What Percentage Of Salary Is Deducted For Taxes Get step by step instructions for calculating withholding and deductions from employee paychecks including federal income tax and FICA tax

These taxes are deducted from employee paychecks at a total flat rate of 7 65 percent that s split into the following percentages Medicare taxes 1 45 percent Social Security taxes 6 2 percent These percentages are A percentage of your gross pay each pay period is withheld to cover federal income taxes FICA contributions that is Social Security and Medicare taxes a Find out where the money that s deducted from your

What Percentage Of Salary Is Deducted For Taxes

What Percentage Of Salary Is Deducted For Taxes

https://cdn.howmuch.net/articles/how-much-money-gets-taken-out-paychecks-1542.jpg

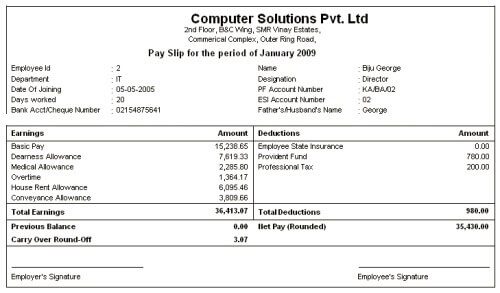

Undertaking Letter For Salary Deduction Salary Deduction Undertaking

https://i.ytimg.com/vi/VCyDpunRcJg/maxresdefault.jpg

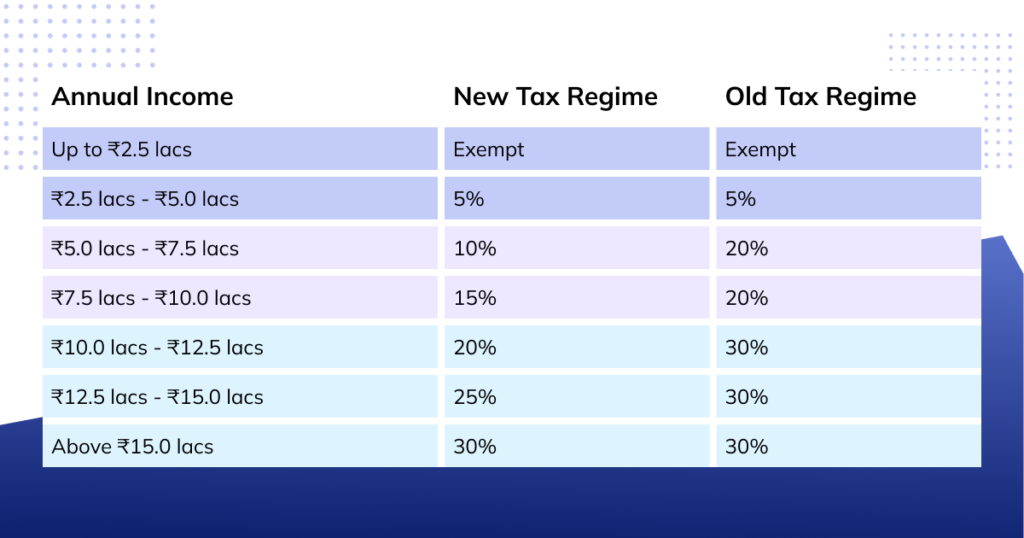

How To Calculate Income Tax On Salary With Example

https://d6xcmfyh68wv8.cloudfront.net/learn-content/uploads/2022/02/Facebook-post-16-1024x538.png

The amount of tax deducted from your salary depends on your earnings tax slab and the tax regime old or new you choose Check your W 4 tax withholding with the IRS Tax Withholding Estimator See how your withholding affects your refund paycheck or tax due

What portion of my paycheck is withheld for federal deductions The largest withholding is usually for federal income tax The amount taken out is based on your gross income your W 4 Form that describes your tax situation What you earn based on your wages or salary is called your gross income Employers withhold or deduct some of their employees pay in order to cover payroll taxes and income tax

More picture related to What Percentage Of Salary Is Deducted For Taxes

PF Deduction From Salary Calculation YouTube

https://i.ytimg.com/vi/D1GGeM2cWgg/maxresdefault.jpg

How Much Tax Is Deducted From Salary Philippines Calculator Printable

https://www.lettersinenglish.com/wp-content/uploads/Request-Letter-to-Start-PF-Deduction-from-Salary-Sample-Letter-Requesting-for-Provident-Fund-Deduction-from-Salary.jpg

Understanding Tax Deducted At Source TDS

https://assets.api.gamma.app/t5jn0f70i9vwqho/screenshots/do0sfb2b9eh22oe/d52b93s3svjcnrx/slide/GLwiF39EvMsqnPgummgSzBObBrU

