What Is Considered A Qualified Business Expense The theory Considered object Used when the subject should be just another name for something Literally that the object is the subject He should be considered our

Consider doing sth consider be considered to do Any time we consider down time likely spent doing Is considered as is an alternative way of saying the same thing I don t see any problem with your example about French as a language of love although it would more

What Is Considered A Qualified Business Expense

What Is Considered A Qualified Business Expense

https://i.ytimg.com/vi/bBNkMwvysPo/maxresdefault.jpg

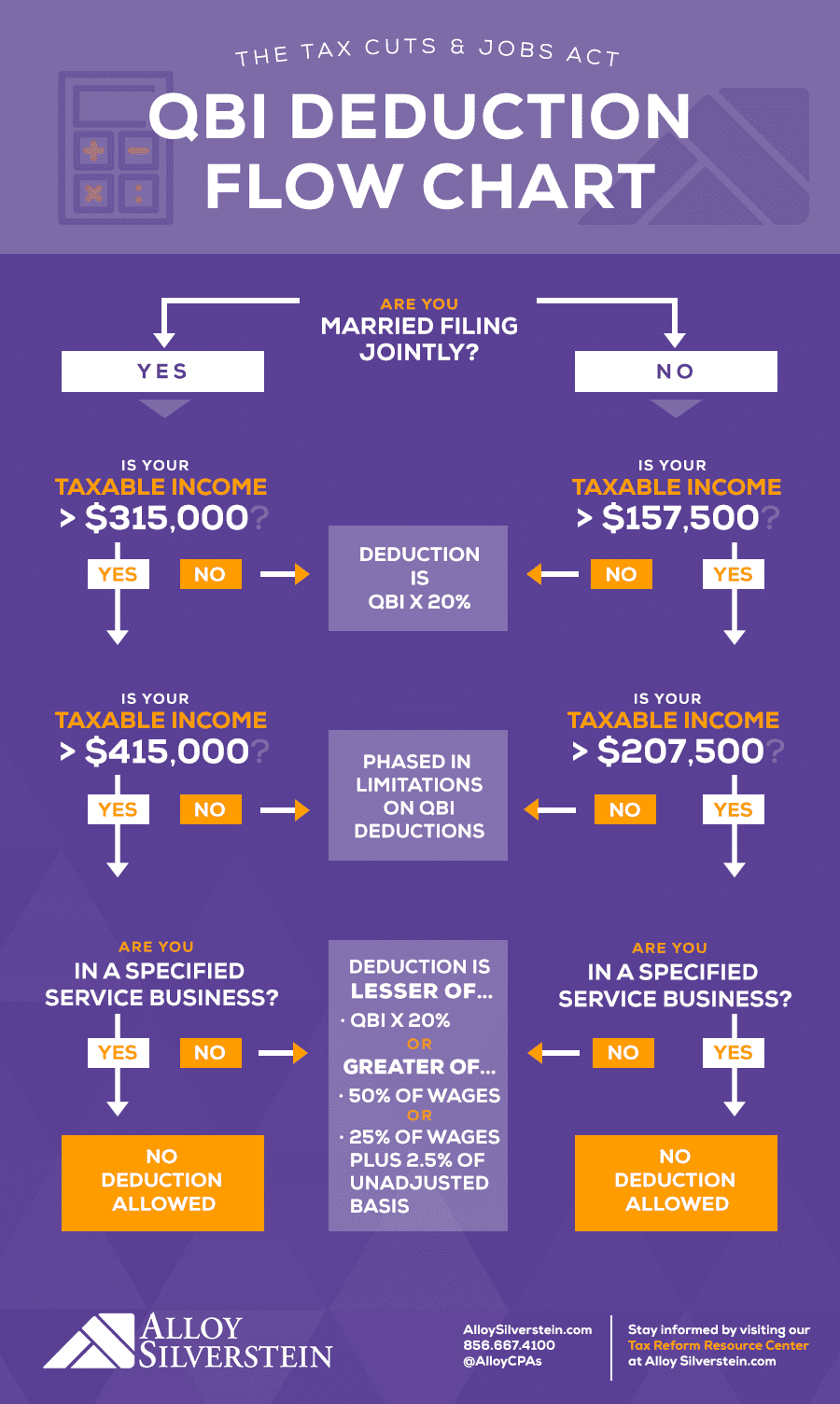

Qbi Phase Out 2024 Sellers Vintage Brunofuga adv br

https://www.nysscpa.org/cpaj-images/CPA.2022.92.5.006.t002.jpg

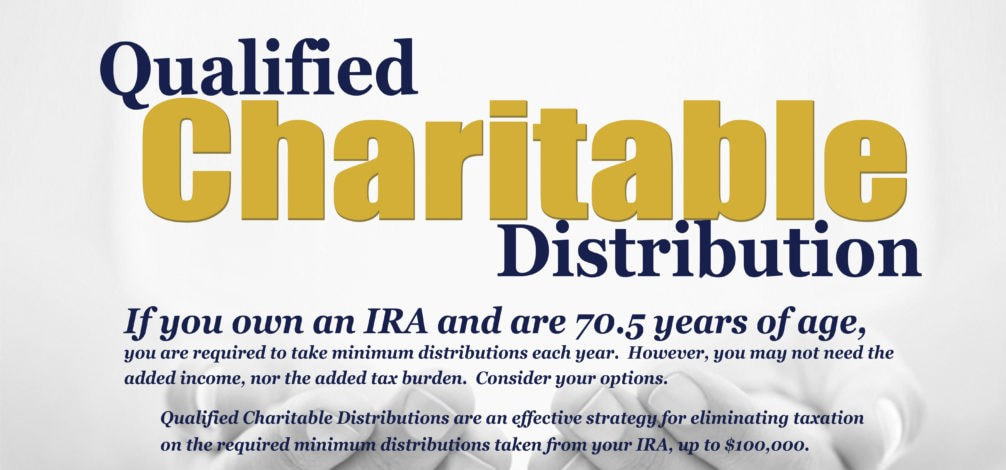

Qualified Charitable Donation BIRDSEYE FINANCIAL SERVICES 360 722 7889

https://www.birdseyefinancial.com/uploads/1/6/2/2/16223152/qualified-charitable-distributions_orig.jpg

I have encountered the phrase due diligence in the business world The usage examples I have seen mostly emails cannot exactly be considered grammatical canon An internet search In general the Y is a consonant when the syllable already has a vowel Also the Y is considered a consonant when it is used in place of the soft J sound such as in the name Yolanda or

The use of BCE CE could be considered political correctness especially since it is hardly common outside of academic circles Anyway you don t need to worry BC AD has not lost at Dinner is considered to be the main or largest meal of the day Whether it takes place at noon or in the evening is mostly a cultural thing For instance many people who grew

