Who Have To Pay Professional Tax Who is Responsible to Pay Professional Taxes In the case of employees an employer is a person responsible for deducting and paying professional tax to the state government subject

Professional tax is applicable to anyone earning an income from salary or practicing a profession Here s a breakdown of who needs to pay professional tax Salaried Individuals Every salaried individual working and earning a monthly income is liable to pay a certain part of his her earnings to the respective state governments in the form of professional tax This tax

Who Have To Pay Professional Tax

Who Have To Pay Professional Tax

https://www.techiequality.com/wp-content/uploads/2022/06/409FEE94-ADCB-4AD5-84CE-B6C9D8B29ADD.jpeg

OnePlus Pad 2 Review You Don t Have To Pay A Lot For A Premium Android

https://static1.howtogeekimages.com/wordpress/wp-content/uploads/2024/10/home-screen-of-the-oneplus-pad-2-1_53893810851_o.jpg

Karnataka Professional Tax Return Filing Process Professional Tax

https://i.ytimg.com/vi/EYuvfp4Tnss/maxresdefault.jpg

If you are in the salaried profession you have to pay professional Tax if you are self employed you pay this tax if you are a Doctor Engineer or Chartered accountant Once collected the professional tax is paid by the employers to the government Otherwise they can be fined if they don t collect or pay them Professional tax must be paid by you if you do not work for anyone else

Get accurate Professional Tax Slabs for all States in India other details like PT act rule filing of returns p tax registration due dates PT deduction PT exemption PT challan latest The professional tax is imposed basis a slab amount on the gross income of the professionals required to pay professional tax Note that the tax paid in the form of

More picture related to Who Have To Pay Professional Tax

![]()

The Outlier

https://outliereditor.co.za/wp-content/uploads/2024/07/Fail-ICON-1.png

Write A Letter To Your Father Requesting That He Send Money To Pay For

https://theshaykhacademy.com/wp-content/uploads/2023/05/png_20230531_075106_0000-1024x1024.png

How To Deactivate Safaricom Line Wikitionary254

https://wikitionary254.com/wp-content/uploads/2023/01/How-to-Deactivate-Safaricom-Line-1.jpg

Who is responsible to collect and pay this tax Professional tax is collected by the Commercial Tax Department of respective states on behalf of the municipality corporation In Almost every individual who earns needs to pay some amount as Professional Tax This can be explained in simpler words as further Any person involved in any form of business

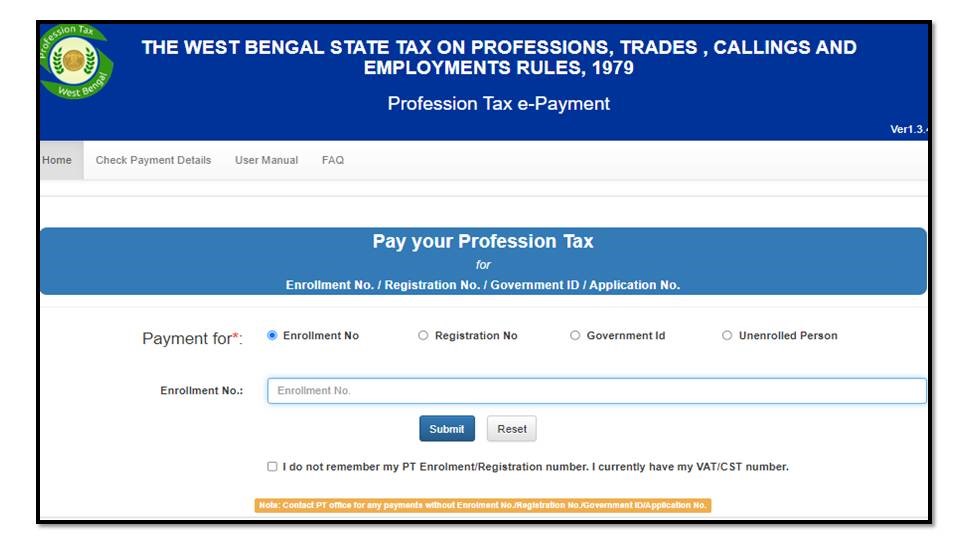

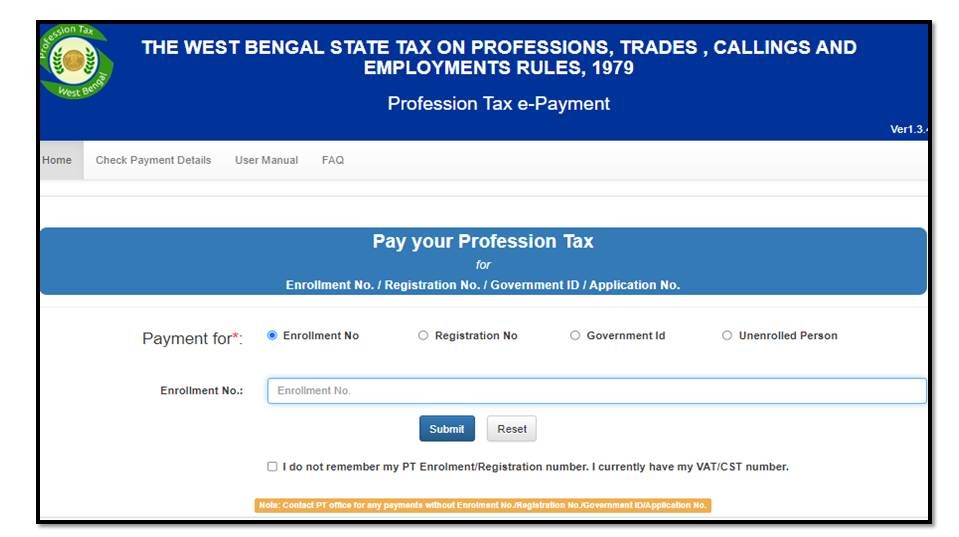

Professional tax or P tax is a direct tax that the State Government imposes on individuals who earn either by practising a profession employment trade or calling or running a freelancing A person must pay Professional tax before the 30th September of a given fiscal year if they register before the start of the fiscal year or before the 31st August of that year

Peg Clara HSR Enthusiast On X Gepard Welt

https://i.pinimg.com/originals/13/56/ae/1356aedeb346315d48611e5255c3ea2c.jpg

2000 02 Macclesfield Away Shirt Mint XL

https://images.classicfootballshirts.co.uk/pub/media/catalog/product/p/4/p4958791-1_y8rnd75vzubpn6to.jpg

https://cleartax.in › professional-tax

Who is Responsible to Pay Professional Taxes In the case of employees an employer is a person responsible for deducting and paying professional tax to the state government subject

https://www.fininformatory.in › all-about...

Professional tax is applicable to anyone earning an income from salary or practicing a profession Here s a breakdown of who needs to pay professional tax Salaried Individuals

The Waikato Times

Peg Clara HSR Enthusiast On X Gepard Welt

Samsung Galaxy Ring Everything We Know So Far About The Rumored Oura

If You Want To Text With Jesus AI Here Is An App For It Dataconomy

IPhone 16 Price How Much Does Each Model Cost TechRadar

IPhone 16 Price How Much Does Each Model Cost TechRadar

IPhone 16 Price How Much Does Each Model Cost TechRadar

IPhone 16 Price How Much Does Each Model Cost TechRadar

Professional Tax In India Rates Exemption And Applicability

FAQs

Who Have To Pay Professional Tax - Get accurate Professional Tax Slabs for all States in India other details like PT act rule filing of returns p tax registration due dates PT deduction PT exemption PT challan latest