Explain Bad Debts Bad debts are credits that businesses extend to customers but the repayment of which seems uncollectable In short when the repayment is irrecoverable the debt is bad Such incidents

Bad debts are the account receivables that have been clearly identified as uncollectible in the present or future time The account receivables are credited by the amount of bad debt The Bad debt expense is the way businesses account for a receivable account that will not be paid Bad debt arises when a customer either cannot pay because of financial difficulties or chooses

Explain Bad Debts

Explain Bad Debts

https://lookaside.fbsbx.com/lookaside/crawler/media/?media_id=267865653055463

Klatsch Tratsch Bad Liebenwerda Und Umgebung Hallo Ihr Lieben

https://lookaside.fbsbx.com/lookaside/crawler/media/?media_id=7316010235116535

All Things Real Estate Memes Stories Advice Referrals With Real

https://lookaside.fbsbx.com/lookaside/crawler/media/?media_id=1987956355024191

A bad debt is a receivable that a customer will not pay Bad debts are possible whenever credit is extended to customers They arise when a company extends too much Bad debt is an expense that a business incurs This is once the repayment of previously extended credit which is receivables from customers becomes uncollectible Once

Bad debt is money borrowed to purchase rapidly depreciating assets or assets for consumption Bad debt can include high levels of credit card debt which can Bad Debt refers to money owed to a company that is unlikely to be recovered because the debtor is unable to pay or has become insolvent It arises when a business extends credit to

