Who Is Liable To Pay Professional Tax In Madhya Pradesh The usual authorities Patridge Fowler OED don t give much guidance on this Certainly there s nothing wrong with the legal expression to be liable for any offence one may

Hi everybody I ve already posted another thread I m a student and i m supposed to understand the difference and the different context of use of the following verbs apt liable You are held liable for a loss but you are liable to be punished a punishment I cannot explain why I am sorry For another sentence You hold responsible for the loss

Who Is Liable To Pay Professional Tax In Madhya Pradesh

Who Is Liable To Pay Professional Tax In Madhya Pradesh

https://uploads-ssl.webflow.com/63ae0c4332bfdb12f5309850/63ae28f2da54a250cc1fb726_Am-I-LIABLE-TO-PAY-TAXES-blog-label.png

How To Pay Professional Tax Online In Bengali West Bengal Professional

https://i.ytimg.com/vi/6toc5bbSH5k/maxresdefault.jpg

What Is ITR U How To File Updated Return Under Section 139 8A

https://paytm.com/blog/wp-content/uploads/2023/07/Blog_Paytm_Should-you-file-ITR-even-if-you-have-no-income-tax-liability.jpg

Responsibility is an obligation you have to do something You re responsible for finishing your work Liability means that you re subject to repercussion if your duties are not Definitely liable for me

I would say with my lawyer hat on technically no you are liable legally responsible for the damage and are required to pay compensation That said a quick Google The company will be liable it will be the company s responsibility the company will be held liable the company will be deemed and treated as being responsible So however

More picture related to Who Is Liable To Pay Professional Tax In Madhya Pradesh

NRIs Selling Indian Property Key Income Tax Rules

https://lh4.googleusercontent.com/Rx7vzifn0TKEqMGNoO6nqS4n2WG-vW2BN9tjnYsSe_fz7oeP9WbXRokMQH2MAZvihCbY76XWfUs-wEgGZyaCtTYguEnrjFx88QG7aN7meUyHJxuSw5Yzu2fSF9bu3MGRCabcHr3M4JtCQ5KzfE3dCAc

Professional Tax In Madhya Pradesh

https://img.indiafilings.com/learn/wp-content/uploads/2018/10/12005318/Professional-Tax-in-Madhya-Pradesh.jpg

National Insurance Co Ltd VS Kavita Devi Ors Supreme Today AI

https://s3.ap-southeast-1.wasabisys.com/static-images/Delhi_1.png

I travel regularly on a British stretch of road which has this sign on it at regular intervals Road liable to flooding If I was in charge of composing these signs I d say Road Liable law likely to be legally punished or forced to do something by law liable to for Anyone found trespassing is liable to a maximum fine of 100 Longman be subject to a

[desc-10] [desc-11]

Persons Liable For Registration Under GST 2023 Update

http://instafiling.com/wp-content/uploads/2022/12/Topic-29-person-liable-for-registration-under-gst.png

Karnataka Professional Tax Return Filing Process Professional Tax

https://i.ytimg.com/vi/EYuvfp4Tnss/maxresdefault.jpg

https://forum.wordreference.com › threads

The usual authorities Patridge Fowler OED don t give much guidance on this Certainly there s nothing wrong with the legal expression to be liable for any offence one may

https://forum.wordreference.com › threads

Hi everybody I ve already posted another thread I m a student and i m supposed to understand the difference and the different context of use of the following verbs apt liable

GST Liability To Pay GST Transfer Of Business I CA I CMA I CS I Tax

Persons Liable For Registration Under GST 2023 Update

Withholding Taxes In The Philippines Table And Computation Eezi

Madhya Pradesh Professional Tax Act 1995 PDF Salary Taxes

Professional Tax In Madhya Pradesh Tax Slab Rates How To Pay Due

Person Liable To Pay Tax On Post cessation Receipts Thompson Taraz Rand

Person Liable To Pay Tax On Post cessation Receipts Thompson Taraz Rand

Professional Tax In Karnataka Your Essential Guide

Advance Tax For Senior Citizen Swati K And Co

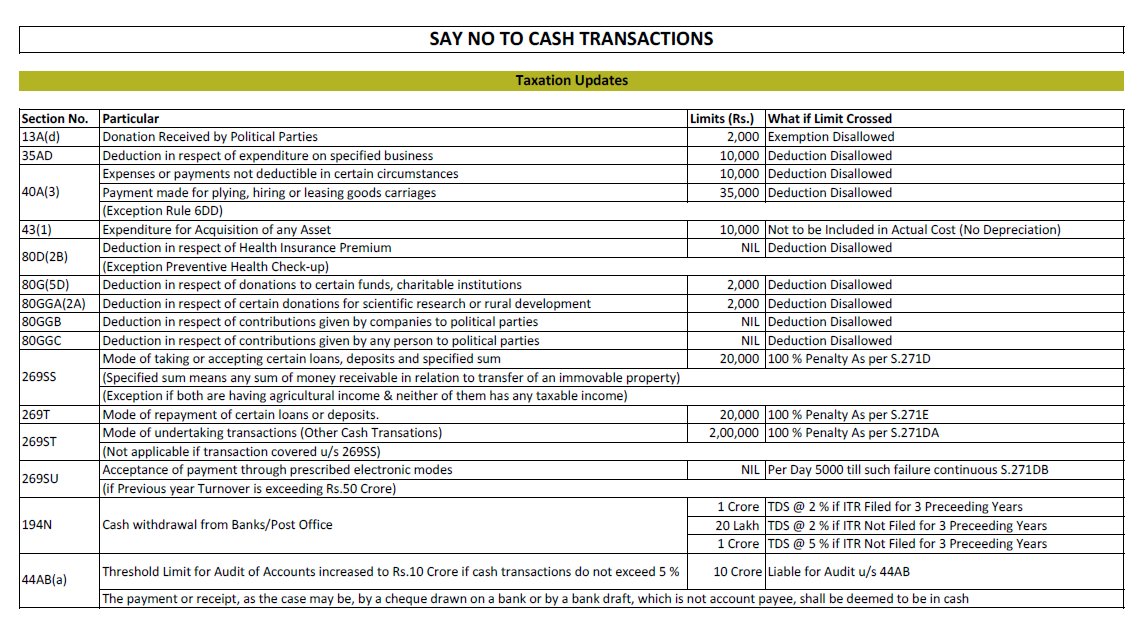

VK Bothra On Twitter RT TaxationUpdates Kindly Check This Cash

Who Is Liable To Pay Professional Tax In Madhya Pradesh - [desc-14]