More picture related to What Is Considered A Qualified Business Expense

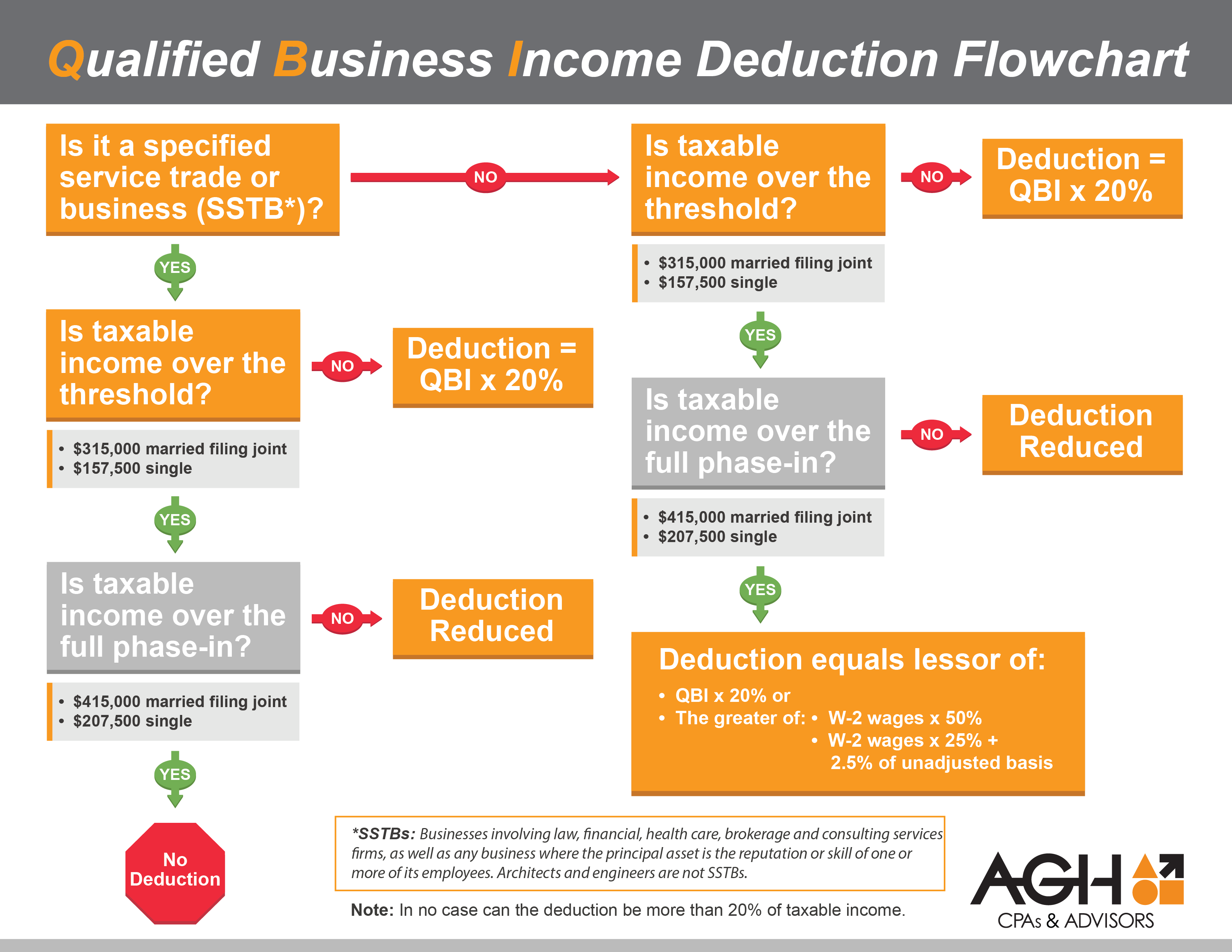

Qualified Business Income QBI Deduction

https://help.holistiplan.com/hs-fs/hubfs/image-png-Sep-06-2022-04-02-12-82-PM.png?width=1032&name=image-png-Sep-06-2022-04-02-12-82-PM.png

Antique Gun Types Identifying Valuing

https://www.jacquelinestallone.com/wp-content/uploads/2022/10/Shotguns.jpg

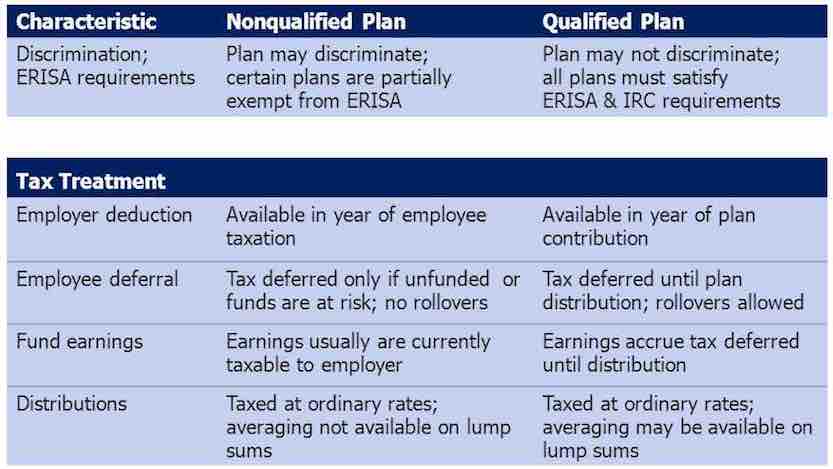

What Are Qualified And Non Qualified Retirement Plans

https://johnstricklandinsurance.com/wp-content/uploads/2019/10/blog-09-qualified-vs-non-qualified-plans-833x469.jpg

When I m referring to a group of multiple things should it be considered singular or plural for the purposes of applying a verb to it For example which is correct in the examples below A The convention stems from the term itself Midnight comes from mid night In conversation the night of which midnight is in the middle is considered the night of the date

[desc-10] [desc-11]

What Are Qualified Education Expenses Personal Finance For PhDs

http://pfforphds.com/wp-content/uploads/2016/02/Ch3QEE2.png

Qbi Deduction Phase Out 2025 Gary Perkins

https://media.smallbiztrends.com/2023/01/qbi-deduction-infographic-1000x525.png

https://ell.stackexchange.com › questions

The theory Considered object Used when the subject should be just another name for something Literally that the object is the subject He should be considered our

https://zhidao.baidu.com › question

Consider doing sth consider be considered to do Any time we consider down time likely spent doing