More picture related to Explain Bad Debts

When The Sun Came Out Last Night After All The Rain This Is What The

https://lookaside.fbsbx.com/lookaside/crawler/threads/C995w9msZyl/0/image.jpg

Differences Between Bad Debts And Doubtful Debts YouTube

https://i.ytimg.com/vi/QiPYt3W43E8/maxresdefault.jpg

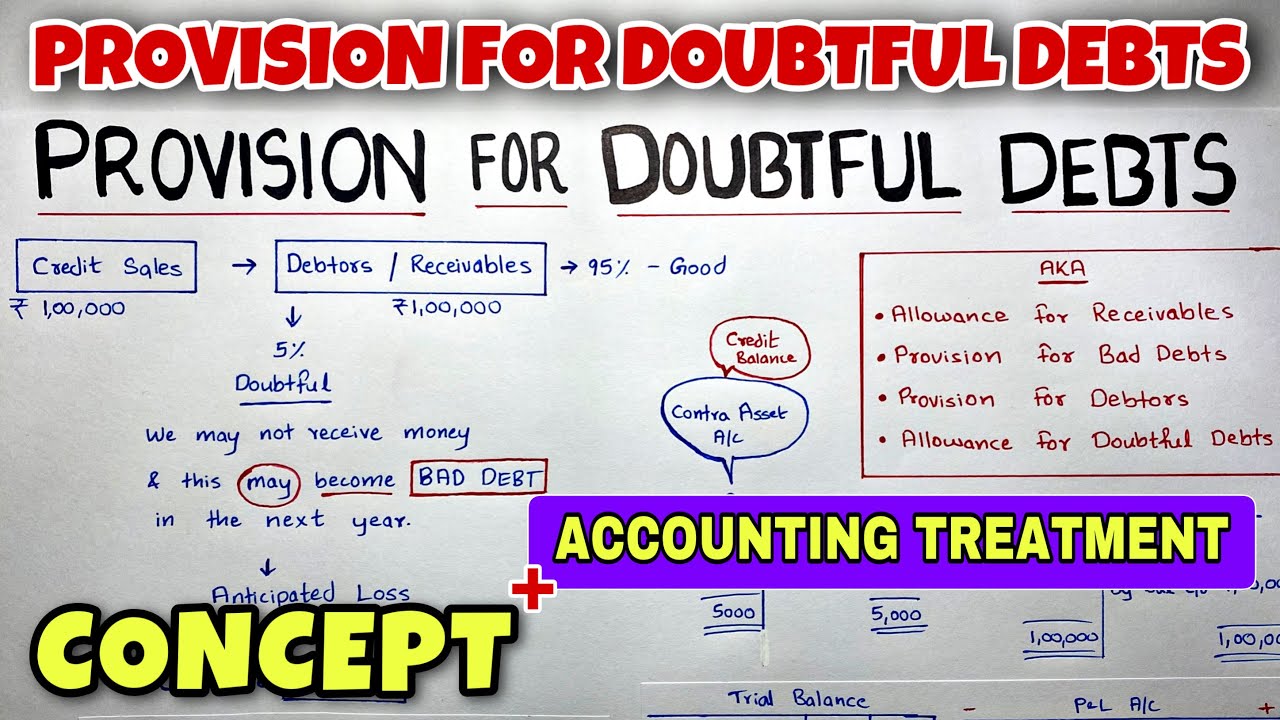

1 Provision For Doubtful Debts Bad Debts By Saheb Academy YouTube

https://i.ytimg.com/vi/PYaMpgZr7O4/maxresdefault.jpg

In finance bad debt occasionally called uncollectible accounts expense is a monetary amount owed to a creditor that is unlikely to be paid and for which the creditor is not willing to take Bad debt is a reality for businesses that provide credit to customers such as banks and insurance companies Planning for this possibility by estimating the amount of

[desc-10] [desc-11]

