What Is Irs Tax Code 150 What is IRS Code 150 A Code 150 on your transcript means that the IRS has finished processing your return and determined your total tax due for the year The IRS has also

Understanding the meaning behind IRS code 150 on a tax transcript unlocks new power over your tax situation You gain visibility into the status of your return refund or balance dues And clarity on what comes next when processing A Code 150 means that the IRS has processed your tax return and added it to its main file Your tax liability has been worked out but you will get a refund if it comes out to be

What Is Irs Tax Code 150

What Is Irs Tax Code 150

https://savingtoinvest.com/wp-content/uploads/2022/09/image-1-768x445.png

What Is IRS Code 150 On My Tax Transcript

https://amynorthardcpa.com/wp-content/uploads/2023/03/irs-transcript.jpg

Match Organization Information With IRS Documentation Cheddar Up

https://support.cheddarup.com/hc/article_attachments/10927892730900

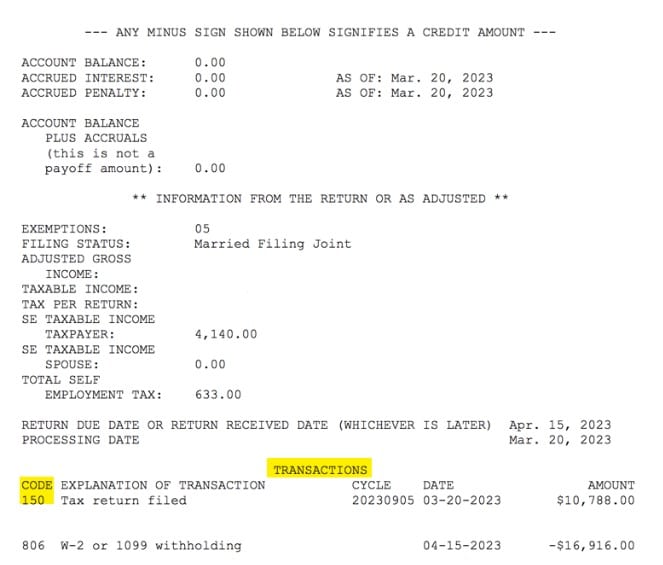

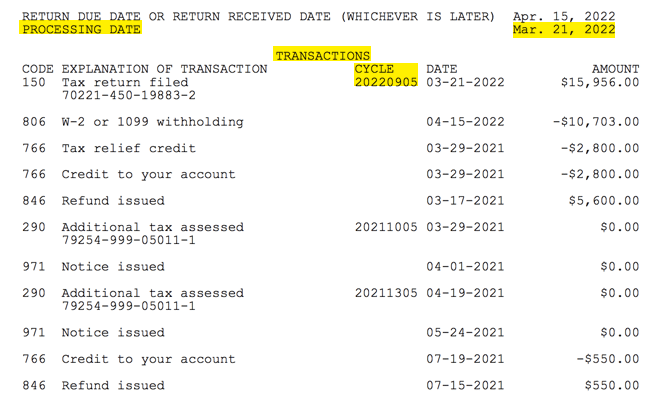

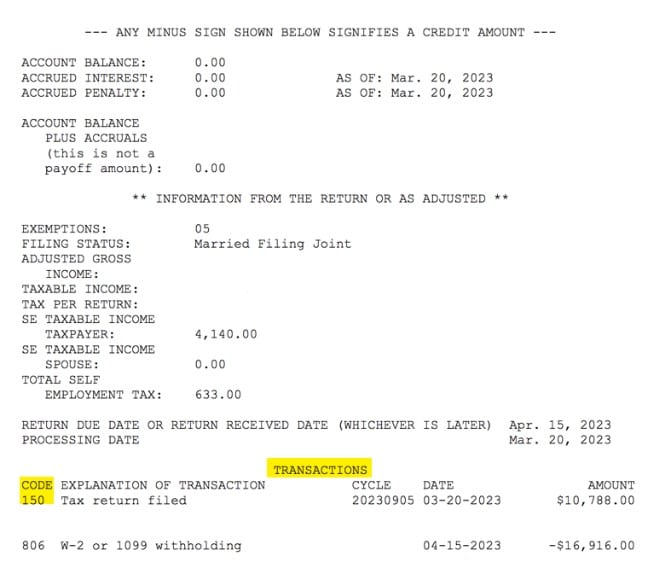

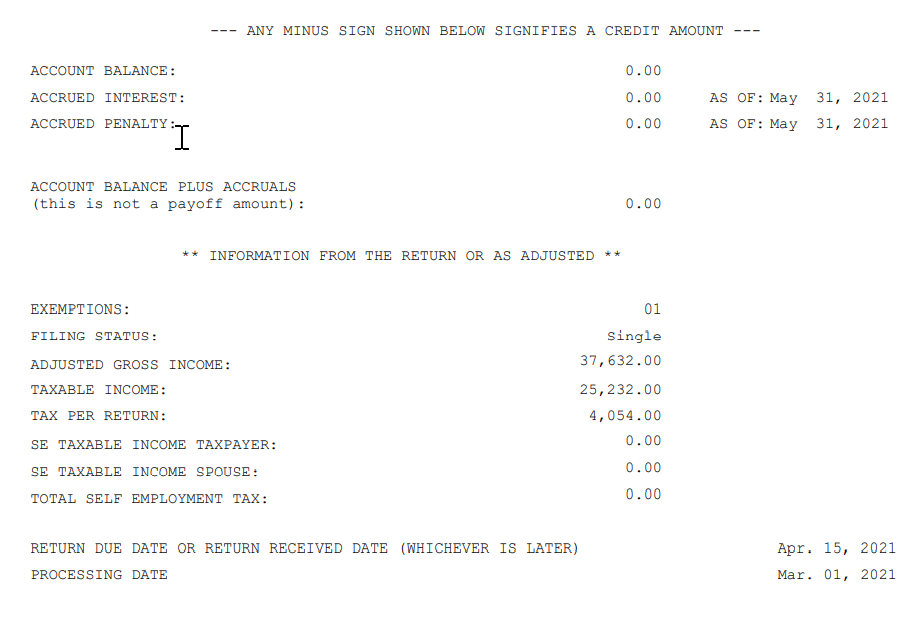

We ll explain Code 150 and why it matters when checking tax returns You ll learn about how long it takes the IRS to process tax returns how to read the information linked to Code 150 on an IRS transcript means that the IRS has accepted your return for processing and has created a current year file for you Transcript code TC 150 may be shown with a dollar amount representing the tax

This article explores Tax Code 150 on a transcript explaining its significance and its role in the tax filing process Meaning of Code 150 on a Tax Transcript Tax Code 150 IRS Code 150 is an essential part of the IRS Master File Transaction Codes It represents the filing of your return and the assessment of tax liability Simply put it means the IRS has

More picture related to What Is Irs Tax Code 150

What Is An IRS Cycle Code

https://amynorthardcpa.com/wp-content/uploads/2022/08/word-image-20022-1.png

IRS Code 150

https://www.zrivo.com/wp-content/uploads/2022/03/What-is-IRS-Code-150.jpg

What Is IRS Form 5498 Tax Law Advocates

https://taxlawadvocates.com/wp-content/uploads/2023/02/IRS-Tax-Forms.png