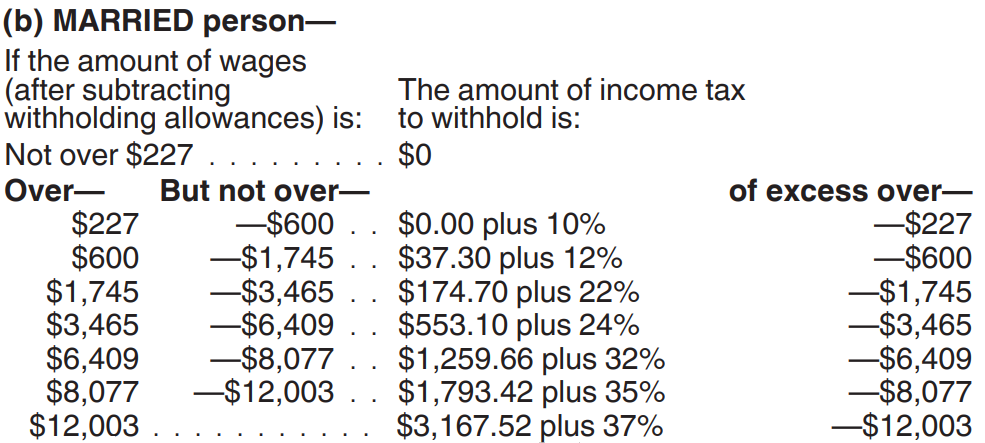

Federal law requires employers to withhold employment taxes from employee pay Employment taxes include federal income tax withholding and taxes for Social Security and Medicare But when After inputting your salary information more on that below the calculator shows you the current amount of federal income taxes being withheld and compares it to an estimate of the total

His withholding is calculated using the tax tables in the IRS Publication 15 and the EDD DE 44 Federal withholding is money that is withheld and sent to the IRS to pay federal income taxes For example if gross pay is 50 000 and deductions taxes and benefits total 7 000 then Net pay 50 000 7 000 43 000 This means the employee takes home

Standard Deduction For Salary Ay 2021 22 Standard Deduction 2021

https://standard-deduction.com/wp-content/uploads/2020/10/latest-income-tax-slab-rates-fy-2020-21-ay-2021-22-11.jpg