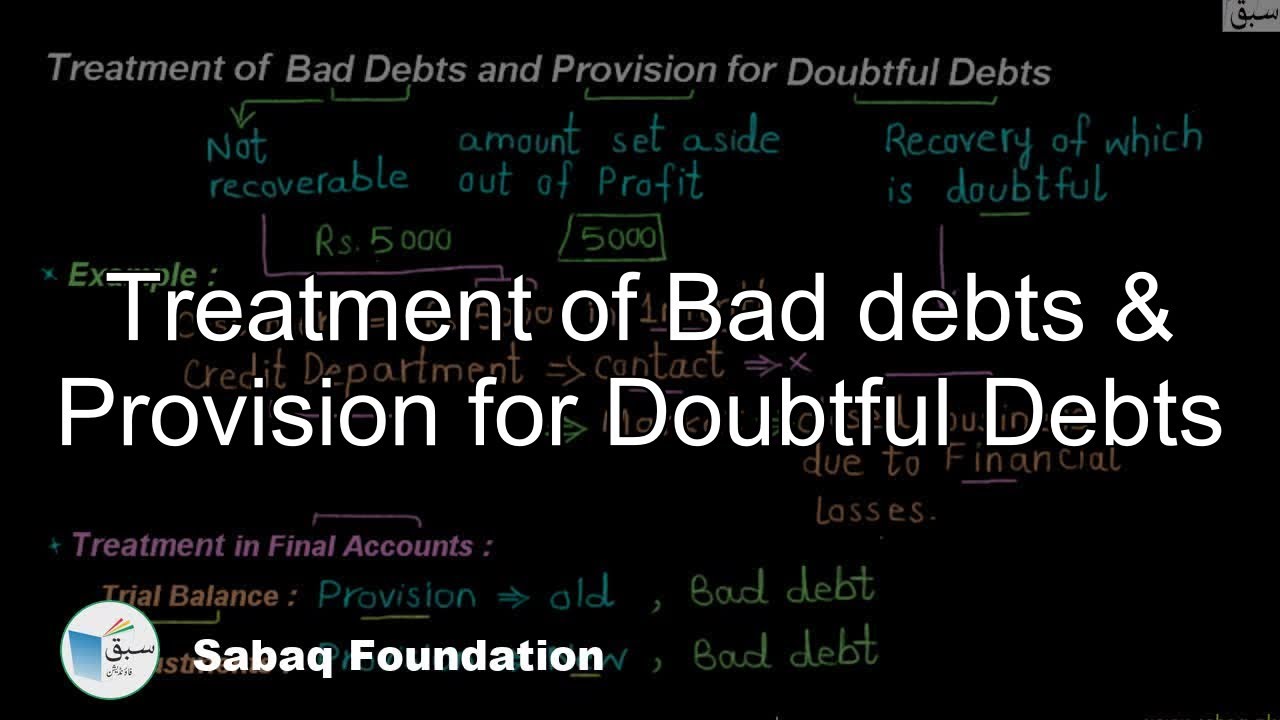

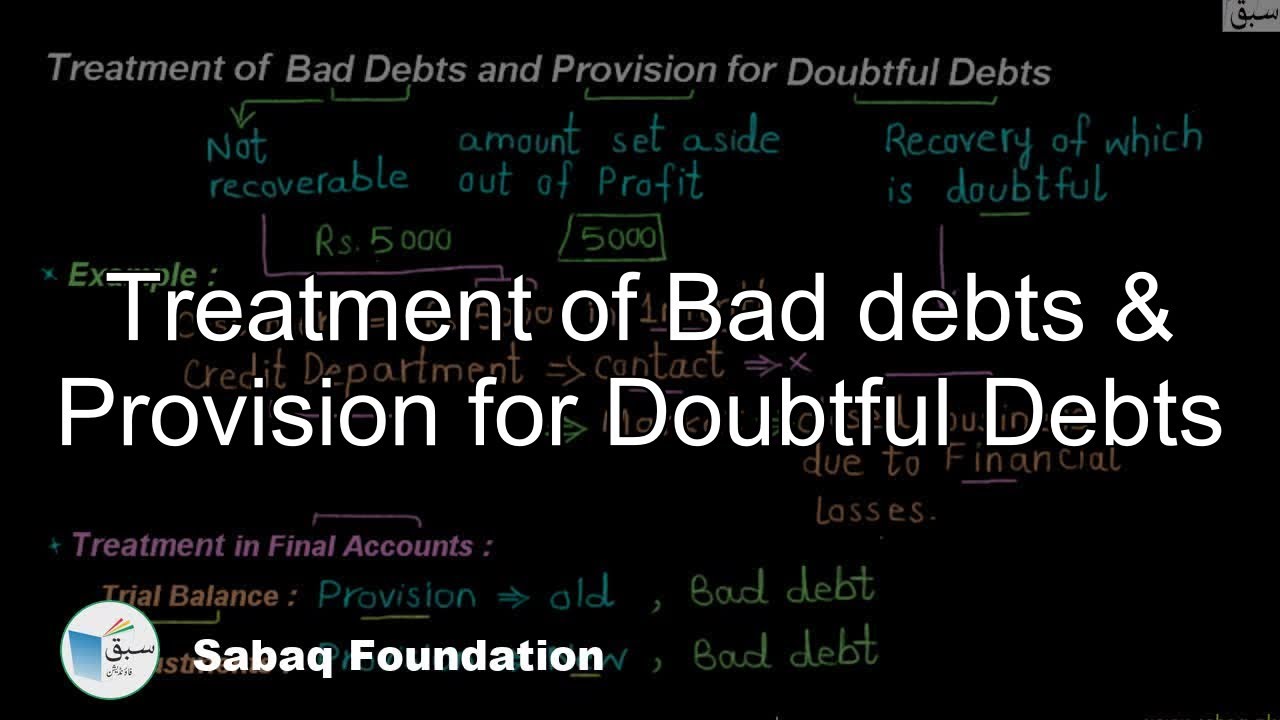

Treatment Of Bad Debts Provision For Doubtful Debts Accounting

https://i.ytimg.com/vi/W52dqBuKjWE/maxresdefault.jpg

Min Yoongi Bts Bts Suga Bts Beautiful Agust D D Day Bad Girl

https://i.pinimg.com/originals/b5/0e/53/b50e5386f93b06373aa6304097a28d6d.jpg

https://www.wallstreetmojo.com › bad-debts

Bad debts are credits that businesses extend to customers but the repayment of which seems uncollectable In short when the repayment is irrecoverable the debt is bad Such incidents

https://www.wikiaccounting.com › accounting-for-bad-debts

Bad debts are the account receivables that have been clearly identified as uncollectible in the present or future time The account receivables are credited by the amount of bad debt The