If you see a Code 150 on your transcript that tells you that your return has been processed and that the IRS has determined your final balance including what you may owe or what they may owe you That s it Transaction Code 150 Return Filed Tax Liability Assessed is one you will prominently see on your transcript likely the first line per the screenshot below after your return is accepted by the IRS and added to their

Tax Code 150 doesn t signify anything like a debit or credit balance of your tax liability or refunds It s just the transaction code used by the IRS to show that a tax return has been filed by the Code 150 indicates that your tax return has been processed and added to the IRS s main file You will receive a refund in the event your tax liability turns out to be

Will The IRS Reconsider Your Tax Assessment And How Much You Owe Wiztax

https://www.wiztax.com/wp-content/uploads/2023/10/irs-assessment-1355x1020.jpg

What Is The Internal Revenue Service IRS Definition History

https://www.thestreet.com/.image/t_share/MTk1NDgwODc2MDI3NDg3ODEz/1.png

https://taxsharkinc.com

What is IRS Code 150 A Code 150 on your transcript means that the IRS has finished processing your return and determined your total tax due for the year The IRS has also

https://handsaccounting.com

Understanding the meaning behind IRS code 150 on a tax transcript unlocks new power over your tax situation You gain visibility into the status of your return refund or balance dues And clarity on what comes next when processing

IRS Redesigns Tax Transcript To Protect Taxpayer Data CPA Practice

Will The IRS Reconsider Your Tax Assessment And How Much You Owe Wiztax

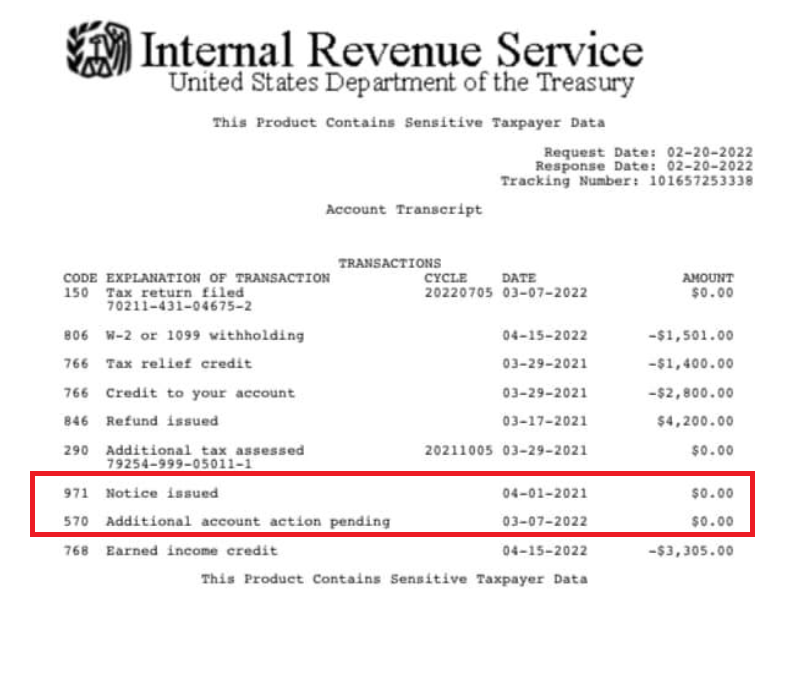

What Does Code 570 And 971 Mean On My IRS Tax Transcript And Will It

Tax Transcript Help Code 150 R IRS

How To Read My Tax Return Transcript Mueller Wilver

Simplify The Tax Code Instead Of Creating An IRS Rival To TurboTax

Simplify The Tax Code Instead Of Creating An IRS Rival To TurboTax

IRS Michigan Treasury Give Tips For Tax Filers To Avoid Common Errors

What Is IRS Form 2848 Power Of Attorney A Detailed Guide For

What IRS Form Can Be Signed Electronically

What Is Irs Tax Code 150 - If you have received Code 150 on IRS transcript in 2022 it means that the IRS has processed your tax return and determined your tax liability According to the U S Internal