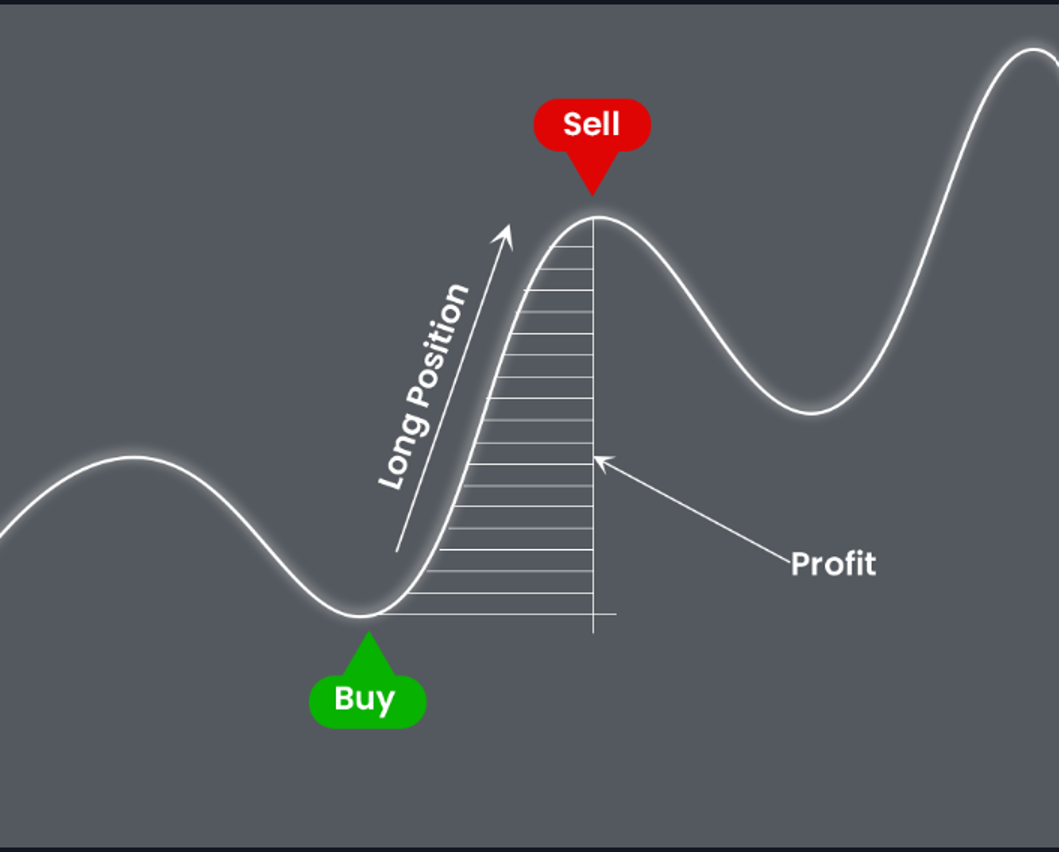

What Is Long Or Short Position Mean For Futures Traders usually go long or open a buy position on certain Futures contracts when they believe that the Future s price is likely to rise in the future On the flip side when traders believe that the price will fall they are more likely to

Long and short position in futures include purchasing and selling futures contracts respectively But does it matter if a trader goes long or short Some go long some short and others do both depending on their strategy Let s look at what it means to short a futures contract and break down a few strategic implications From a functional standpoint traders have several reasons to short a futures contract Exit a

What Is Long Or Short Position Mean For Futures

What Is Long Or Short Position Mean For Futures

https://i.ytimg.com/vi/yl2jVVphJ0A/maxresdefault.jpg

What Is A Long Position Definition Examples Related Terms TheStreet

https://www.thestreet.com/.image/t_share/MTkwNDExNjk0NzA1NDg1MDQ5/long-position-top-image.png

What Is Long Position And Short Position stock market for beginners

https://i.ytimg.com/vi/GzyTbXTjmAw/maxresdefault.jpg

The main difference between long and short positions in futures trading lies in the trader s expectations for the price movement of the underlying asset A long position is taken when the trader expects the price to rise while The main difference between a long position and a short position lies in the trader s expectation of the asset s price movement While a long position anticipates an increase in value a short position anticipates a

The key difference between a long position and a short position is the direction of the bet that an investor takes on an asset s price movement In a long position an investor buys What Is Long and Short in Futures When trading futures long and short refer to the two positions a trader can take based on their expectations of price movement A long

More picture related to What Is Long Or Short Position Mean For Futures

Long Position Vs Short Position Which Is Better YouTube

https://i.ytimg.com/vi/mrO-cQwze50/maxresdefault.jpg

How To Use Long Position And Short Position Tool In Trading View

https://i.ytimg.com/vi/Jlq2YGsdOBs/maxresdefault.jpg

Short Position Vs Long Position Ultimate Guide

https://assets-global.website-files.com/5cc1a690df4e901766e92dcd/64522f3ec1c9143d02fbbb71_short_position_long_position.jpeg

The difference between a long position and a short position is the direction of the market assumption On one side you have the choice of going long buy when your trading plan provides evidence that the market price of an asset will rise Long positions contribute to market growth and optimism because they are based on the belief in future price increases while short positions provide a mechanism for price correction and market efficiency by betting

A long position refers to buying security or stock currency or commodity with the expectation of making a profit When a stock s value relies on another one it is known as a derivative In contrast a short position is when a Choosing between a long or short position in futures trading depends on your market predictions and risk tolerance Long positions anticipate price increases while short positions bet on price

What Is Long And Short Position In Future StockPe Blog

https://stockpe.app/blog/wp-content/uploads/2023/09/image-2.png

Long Bicep Vs Short Bicep Everything You Need To Know Fitness Volt

https://fitnessvolt.com/wp-content/uploads/2022/11/Long-Bicep-vs-Short-Bicep.jpg

https://us.plus500.com › academy

Traders usually go long or open a buy position on certain Futures contracts when they believe that the Future s price is likely to rise in the future On the flip side when traders believe that the price will fall they are more likely to

https://blog.dhan.co › what-is-long-and-sh…

Long and short position in futures include purchasing and selling futures contracts respectively But does it matter if a trader goes long or short Some go long some short and others do both depending on their strategy

How To Calculate Long Position Vs Short Position Profits BitMart

What Is Long And Short Position In Future StockPe Blog

Short Position Vs Long Position Which Should You Choose

Long And Short Positions Guide To Wall Street Lingo 365 Financial

What Is Long And Short In Trading Robots

How To Use Long And Short Position Tool On TradingView Mobile To

How To Use Long And Short Position Tool On TradingView Mobile To

Short Vs Long Vowels Anchor Chart Etsy

Day trading Comprensi n De Las P rdidas Y Ganancias A

Short form Or Long form Videos Which Works Best For Brands Social

What Is Long Or Short Position Mean For Futures - The key difference between a long position and a short position is the direction of the bet that an investor takes on an asset s price movement In a long position an investor buys