Country Humor Country Art Funny Beach Pictures Simpsons Quotes

Treatment Of Bad Debts Provision For Doubtful Debts Accounting

Karte Bad Ragaz Bad Ragartz Stiftung Triennale Der Skulptur

Impressum

Fluffy Corp The GreedWille

Explain Student Pointing Stock Illustration 19560385 PIXTA Clip

Explain Student Pointing Stock Illustration 19560385 PIXTA Clip

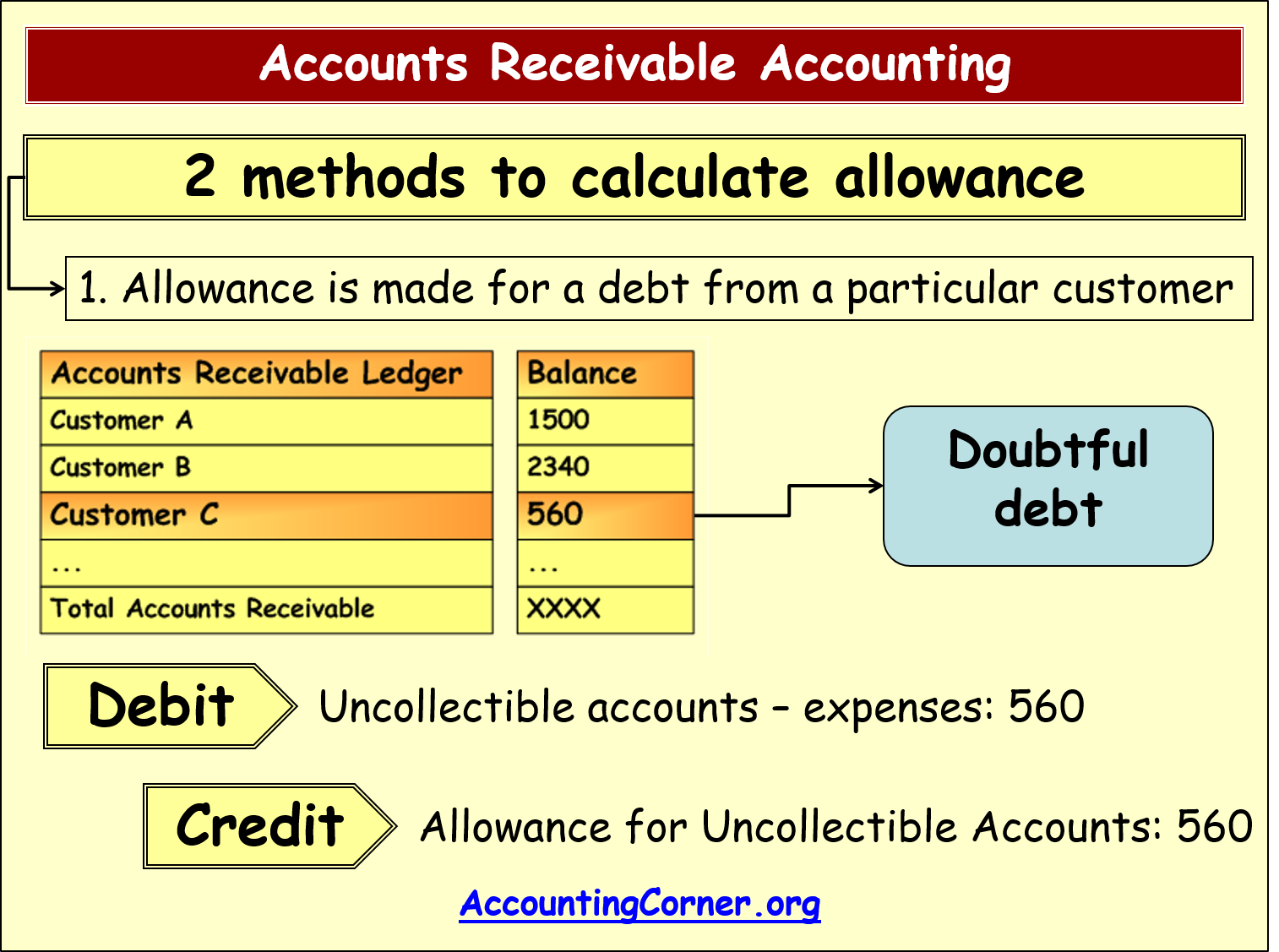

Allowance for doubtful accounts 8

Rebecca Zamolo Grateful For All The Memories In 2024 And Excited For

Explain Bad Debts - [desc-13]