startrader.com/wp-content/uploads/2023/03/EDUCATIONAL-VIDEO-TEMPLATE-03-3-scaled.jpg

10 How To Calculate Spread DominickMydah

https://images.slideplayer.com/39/10840975/slides/slide_12.jpg

Term spreads also known as interest rate spreads represent the difference between the long term interest rates and short term interest rates on debt instruments such as A spread is a gap between two rates yields or prices Spreads vary depending on what you are trading For example a stock spread is the difference between a stock s bid and

[desc-10] [desc-11]

Premia Academy Spreads Call Put

https://images.prismic.io/premia-academy/65ec9459-d290-4dd8-9638-7249cd0f476f_premia-academy-option-spread.png?auto=compress%2Cformat&fit=max&w=3840

What Is Spread Footing 8 Different Types Of Spread Footing

https://www.propertygeek.in/wp-content/uploads/2023/02/spread-footing.jpg

https://www.investopedia.com › terms › net-interest-rate-spread.asp

What Is the Net Interest Rate Spread The net interest rate spread is the difference between the yield that a financial institution receives from loans and other interest accruing

https://www.investopedia.com › terms › yieldspread.asp

What Is a Yield Spread A yield spread is the difference between yields on differing debt instruments of varying maturities credit ratings issuers or risk levels A yield

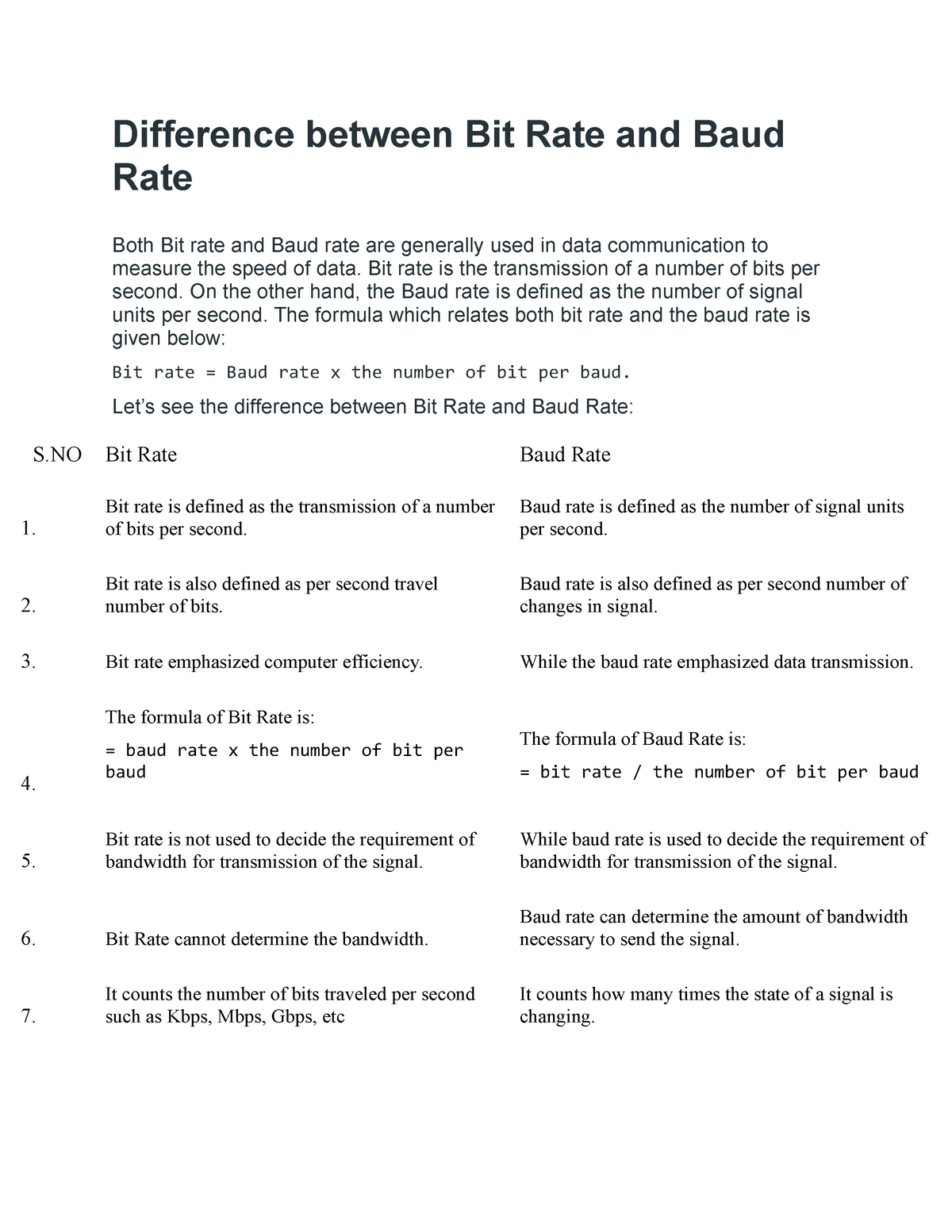

Difference Between Bit Rate And Baud Rate Difference Between Bit Rate

Premia Academy Spreads Call Put

What Is A Spread Recommended Broker With The Lowest Spread In Forex

What Does Spread Mean In Finance Commons credit portal

5 Different Types Of Spread In Trading ForexBee

What Is The Minimum Payment On A Credit Card Lexington Law

What Is The Minimum Payment On A Credit Card Lexington Law

What Is A Spread In Stocks Definitions For Investing Pearler

What Is A Spread Option InfoComm

What Is A Cap Rate Spread CPI

What Is A Spread Rate - In finance the spread is the difference between the bid and ask prices of the same security or asset The bid price is the highest price that a buyer is willing to pay for an asset while the ask