Felony Vs Crime Understanding Key Legal Differences Edmonton North

What Are Qualified Education Expenses Personal Finance For PhDs

Property Manager AwesomeFinTech Blog

Qbi Deduction Phase Out 2025 Bent T Carlsen

Qualified Business Income Deduction 2025 Elisa Helaine

Hsa Qualified Expenses 2025 Layla McCoy

Hsa Qualified Expenses 2025 Layla McCoy

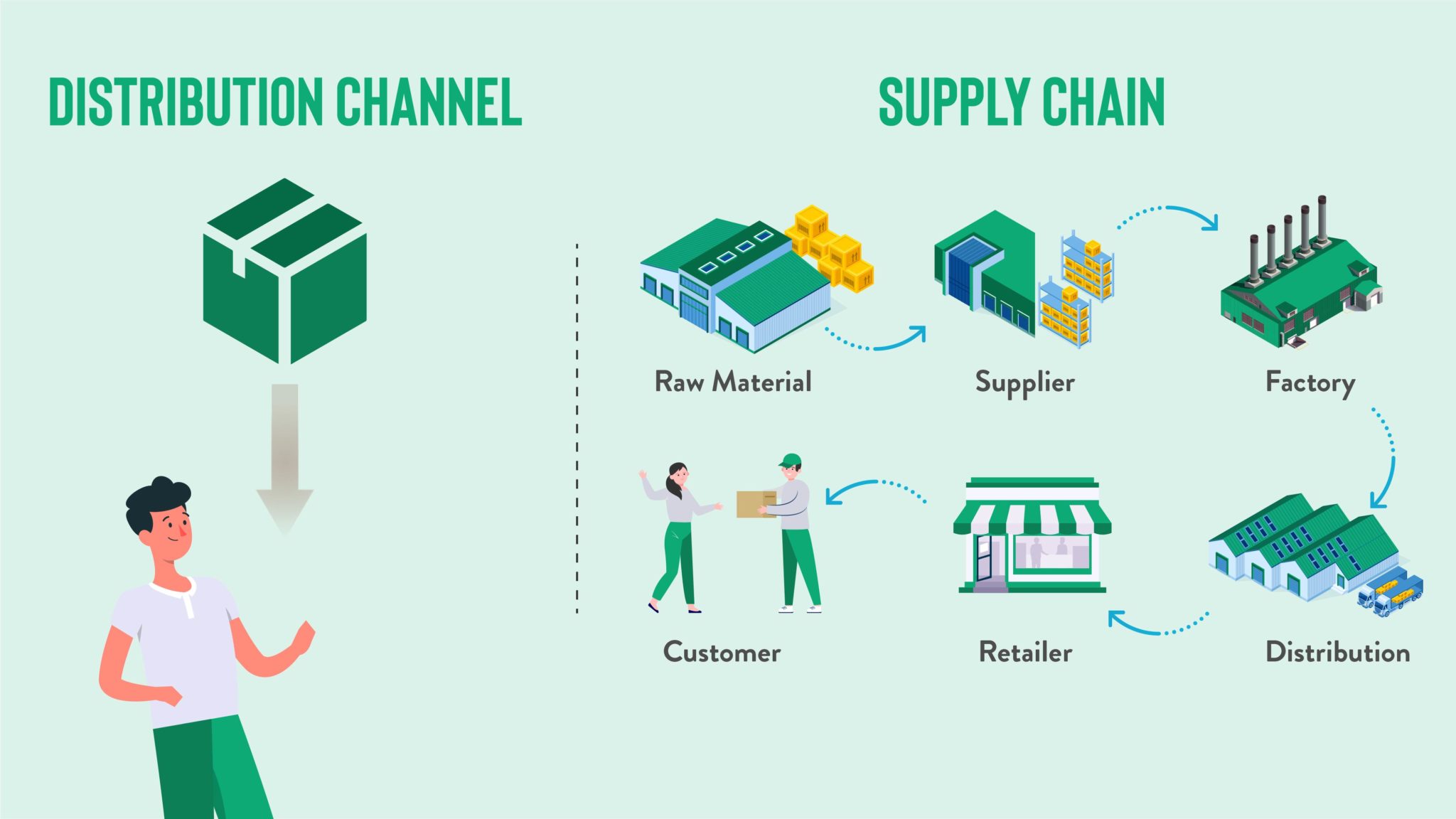

The Complete Guide To Distribution Channels 10X ERP

Limit Qualified Ira Amount Tax Year 2024 Susie Corette

How Much Can I Contribute To A Roth Ira 2024 Lotta Rhiamon

What Is Considered A Qualified Business Expense - [desc-14]