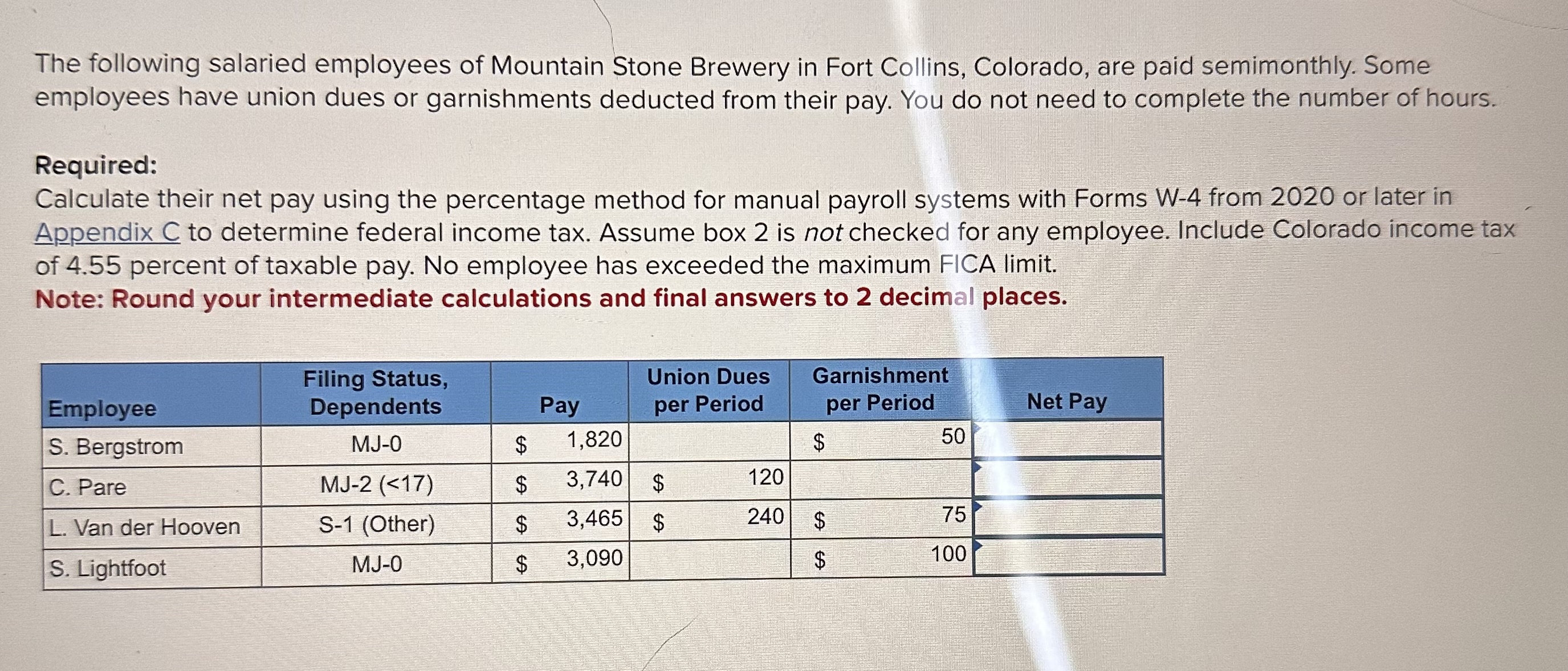

The Following Salaried Employees Of Mountain Stone Chegg

https://media.cheggcdn.com/media/4e7/4e79d24a-ce26-4746-8f41-91415da925bb/phpxHMcPU

https://www.thebalancemoney.com

Get step by step instructions for calculating withholding and deductions from employee paychecks including federal income tax and FICA tax

https://www.groupmgmt.com › blog › post › …

These taxes are deducted from employee paychecks at a total flat rate of 7 65 percent that s split into the following percentages Medicare taxes 1 45 percent Social Security taxes 6 2 percent These percentages are

Ouida Minor

Standard Deduction For Salary Ay 2021 22 Standard Deduction 2021

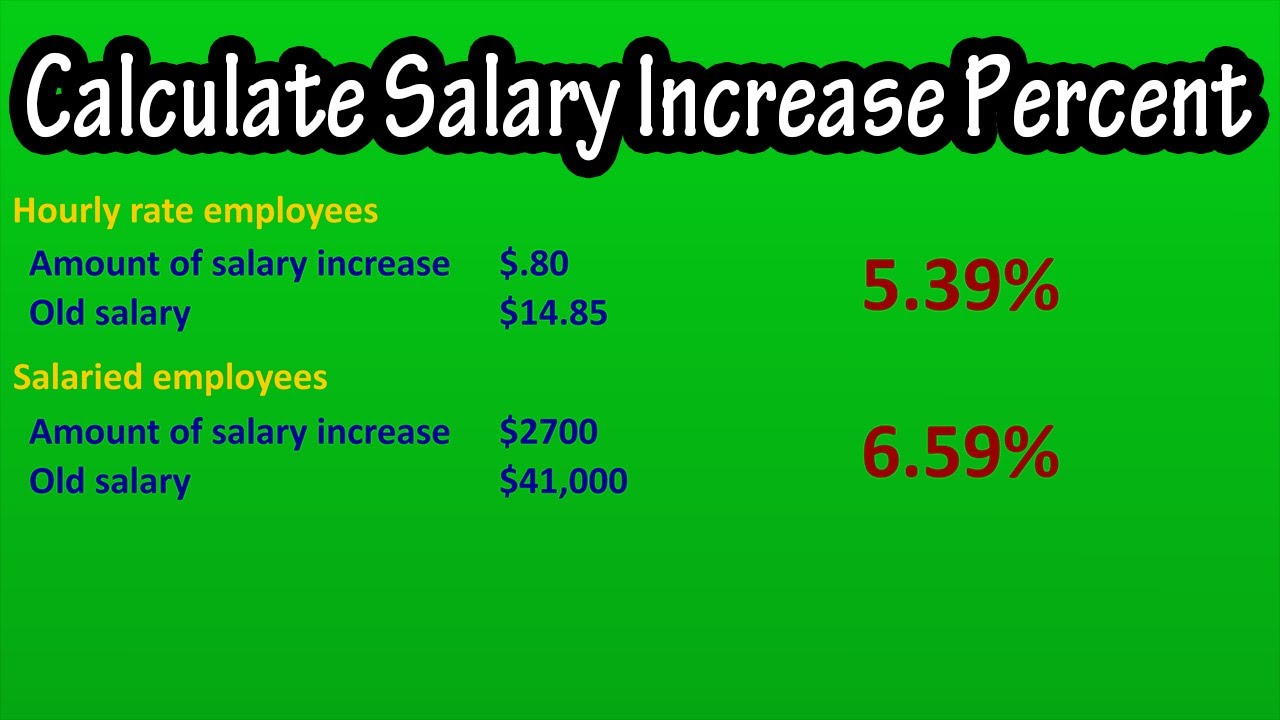

How To Calculate Salary Increase Percentage In Excel Exceldemy Riset

How Can I Reduce My Income Tax Leia Aqui How Can I Lower My Income

Byrd Chen 2022 Pr Exam Ch05 Chapter 5 Capital Cost Allowance

Byrd Chen 2022 Pr Exam Ch06 Chapter 6 Income Or Loss From A Business

Byrd Chen 2022 Pr Exam Ch06 Chapter 6 Income Or Loss From A Business

Standard Deduction Budget Announcements Budget 2018 Gives Rs 40 000

Salary Net Salary Gross Salary Cost To Company What Is The Difference

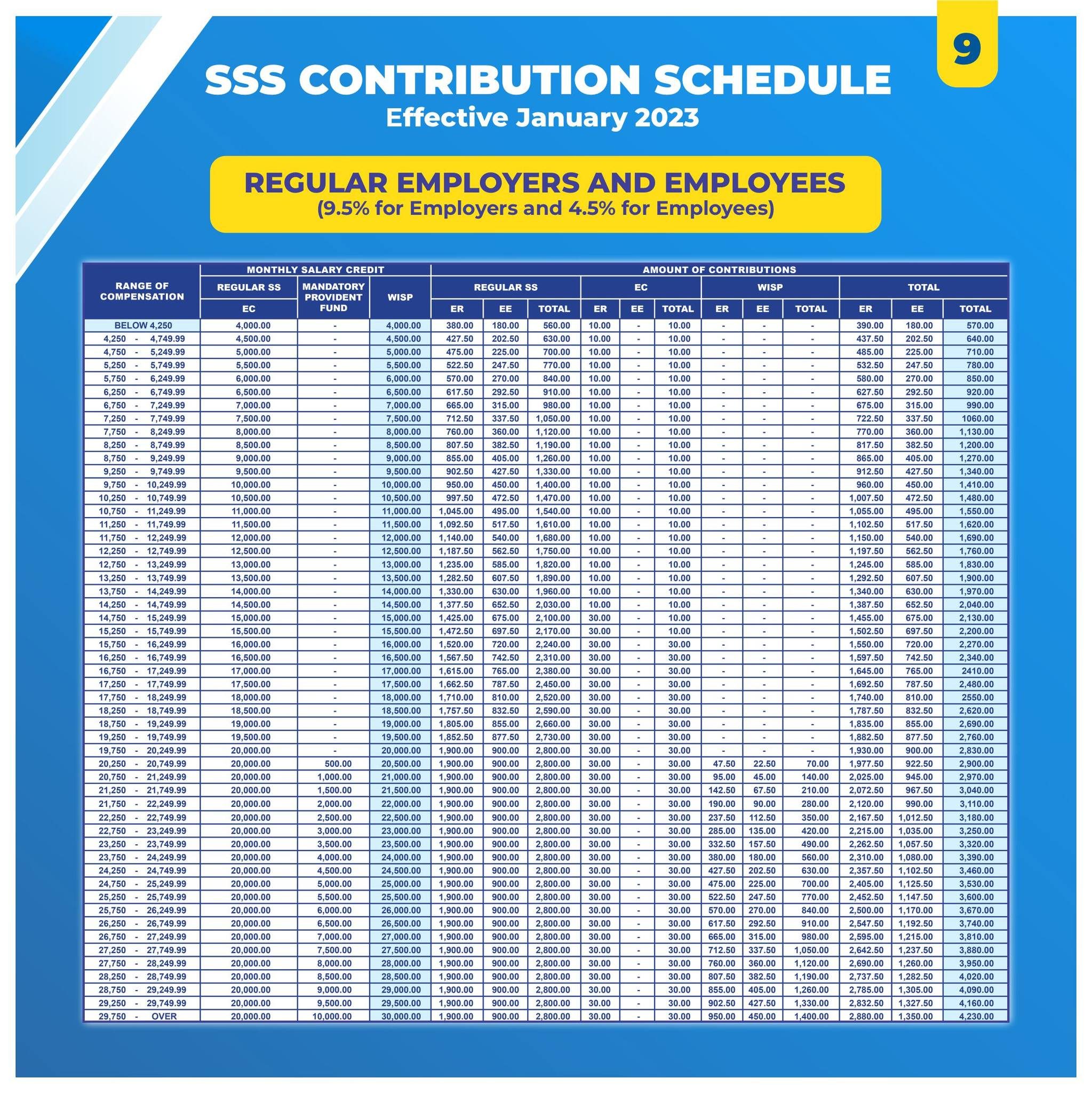

FAST FACTS What Are SSS GSIS PhilHealth Pag IBIG Salary Deductions

What Percentage Of Salary Is Deducted For Taxes - Let s understand income tax calculation under both old and new tax regimes by way of an example Neha receives a Basic Salary of Rs 1 00 000 per month HRA of Rs 50 000 Special